Andy Palmer, the Nissan veteran who joined Aston Martin in 2014 to help revive the company, is leaving the classic brand made famous by James Bond movies as part of a management shake-up.

"My departure is immediate," Mr Palmer told The National by email, adding that he has no immediate plans.

Mr Palmer's departure was first reported by the Financial Times, who said the luxury carmaker will replace him with Tobias Moers, who runs the AMG performance arm of Mercedes-Benz.

An announcement about the changes will “be made as and when appropriate,” Aston Martin told Bloomberg following the newspaper's report on Sunday.

In 2014, the former No 3 executive at Nissan joined Aston Martin, which has been insolvent seven times in its 107 years in existence. Mr Palmer's mandate was to turn the company around as part of a seven-year plan that diversifies the car models produced and scales up the business across the globe.

Mr Palmer would build on his experience at the Japanese manufacturer, and import the lean monozukuri manufacturing principles across the corporate culture of Aston Martin.

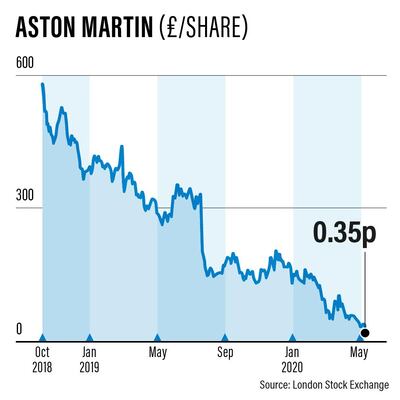

However, as the car manufacturer went public on the London Stock Exchange in 2018, its share price did not immediately perform well and Mr Palmer said in an interview shortly after the debut with The National what mattered most was the long-term evolution of the company.

The company's shares have fallen nearly 94 per cent since its listing due to oversupply to its dealerships and a slowdown among luxury buyers.

Aston Martin reported a £119 million (Dh532m / $145m) loss in the first three months of 2020, in part because factories and dealers closed due to coronavirus pandemic.

Covid-19 and the resulting global economic shutdown "had a material impact on our performance this quarter but during this unprecedented time we completed a £536m capital raise and continued to implement our exciting strategy to reset and safeguard the long-term future of the business", Mr Palmer said in a regulatory filing announcing the results.

"Part of the reset includes reducing our global dealer inventory to a luxury norm to rebalance supply and demand, to build resilience and profitability for the future," he said.

"We have made significant progress on this with dealer inventory reducing by 428 units compared to the start of the year."

The US accounts for 30 per cent of the company’s total sales, followed by the UK. Europe and the Asia-Pacific region, which includes China, are closely behind in third and fourth place, respectively. The Middle East accounts for 10 per cent of the company’s sales.

Mr Palmer, who oversaw the Nissan Patrol that is widely popular across the Arab world, was bullish on promoting Aston Martin's Dh694,197 DBX 4x4 globally.

The DBX competes with rivals rolled out by Bentley, Lamborghini and Rolls-Royce. Ferrari, which Aston Martin considers its peer rival since it is the only other luxury company that is publicly listed, was according to pre-Covid plans set to release its Purosangue 4x4 in 2022.

In its first quarter disclosure Aston Martin said it can't give a clear view on the full-year outlook.

2020 was the year in which the business was being reset by reducing core wholesale revenue and rebalancing supply to demand. However, "the uncertainty surrounding the duration and impact of the Covid-19 pandemic on the global economy, makes it not possible to provide a clear view on the full year outlook and the company withdraws the previous guidance for the year", the company said.

Earlier this month Aston Martin said it assumes trading will remain challenging and it will implement measures to take further actions on operating costs and focus on conserving cash.

"Given the ongoing uncertainties, as is prudent, the company continues to review all future funding and refinancing options to increase liquidity," it said.

Mercer, the investment consulting arm of US services company Marsh & McLennan, expects its wealth division to at least double its assets under management (AUM) in the Middle East as wealth in the region continues to grow despite economic headwinds, a company official said.

Mercer Wealth, which globally has $160 billion in AUM, plans to boost its AUM in the region to $2-$3bn in the next 2-3 years from the present $1bn, said Yasir AbuShaban, a Dubai-based principal with Mercer Wealth.

“Within the next two to three years, we are looking at reaching $2 to $3 billion as a conservative estimate and we do see an opportunity to do so,” said Mr AbuShaban.

Mercer does not directly make investments, but allocates clients’ money they have discretion to, to professional asset managers. They also provide advice to clients.

“We have buying power. We can negotiate on their (client’s) behalf with asset managers to provide them lower fees than they otherwise would have to get on their own,” he added.

Mercer Wealth’s clients include sovereign wealth funds, family offices, and insurance companies among others.

From its office in Dubai, Mercer also looks after Africa, India and Turkey, where they also see opportunity for growth.

Wealth creation in Middle East and Africa (MEA) grew 8.5 per cent to $8.1 trillion last year from $7.5tn in 2015, higher than last year’s global average of 6 per cent and the second-highest growth in a region after Asia-Pacific which grew 9.9 per cent, according to consultancy Boston Consulting Group (BCG). In the region, where wealth grew just 1.9 per cent in 2015 compared with 2014, a pickup in oil prices has helped in wealth generation.

BCG is forecasting MEA wealth will rise to $12tn by 2021, growing at an annual average of 8 per cent.

Drivers of wealth generation in the region will be split evenly between new wealth creation and growth of performance of existing assets, according to BCG.

