In a fresh sign of his growing concerns about inflation, Chairman Jerome Powell said on Wednesday that the Federal Reserve cannot be sure that price increases will slow in the second half of next year as many economists expect.

Mr Powell told the House Financial Services Committee that most economists regard the current price spikes, which have sent consumer inflation to a three-decade high, as largely a response to the pandemic’s persistent disruptions to supply and demand.

As Americans have spent more time at home, they have ramped up spending on furniture, appliances and laptop computers. Soaring demand for such goods, combined with parts shortages, have resulted in supply chain snarls and higher prices.

In the past, Mr Powell, who was nominated last week to a second four-year term by President Joe Biden, has frequently expressed his belief that these supply-and-demand imbalances should fade as the pandemic eases, which would reduce inflation. But on Wednesday, he said that while such an outcome is “likely”, it is only a forecast.

“The point is, we can’t act as if we’re sure of that,” he said. “We’re not at all sure of that. Inflation has been more persistent and higher than we’ve expected.”

At the same hearing on Wednesday, Treasury Secretary Janet Yellen clashed with many committee Republicans, who said that excess spending by the Biden administration has been a major contributor to high inflation.

The administration’s proposed $2 trillion social and environmental spending bill, they argued, would further accelerate inflation.

“It is the multiple trillions of dollars that this Congress and this administration is spending that is putting jet fuel on the fires of this economy,” said Patrick McHenry from North Carolina, the senior Republican on the committee. “It is making things worse.”

Ms Yellen countered that the new spending would occur over a decade, which would reduce its inflationary impact.

She also argued that the administration’s proposals to spend more on childcare subsidies, universal early childcare education and the child tax credit would make it easier for many women to return to work after having children. Their return, Ms Yellen said, would help address the labour shortages that are contributing to higher inflation.

The secretary also defended the administration’s $1.9tn financial relief package, approved last March, and said that “at most”, it was a “small contributor” to higher prices, which she said were mostly due to supply chain bottlenecks.

The financial relief bill “put money in people’s pockets, helped to meet expenses that they had and contributed to strong demand in the US economy”, Ms Yellen said.

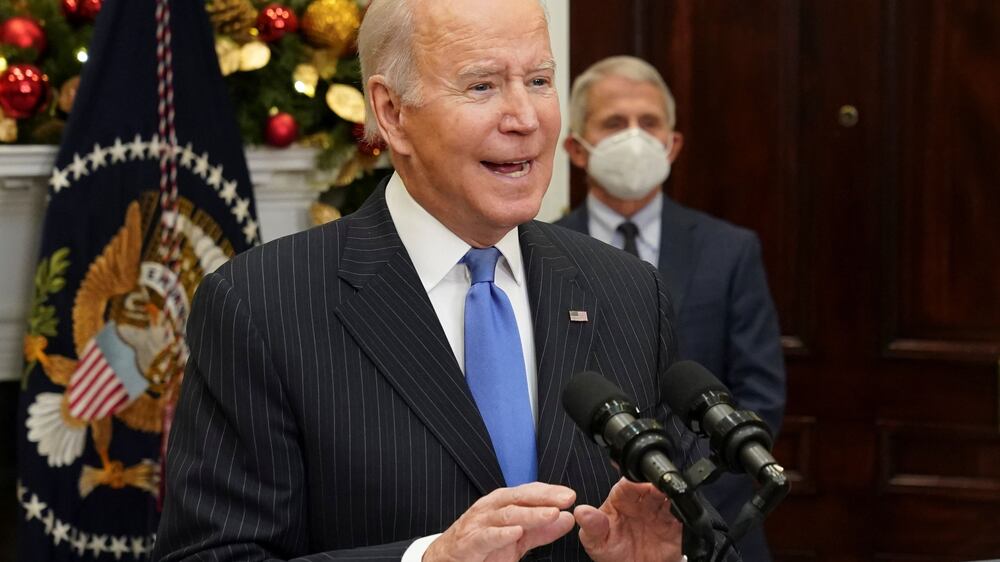

Joe Biden on Omicron: 'Not a cause for panic'

Mr Powell’s latest remarks came a day after he signalled a sharp turn towards tightening credit more quickly than the Fed has previously indicated.

Stock prices tumbled after Mr Powell said that it would be “appropriate” for the central bank to consider accelerating the reduction of its bond purchases at its next meeting in mid-December.

That step would pave the way to the Fed increasing its benchmark interest rate as early as next spring. Low interest rates have been a key driver of stock market record highs during the pandemic. Shares recovered most of those losses in mid-day trading on Wednesday.

Mr Powell also played down sharp wage gains this year as something that could boost inflation further, suggesting that he does not yet see a wage-price spiral developing.

In the 1970s, as prices rose steadily, workers were able to demand higher pay to keep up with greater costs. Yet businesses then raised prices further to cover the higher wages, extending the worst run of inflation since the Second World War.

“We like to see wages move up,” Mr Powell said. “At this point, we don’t see them moving up at a troubling rate that would tend to spark higher inflation, but that’s something we’re watching very carefully.”