It was a budget quite like no other. Not only did it introduce record tax increases, but the market-sensitive document was accidentally published a full 40 minutes before Britain's Chancellor of the Exchequer Rachel Reeves was set to unveil it in the House of Commons.

Pundits were quick to pounce, given the amount of leaks and briefings in the weeks before, with some calling it a ‘multi-shambles’. The UK's Office for Budget Responsibility, which publishes its verdict on the budget once the chancellor sits down, took the blame. While the department pleaded a “technical fault”, the act was another breach of the principle of closely guarded secret that has surrounded every budget since Victorian times.

Even before she got to her feet, the chancellor received a dressing-down from Deputy Speaker Nusrat Ghani condemning the “unprecedented” early disclosures that fell “short of standards that the House expects”.

Chancellor muted

For a moment it almost felt as if the wheels were truly coming off. Ms Reeves rose following the admonishment, then struggled to be heard, not only above the Tory roars of dissent, but with her microphone on low volume.

That at least could be rapidly fixed, while the British economy appears some way off from mending. Ms Reeves did not hold back on the grim picture facing the country, which now has a £2.8-trillion debt – 86 per cent of GDP – with every £1 out of £10 in tax spent serving the interest.

Therefore, Ms Reeves tried to assure her backbenchers that it was necessary, in a roundabout manner, to raise taxes.

Those on moderate incomes are being forced to shoulder the burden with the now well-trodden tactic of freezing tax thresholds, meaning that through inflation and pay increase nearly one million more people will fall into the higher rate, which is 40 per cent on income over £50,000.

Thus, she accepted a breach of Labour manifesto by freezing the thresholds. “I won’t pretend otherwise now,” she said. “I am asking everyone to make a contribution.”

More manifesto breaches were found by sharp political observers who pointed to Labour’s promised £8.5bn of tax rises, which have now spiralled to £66bn over two budgets in 16 months.

‘Not disastrous’ City verdict

The coming days will tell us if Ms Reeves's budget has done enough to save Britain’s economy and indeed the political life of the Labour government.

Instead of applying a sensible but politically toxic 2-pence increase in income tax she opted for a smorgasbord of taxation, which she will hope the markets will view as sensible.

What the Chancellor cannot avoid is that she has raised taxes to a historic high by adding another £26 million in this budget, which did however provide her with £22 billion fiscal headroom.

Indeed, the marking from traders in the City signalled that it was not a negative budget, unlike her first that led to inflation meaning that interest rates could not be cut or productivity increased.

“It was not as bad as it could have been from a trading perspective,” a hedge fund manager told The National. “It was just a bit back-end loaded with a lot of tax receipts being from 2028 plus. So it’s a flat budget, unlike last year’s disaster.”

He added that the view in the City was that Ms Reeves needed to remain in post as “everyone is scared about a far-left coup and the type of government that would bring”.

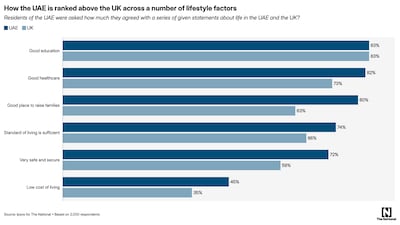

With the growing mass departures of the rich to countries with lower taxes, such as the UAE, Ms Reeves understood that any further taxation on wealth would be self-defeating.

Taxing homes

A mansion tax has been levied on those who own homes valued at more than £2m, who will face an annual charge of £2,500 from 2028 going up to £7,500 for those valued £5m or more.

From the low starting point, Ms Reeves did show resilience and grew in stature as she retorted to the guffawing on Tory benches over the tax that people living in £5 million homes should be capable of stumping up the extra cash.

Badenoch’s 'Benefits Street'

But the Office for Budget Responsibility's blunder merely capped what has been a calamitous few weeks, with the leaks, briefings and then counter-briefings making for a hapless-looking government.

With plots to unseat him thickening, the budget is a make-or-break moment for Prime Minister Keir Starmer’s embattled leadership and the coming weeks will show whether his Chancellor has done enough to save their collective skin.

What is seen as poor political leadership by Mr Starmer has led to a plunge in his popularity with the prime minister experiencing a -51 per cent net favourability rating and Labour plunging to 18 per cent in the polls.

