More than three quarters of British voters are convinced that Chancellor Rachel Reeves will raise income tax levels later this month, polling has shown, as the UK experiences an exodus of millionaires.

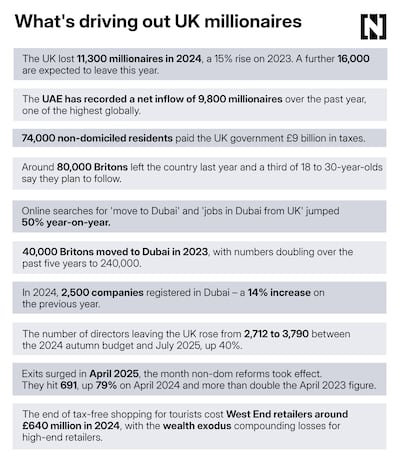

A record number are now heading to the UAE, and Dubai in particularly, with the emirates experiencing a net inflow of 9,800 millionaires from around the world in the past year. A large chunk of that is Britons disenchanted with Labour’s decision to axe “non-dom” status, with a record 691 leaving in April after tax reforms took effect, a 79 per cent increase on 2024.

Ms Reeves gave a strong hint that Labour would break its manifesto pledge not to raise taxes on Tuesday, stating that “we will all have to contribute" to secure Britain’s economic future.

A YouGov poll released on Thursday showed that 77 per cent believe she will increase the levy after they were asked “from what you have seen and heard, do you believe Rachel Reeves will or will not raise the basic rate of income tax?” Just one per cent thought she would not.

Millionaire moves

“I know one billionaire who can afford to stay in England, and the rest of my wealthy friends have either left or are now making moves to go,” a multi-millionaire who moved to Dubai told The National.

The “high net worth individual” disclosed that many had fled to the emirates but other contacts were also seeking residency in Athens or Italy, which offer inducements for wealthy people to migrate.

But the person, who moved to Dubai last year, argued that the UAE was by far the most straightforward country to migrate to as it was “highly economically efficient” and the administrative aspect of getting a visa was “hassle-free”.

“Suddenly you've got a lifestyle, lower stress and quality of life and things that you can no longer access in England,” added the person, who did not want to be named.

Privilege no more

A sign that Britain is becoming less attractive for the rich is that the proportion of foreigners looking to buy a UK home dropped to under one per cent this year for the first time since 2008, according to figures from estate agents Hamptons International.

That is compounded by the number of directors leaving Britain, which rose from 2,712 to 3,790 between the autumn budget last year and July, a 40 per cent increase.

The main reason has been Labour’s tax changes after the government scrapped the 225-year-old “non-dom” tax system, which allowed the British or overseas rich not to pay UK taxes on their overseas earnings in return for an annual fee of £30,000.

The UAE, and Dubai in particular, has become the most popular destination due to the lack of taxes on income, capital gains or inheritance.

There is low crime, English is widely spoken and private school fees are two thirds of what they are in Britain, which accounts for why a quarter of a million British people now call Dubai home.

British worker Graeme Wilson said that, while it would be an “enormous wrench” to leave Britain, “the difference it would make to us financially is enormous” – about £250,000 a year net. “The tax situation in the UK has taken us to breaking point,” he wrote on Facebook.

Emirates-bound

The UAE alone has had a net inflow of 9,800 millionaires this year, according to figures from the consultancy group, New World Wealth.

Globally, the group found that the emirates has the second-highest growth of millionaires in the past decade (just behind Montenegro) with 130,500 taking up residence, a figure that also includes 28 foreign billionaires. New World Wealth also found that London had lost 11,300 millionaires in the last year, a higher proportion than anywhere else bar Moscow.

The figures were jointly compiled by relocation specialists Henley & Partners, who have had a record 200 per cent increase in applications to the firm this year. Among the leavers are the former Manchester United and England footballer Rio Ferdinand, who announced that he was making Dubai his home.

His family will be joined by the billionaire steel tycoon Lakshmi Mittal, alongside Egyptian billionaires Nassef Sawiris and Bassim Haidar, who are co-owners of Aston Villa football club.

Tax reversal?

Dubai is also seen as an economic hub that offers a chance for career advancement, while Britain is viewed as having high taxes, poor public services and rising crime.

Earlier this week Nigel Farage, whose far-right populist Reform party is leading in the polls, stated he would lure back non-doms with a “Britannia Pass”, with people paying £250,000 for a 10-year UK residency in exchange for favourable tax status including exemption from taxation on their foreign income or capital.

Mr Farage also predicted that 16,500 “very rich people will leave this country this year.” Analysts believe that if Labour reversed its non-dom tax measures Britain would return to the top of the table for top places to live for HNIs.

But in the meantime thousands are leaving, with the possibility that when they have put down roots in places like Dubai, they will not return, which means Ms Reeves will have fewer millionaires to tax.