Another general trend in the region is clients’ looking for a comprehensive approach to investing, according to Mr AbuShaban.

“Institutional investors or some of the families are seeing a slowdown in the available capital they have to invest and in that sense they are looking at optimizing the way they manage their portfolios and making sure they are not investing haphazardly and different parts of their investment are working together,” said Mr AbuShaban.

Some clients also have a higher appetite for risk, given the low interest-rate environment that does not provide enough yield for some institutional investors. These clients are keen to invest in illiquid assets, such as private equity and infrastructure.

“What we have seen is a desire for higher returns in what has been a low-return environment specifically in various fixed income or bonds,” he said.

“In this environment, we have seen a de facto increase in the risk that clients are taking in things like illiquid investments, private equity investments, infrastructure and private debt, those kind of investments were higher illiquidity results in incrementally higher returns.”

The Abu Dhabi Investment Authority, one of the largest sovereign wealth funds, said in its 2016 report that has gradually increased its exposure in direct private equity and private credit transactions, mainly in Asian markets and especially in China and India. The authority’s private equity department focused on structured equities owing to “their defensive characteristics.”

The specs

Engine: 1.5-litre turbo

Power: 181hp

Torque: 230Nm

Transmission: 6-speed automatic

Starting price: Dh79,000

On sale: Now

The specs: 2017 Ford F-150 Raptor

Price, base / as tested Dh220,000 / Dh320,000

Engine 3.5L V6

Transmission 10-speed automatic

Power 421hp @ 6,000rpm

Torque 678Nm @ 3,750rpm

Fuel economy, combined 14.1L / 100km

How to avoid crypto fraud

- Use unique usernames and passwords while enabling multi-factor authentication.

- Use an offline private key, a physical device that requires manual activation, whenever you access your wallet.

- Avoid suspicious social media ads promoting fraudulent schemes.

- Only invest in crypto projects that you fully understand.

- Critically assess whether a project’s promises or returns seem too good to be true.

- Only use reputable platforms that have a track record of strong regulatory compliance.

- Store funds in hardware wallets as opposed to online exchanges.

RACE CARD

6.30pm Maiden (TB) Dh82.500 (Dirt) 1,400m

7.05pm Handicap (TB) Dh87,500 (D) 1,400m

7.40pm Handicap (TB) Dh92,500 (Turf) 2,410m

8.15pm Handicap (TB) Dh105,000 (D) 1,900m

8.50pm UAE 2000 Guineas Trial (TB) Conditions Dh183,650 (D) 1,600m

9.25pm Dubai Trophy (TB) Conditions Dh183,650 (T) 1,200m

10pm Handicap (TB) Dh102,500 (T) 1,400m

Vikram%20Vedha

%3Cp%3E%3Cstrong%3EDirectors%3A%3C%2Fstrong%3E%20Gayatri%2C%20Pushkar%3C%2Fp%3E%0A%3Cp%3E%3Cstrong%3EStars%3A%3C%2Fstrong%3E%20Hrithik%20Roshan%2C%20Saif%20Ali%20Khan%2C%20Radhika%20Apte%3C%2Fp%3E%0A%3Cp%3E%3Cstrong%3ERating%3A%C2%A0%3C%2Fstrong%3E3.5%2F5%3C%2Fp%3E%0A

KILLING OF QASSEM SULEIMANI

ZAYED SUSTAINABILITY PRIZE

Results

Stage Two:

1. Mark Cavendish (GBR) QuickStep-AlphaVinyl 04:20:45

2. Jasper Philipsen (BEL) Alpecin-Fenix

3. Pascal Ackermann (GER) UAE Team Emirates

4. Olav Kooij (NED) Jumbo-Visma

5. Arnaud Demare (FRA) Groupama-FDJ

General Classification:

1. Jasper Philipsen (BEL) Alpecin-Fenix 09:03:03

2. Dmitry Strakhov (RUS) Gazprom-Rusvelo 00:00:04

3. Mark Cavendish (GBR) QuickStep-AlphaVinyl 00:00:06

4. Sam Bennett (IRL) Bora-Hansgrohe 00:00:10

5. Pascal Ackermann (GER) UAE Team Emirates 00:00:12

The%20specs%20

%3Cp%3E%3Cstrong%3EEngine%3A%20%3C%2Fstrong%3E2.0-litre%204cyl%20turbo%0D%3Cbr%3E%3Cstrong%3EPower%3A%20%3C%2Fstrong%3E261hp%20at%205%2C500rpm%0D%3Cbr%3E%3Cstrong%3ETorque%3A%20%3C%2Fstrong%3E400Nm%20at%201%2C750-4%2C000rpm%0D%3Cbr%3E%3Cstrong%3ETransmission%3A%20%3C%2Fstrong%3E7-speed%20dual-clutch%20auto%0D%3Cbr%3E%3Cstrong%3EFuel%20consumption%3A%20%3C%2Fstrong%3E10.5L%2F100km%0D%3Cbr%3E%3Cstrong%3EOn%20sale%3A%20%3C%2Fstrong%3ENow%0D%3Cbr%3E%3Cstrong%3EPrice%3A%20%3C%2Fstrong%3EFrom%20Dh129%2C999%20(VX%20Luxury)%3B%20from%20Dh149%2C999%20(VX%20Black%20Gold)%3C%2Fp%3E%0A

INFO

Everton 0

Arsenal 0

Man of the Match: Djibril Sidibe (Everton)