There was however a big winner on Wednesday. After a year of stalled leadership and policies, Tory leader Kemi Badenoch demonstrated deft political footwork by launching a wittily eviscerating critique both on Prime Minister Keir Starmer during earlier questions and then on to Ms Reeves.

With the government U-turns on the winter fuel allowance, disability benefits cuts and the two-child benefit cap leading to the OBR forecasting welfare spending to rise by £73bn to £406bn in the next five years, she had a big target to aim at.

“This is a budget for ‘Benefits Street’ paid for by working people,” she shot across the chamber. “She has broken every single promise, if she had any decency she would resign. She is the country's worst-ever Chancellor.”

As Ms Badenoch sat, senior Conservative MPs lined up to congratulate her. On the other side of the aisle the praise appeared more muted, with Labour MPs knowing that if the budget undermines the economy, time will be called on their tenure on the government benches.

The%20Emperor%20and%20the%20Elephant

%3Cp%3E%3Cstrong%3EAuthor%3A%20%3C%2Fstrong%3ESam%20Ottewill-Soulsby%3C%2Fp%3E%0A%3Cp%3E%3Cstrong%3EPublisher%3A%20%3C%2Fstrong%3EPrinceton%20University%20Press%3C%2Fp%3E%0A%3Cp%3E%3Cstrong%3EPages%3A%20%3C%2Fstrong%3E392%3C%2Fp%3E%0A%3Cp%3E%3Cstrong%3EAvailable%3A%20%3C%2Fstrong%3EJuly%2011%3C%2Fp%3E%0A

It Was Just an Accident

Director: Jafar Panahi

Stars: Vahid Mobasseri, Mariam Afshari, Ebrahim Azizi, Hadis Pakbaten, Majid Panahi, Mohamad Ali Elyasmehr

Rating: 4/5

Tips on buying property during a pandemic

Islay Robinson, group chief executive of mortgage broker Enness Global, offers his advice on buying property in today's market.

While many have been quick to call a market collapse, this simply isn’t what we’re seeing on the ground. Many pockets of the global property market, including London and the UAE, continue to be compelling locations to invest in real estate.

While an air of uncertainty remains, the outlook is far better than anyone could have predicted. However, it is still important to consider the wider threat posed by Covid-19 when buying bricks and mortar.

Anything with outside space, gardens and private entrances is a must and these property features will see your investment keep its value should the pandemic drag on. In contrast, flats and particularly high-rise developments are falling in popularity and investors should avoid them at all costs.

Attractive investment property can be hard to find amid strong demand and heightened buyer activity. When you do find one, be prepared to move hard and fast to secure it. If you have your finances in order, this shouldn’t be an issue.

Lenders continue to lend and rates remain at an all-time low, so utilise this. There is no point in tying up cash when you can keep this liquidity to maximise other opportunities.

Keep your head and, as always when investing, take the long-term view. External factors such as coronavirus or Brexit will present challenges in the short-term, but the long-term outlook remains strong.

Finally, keep an eye on your currency. Whenever currency fluctuations favour foreign buyers, you can bet that demand will increase, as they act to secure what is essentially a discounted property.

Paris Can Wait

Dir: Eleanor Coppola

Starring: Alec Baldwin, Diane Lane, Arnaud Viard

Two stars

Gothia Cup 2025

4,872 matches

1,942 teams

116 pitches

76 nations

26 UAE teams

15 Lebanese teams

2 Kuwaiti teams

Bib%20Gourmand%20restaurants

%3Cp%3EAl%20Khayma%0D%3Cbr%3EBait%20Maryam%0D%3Cbr%3EBrasserie%20Boulud%0D%3Cbr%3EFi'lia%0D%3Cbr%3Efolly%0D%3Cbr%3EGoldfish%0D%3Cbr%3EIbn%20AlBahr%0D%3Cbr%3EIndya%20by%20Vineet%0D%3Cbr%3EKinoya%0D%3Cbr%3ENinive%0D%3Cbr%3EOrfali%20Bros%0D%3Cbr%3EReif%20Japanese%20Kushiyaki%0D%3Cbr%3EShabestan%0D%3Cbr%3ETeible%3C%2Fp%3E%0A

