Islamic banking growth in the UAE outpaced that of conventional banks last year on the back of growing investor demand for Islamic products and deep distribution networks, Fitch Ratings has said.

Islamic banks grew by 8 per cent in 2022, higher than conventional banks, which grew by 3 per cent, the rating agency said in its latest report.

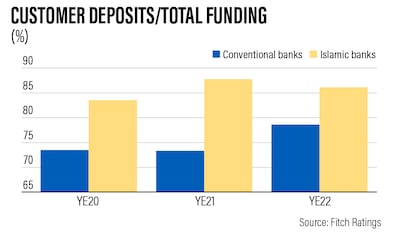

High oil prices and solid economic conditions will continue to support UAE Islamic banks’ credit fundamentals in 2023, limiting the impact of rising profit rates on borrowers, Fitch said.

“Islamic banks in the UAE have a product offering that matches the conventional banks, meaning they can attract non-Islamic customers in addition to those who require Sharia-compliant products,” Bashar Al Natoor, global head of Islamic finance at Fitch Ratings, told The National.

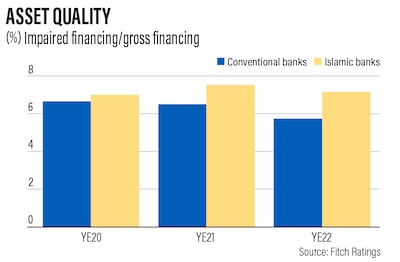

The gross financing/deposits ratio remained stable at 91 per cent at the end of 2022 – still well above that of conventional banks.

Islamic banks continue to be mainly deposit-funded, at 86 per cent of total funding, higher than the conventional banks’ 79 per cent.

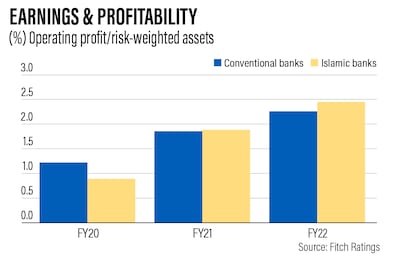

Margins were also supported by Islamic banks’ sizeable low-cost current account savings account deposits, reflecting their strong retail franchises, and remained significantly above those of conventional banks.

Islamic banks’ liquidity also remains supported by the wider availability of instruments in the UAE compared to most other countries, Fitch Ratings said.

The UAE has been issuing treasury bonds and sukuk as part of plans to build a local currency bond market and diversify its financial resources.

The first auction of the UAE's dirham-denominated treasury sukuk for this year was oversubscribed by 7.6 times, receiving bids worth Dh8.3 billion ($2.26 billion), the government said last week.

The value of the first auction stands at Dh1.1 billion.

According to Fitch Ratings, this is an important step in the development of the nascent domestic debt capital market.

“It gives all banks more options to invest their liquidity and should help build the domestic yield curve,” it said.

Continued digitalisation will enhance the need for further mergers and acquisitions to defend market share and find cost synergies, particularly among smaller Islamic banks that risk being left behind, it added.

The global Islamic finance industry is expected to grow by about 10 per cent in 2023-2024 despite the economic slowdown, after posting a similar expansion in 2022, mainly led by Gulf Co-operation Council countries, according to S&P Global Ratings.

Demand for Sharia-compliant financing is set to outpace conventional funding in 2023, driven by strong economic growth and development agendas in key markets including Saudi Arabia amid higher oil prices, Moody’s Investors Service recently said.

Ad Astra

Director: James Gray

Stars: Brad Pitt, Tommy Lee Jones

Five out of five stars

Breast cancer in men: the facts

1) Breast cancer is men is rare but can develop rapidly. It usually occurs in those over the ages of 60, but can occasionally affect younger men.

2) Symptoms can include a lump, discharge, swollen glands or a rash.

3) People with a history of cancer in the family can be more susceptible.

4) Treatments include surgery and chemotherapy but early diagnosis is the key.

5) Anyone concerned is urged to contact their doctor

PROFILE OF HALAN

Started: November 2017

Founders: Mounir Nakhla, Ahmed Mohsen and Mohamed Aboulnaga

Based: Cairo, Egypt

Sector: transport and logistics

Size: 150 employees

Investment: approximately $8 million

Investors include: Singapore’s Battery Road Digital Holdings, Egypt’s Algebra Ventures, Uber co-founder and former CTO Oscar Salazar

BRAZIL%20SQUAD

World Mental Health Day

Cinco in numbers

Dh3.7 million

The estimated cost of Victoria Swarovski’s gem-encrusted Michael Cinco wedding gown

46

The number, in kilograms, that Swarovski’s wedding gown weighed.