Springtime in a Broken Mirror,

Mario Benedetti, Penguin Modern Classics

Wayne Rooney's career

Everton (2002-2004)

- Appearances: 48

- Goals: 17

Manchester United (2004-2017)

- Appearances: 496

- Goals: 253

England (2003-)

- Appearances: 119

- Goals: 53

Types of policy

Term life insurance: this is the cheapest and most-popular form of life cover. You pay a regular monthly premium for a pre-agreed period, typically anything between five and 25 years, or possibly longer. If you die within that time, the policy will pay a cash lump sum, which is typically tax-free even outside the UAE. If you die after the policy ends, you do not get anything in return. There is no cash-in value at any time. Once you stop paying premiums, cover stops.

Whole-of-life insurance: as its name suggests, this type of life cover is designed to run for the rest of your life. You pay regular monthly premiums and in return, get a guaranteed cash lump sum whenever you die. As a result, premiums are typically much higher than one term life insurance, although they do not usually increase with age. In some cases, you have to keep up premiums for as long as you live, although there may be a cut-off period, say, at age 80 but it can go as high as 95. There are penalties if you don’t last the course and you may get a lot less than you paid in.

Critical illness cover: this pays a cash lump sum if you suffer from a serious illness such as cancer, heart disease or stroke. Some policies cover as many as 50 different illnesses, although cancer triggers by far the most claims. The payout is designed to cover major financial responsibilities such as a mortgage or children’s education fees if you fall ill and are unable to work. It is cost effective to combine it with life insurance, with the policy paying out once if you either die or suffer a serious illness.

Income protection: this pays a replacement income if you fall ill and are unable to continue working. On the best policies, this will continue either until you recover, or reach retirement age. Unlike critical illness cover, policies will typically pay out for stress and musculoskeletal problems such as back trouble.

COMPANY%20PROFILE

%3Cp%3E%3Cstrong%3ECompany%3A%20%3C%2Fstrong%3EGrowdash%0D%3Cbr%3E%3Cstrong%3EStarted%3A%20%3C%2Fstrong%3EJuly%202022%0D%3Cbr%3E%3Cstrong%3EFounders%3A%20%3C%2Fstrong%3ESean%20Trevaskis%20and%20Enver%20Sorkun%0D%3Cbr%3E%3Cstrong%3EBased%3A%20%3C%2Fstrong%3EDubai%2C%20UAE%0D%3Cbr%3E%3Cstrong%3EIndustry%3A%20%3C%2Fstrong%3ERestaurant%20technology%0D%3Cbr%3E%3Cstrong%3EFunding%20so%20far%3A%3C%2Fstrong%3E%20%24750%2C000%0D%3Cbr%3E%3Cstrong%3EInvestors%3A%20%3C%2Fstrong%3EFlat6Labs%2C%20Plus%20VC%2C%20Judah%20VC%2C%20TPN%20Investments%20and%20angel%20investors%2C%20including%20former%20Talabat%20chief%20executive%20Abdulhamid%20Alomar%2C%20and%20entrepreneur%20Zeid%20Husban%3C%2Fp%3E%0A

FA CUP FINAL

Manchester City 6

(D Silva 26', Sterling 38', 81', 87', De Bruyne 61', Jesus 68')

Watford 0

Man of the match: Bernardo Silva (Manchester City)

Timeline

2012-2015

The company offers payments/bribes to win key contracts in the Middle East

May 2017

The UK SFO officially opens investigation into Petrofac’s use of agents, corruption, and potential bribery to secure contracts

September 2021

Petrofac pleads guilty to seven counts of failing to prevent bribery under the UK Bribery Act

October 2021

Court fines Petrofac £77 million for bribery. Former executive receives a two-year suspended sentence

December 2024

Petrofac enters into comprehensive restructuring to strengthen the financial position of the group

May 2025

The High Court of England and Wales approves the company’s restructuring plan

July 2025

The Court of Appeal issues a judgment challenging parts of the restructuring plan

August 2025

Petrofac issues a business update to execute the restructuring and confirms it will appeal the Court of Appeal decision

October 2025

Petrofac loses a major TenneT offshore wind contract worth €13 billion. Holding company files for administration in the UK. Petrofac delisted from the London Stock Exchange

November 2025

180 Petrofac employees laid off in the UAE