1,000

The hours it took to create Cinco’s vermillion petal gown, as seen in his atelier [note, is the one he’s playing with in the corner of a room]

50

How many looks Cinco has created in a new collection to celebrate Ballet Philippines’ 50th birthday

3,000

The hours needed to create the butterfly gown worn by Aishwarya Rai to the 2018 Cannes Film Festival.

1.1 million

The number of followers that Michael Cinco’s Instagram account has garnered.

NATIONAL%20SELECTIONS

Martin Sabbagh profile

Job: CEO JCDecaux Middle East

In the role: Since January 2015

Lives: In the UAE

Background: M&A, investment banking

Studied: Corporate finance

Attacks on Egypt’s long rooted Copts

Egypt’s Copts belong to one of the world’s oldest Christian communities, with Mark the Evangelist credited with founding their church around 300 AD. Orthodox Christians account for the overwhelming majority of Christians in Egypt, with the rest mainly made up of Greek Orthodox, Catholics and Anglicans.

The community accounts for some 10 per cent of Egypt’s 100 million people, with the largest concentrations of Christians found in Cairo, Alexandria and the provinces of Minya and Assiut south of Cairo.

Egypt’s Christians have had a somewhat turbulent history in the Muslim majority Arab nation, with the community occasionally suffering outright persecution but generally living in peace with their Muslim compatriots. But radical Muslims who have first emerged in the 1970s have whipped up anti-Christian sentiments, something that has, in turn, led to an upsurge in attacks against their places of worship, church-linked facilities as well as their businesses and homes.

More recently, ISIS has vowed to go after the Christians, claiming responsibility for a series of attacks against churches packed with worshippers starting December 2016.

The discrimination many Christians complain about and the shift towards religious conservatism by many Egyptian Muslims over the last 50 years have forced hundreds of thousands of Christians to migrate, starting new lives in growing communities in places as far afield as Australia, Canada and the United States.

Here is a look at major attacks against Egypt's Coptic Christians in recent years:

November 2: Masked gunmen riding pickup trucks opened fire on three buses carrying pilgrims to the remote desert monastery of St. Samuel the Confessor south of Cairo, killing 7 and wounding about 20. IS claimed responsibility for the attack.

May 26, 2017: Masked militants riding in three all-terrain cars open fire on a bus carrying pilgrims on their way to the Monastery of St. Samuel the Confessor, killing 29 and wounding 22. ISIS claimed responsibility for the attack.

April 2017: Twin attacks by suicide bombers hit churches in the coastal city of Alexandria and the Nile Delta city of Tanta. At least 43 people are killed and scores of worshippers injured in the Palm Sunday attack, which narrowly missed a ceremony presided over by Pope Tawadros II, spiritual leader of Egypt Orthodox Copts, in Alexandria's St. Mark's Cathedral. ISIS claimed responsibility for the attacks.

February 2017: Hundreds of Egyptian Christians flee their homes in the northern part of the Sinai Peninsula, fearing attacks by ISIS. The group's North Sinai affiliate had killed at least seven Coptic Christians in the restive peninsula in less than a month.

December 2016: A bombing at a chapel adjacent to Egypt's main Coptic Christian cathedral in Cairo kills 30 people and wounds dozens during Sunday Mass in one of the deadliest attacks carried out against the religious minority in recent memory. ISIS claimed responsibility.

July 2016: Pope Tawadros II says that since 2013 there were 37 sectarian attacks on Christians in Egypt, nearly one incident a month. A Muslim mob stabs to death a 27-year-old Coptic Christian man, Fam Khalaf, in the central city of Minya over a personal feud.

May 2016: A Muslim mob ransacks and torches seven Christian homes in Minya after rumours spread that a Christian man had an affair with a Muslim woman. The elderly mother of the Christian man was stripped naked and dragged through a street by the mob.

New Year's Eve 2011: A bomb explodes in a Coptic Christian church in Alexandria as worshippers leave after a midnight mass, killing more than 20 people.

More from Neighbourhood Watch:

Brief scores:

Toss: India, opted to field

Australia 158-4 (17 ov)

Maxwell 46, Lynn 37; Kuldeep 2-24

India 169-7 (17 ov)

Dhawan 76, Karthik 30; Zampa 2-22

Result: Australia won by 4 runs by D/L method

What can victims do?

Always use only regulated platforms

Stop all transactions and communication on suspicion

Save all evidence (screenshots, chat logs, transaction IDs)

Report to local authorities

Warn others to prevent further harm

Courtesy: Crystal Intelligence

COMPANY PROFILE

UK’s AI plan

- AI ambassadors such as MIT economist Simon Johnson, Monzo cofounder Tom Blomfield and Google DeepMind’s Raia Hadsell

- £10bn AI growth zone in South Wales to create 5,000 jobs

- £100m of government support for startups building AI hardware products

- £250m to train new AI models

Jeff Buckley: From Hallelujah To The Last Goodbye

By Dave Lory with Jim Irvin

Women’s World T20, Asia Qualifier

UAE results

Beat China by 16 runs

Lost to Thailand by 10 wickets

Beat Nepal by five runs

Beat Hong Kong by eight wickets

Beat Malaysia by 34 runs

Standings (P, W, l, NR, points)

1. Thailand 5 4 0 1 9

2. UAE 5 4 1 0 8

3. Nepal 5 2 1 2 6

4. Hong Kong 5 2 2 1 5

5. Malaysia 5 1 4 0 2

6. China 5 0 5 0 0

Final

Thailand v UAE, Monday, 7am

SPIDER-MAN%3A%20ACROSS%20THE%20SPIDER-VERSE

The bio:

Favourite film:

Declan: It was The Commitments but now it’s Bohemian Rhapsody.

Heidi: The Long Kiss Goodnight.

Favourite holiday destination:

Declan: Las Vegas but I also love getting home to Ireland and seeing everyone back home.

Heidi: Australia but my dream destination would be to go to Cuba.

Favourite pastime:

Declan: I love brunching and socializing. Just basically having the craic.

Heidi: Paddleboarding and swimming.

Personal motto:

Declan: Take chances.

Heidi: Live, love, laugh and have no regrets.

more from Janine di Giovanni

Transgender report

While you're here

Four%20scenarios%20for%20Ukraine%20war

While you're here

The National editorial: Turkey's soft power weighs heavy on Europe's Muslims

Con Coughlin: How extremists use Zoom and other tools to exploit pandemic

Nicky Harley: Peace TV preacher Zakir Naik prompts UK hate laws review

2025 Fifa Club World Cup groups

Group A: Palmeiras, Porto, Al Ahly, Inter Miami.

Group B: Paris Saint-Germain, Atletico Madrid, Botafogo, Seattle.

Group C: Bayern Munich, Auckland City, Boca Juniors, Benfica.

Group D: Flamengo, ES Tunis, Chelsea, Leon.

Group E: River Plate, Urawa, Monterrey, Inter Milan.

Group F: Fluminense, Borussia Dortmund, Ulsan, Mamelodi Sundowns.

Group G: Manchester City, Wydad, Al Ain, Juventus.

Group H: Real Madrid, Al Hilal, Pachuca, Salzburg.

How to get exposure to gold

Although you can buy gold easily on the Dubai markets, the problem with buying physical bars, coins or jewellery is that you then have storage, security and insurance issues.

A far easier option is to invest in a low-cost exchange traded fund (ETF) that invests in the precious metal instead, for example, ETFS Physical Gold (PHAU) and iShares Physical Gold (SGLN) both track physical gold. The VanEck Vectors Gold Miners ETF invests directly in mining companies.

Alternatively, BlackRock Gold & General seeks to achieve long-term capital growth primarily through an actively managed portfolio of gold mining, commodity and precious-metal related shares. Its largest portfolio holdings include gold miners Newcrest Mining, Barrick Gold Corp, Agnico Eagle Mines and the NewMont Goldcorp.

Brave investors could take on the added risk of buying individual gold mining stocks, many of which have performed wonderfully well lately.

London-listed Centamin is up more than 70 per cent in just three months, although in a sign of its volatility, it is down 5 per cent on two years ago. Trans-Siberian Gold, listed on London's alternative investment market (AIM) for small stocks, has seen its share price almost quadruple from 34p to 124p over the same period, but do not assume this kind of runaway growth can continue for long

However, buying individual equities like these is highly risky, as their share prices can crash just as quickly, which isn't what what you want from a supposedly safe haven.

Omar Yabroudi's factfile

Born: October 20, 1989, Sharjah

Education: Bachelor of Science and Football, Liverpool John Moores University

2010: Accrington Stanley FC, internship

2010-2012: Crystal Palace, performance analyst with U-18 academy

2012-2015: Barnet FC, first-team performance analyst/head of recruitment

2015-2017: Nottingham Forest, head of recruitment

2018-present: Crystal Palace, player recruitment manager

Sunday's games

Liverpool v West Ham United, 4.30pm (UAE)

Southampton v Burnley, 4.30pm

Arsenal v Manchester City, 7pm

The rules of the road keeping cyclists safe

Cyclists must wear a helmet, arm and knee pads

Have a white front-light and a back red-light on their bike

They must place a number plate with reflective light to the back of the bike to alert road-users

Avoid carrying weights that could cause the bike to lose balance

They must cycle on designated lanes and areas and ride safe on pavements to avoid bumping into pedestrians

On Women's Day

Dr Nawal Al-Hosany: Why more women should be on the frontlines of climate action

Shelina Janmohamed: Why shouldn't a spouse be compensated fairly for housework?

Samar Elmnhrawy: How companies in the Middle East can catch up on gender equality

Justin Thomas: Challenge the notion that 'men are from Mars, women are from Venus'

Kandahar%20

'The Woman in the House Across the Street from the Girl in the Window'

Director:Michael Lehmann

Stars:Kristen Bell

Rating: 1/5

Emirates Cricket Board Women’s T10

ECB Hawks v ECB Falcons

Monday, April 6, 7.30pm, Sharjah Cricket Stadium

The match will be broadcast live on the My Sports Eye Facebook page

Hawks

Coach: Chaitrali Kalgutkar

Squad: Chaya Mughal (captain), Archara Supriya, Chamani Senevirathne, Chathurika Anand, Geethika Jyothis, Indhuja Nandakumar, Kashish Loungani, Khushi Sharma, Khushi Tanwar, Rinitha Rajith, Siddhi Pagarani, Siya Gokhale, Subha Srinivasan, Suraksha Kotte, Theertha Satish

Falcons

Coach: Najeeb Amar

Squad: Kavisha Kumari (captain), Almaseera Jahangir, Annika Shivpuri, Archisha Mukherjee, Judit Cleetus, Ishani Senavirathne, Lavanya Keny, Mahika Gaur, Malavika Unnithan, Rishitha Rajith, Rithika Rajith, Samaira Dharnidharka, Shashini Kaluarachchi, Udeni Kuruppuarachchi, Vaishnave Mahesh

Biog

Mr Kandhari is legally authorised to conduct marriages in the gurdwara

He has officiated weddings of Sikhs and people of different faiths from Malaysia, Sri Lanka, Russia, the US and Canada

Father of two sons, grandfather of six

Plays golf once a week

Enjoys trying new holiday destinations with his wife and family

Walks for an hour every morning

Completed a Bachelor of Commerce degree in Loyola College, Chennai, India

2019 is a milestone because he completes 50 years in business

Gifts exchanged

- King Charles - replica of President Eisenhower Sword

- Queen Camilla - Tiffany & Co vintage 18-carat gold, diamond and ruby flower brooch

- Donald Trump - hand-bound leather book with Declaration of Independence

- Melania Trump - personalised Anya Hindmarch handbag

THE%20SWIMMERS

While you're here ...

Company profile

Name: Steppi

Founders: Joe Franklin and Milos Savic

Launched: February 2020

Size: 10,000 users by the end of July and a goal of 200,000 users by the end of the year

Employees: Five

Based: Jumeirah Lakes Towers, Dubai

Financing stage: Two seed rounds – the first sourced from angel investors and the founders' personal savings

Second round raised Dh720,000 from silent investors in June this year

India team for Sri Lanka series

Test squad: Rohit Sharma (captain), Priyank Panchal, Mayank Agarwal, Virat Kohli, Shreyas Iyer, Hanuma Vihari, Shubhman Gill, Rishabh Pant (wk), KS Bharath (wk), Ravindra Jadeja, Jayant Yadav, Ravichandran Ashwin, Kuldeep Yadav, Sourabh Kumar, Mohammed Siraj, Umesh Yadav, Mohammed Shami, Jasprit Bumrah.

T20 squad: Rohit Sharma (captain), Ruturaj Gaikwad, Shreyas Iyer, Surya Kumar Yadav, Sanju Samson, Ishan Kishan (wk), Venkatesh Iyer, Deepak Chahar, Deepak Hooda, Ravindra Jadeja, Yuzvendra Chahal, Ravi Bishnoi, Kuldeep Yadav, Mohammed Siraj, Bhuvneshwar Kumar, Harshal Patel, Jasprit Bumrah, Avesh Khan

WORLD CUP FINAL

England v South Africa

Yokohama International Stadium, Tokyo

Saturday, kick-off 1pm (UAE)

While you're here

Hussein Ibish: Could it be game over for Donald Trump?

Joyce Karam: Trump's campaign thrown off balance

Trump tests positive: everything we know so far

On Women's Day

Dr Nawal Al-Hosany: Why more women should be on the frontlines of climate action

Samar Elmnhrawy: How companies in the Middle East can catch up on gender equality

The National Editorial: Is there much to celebrate on International Women's Day 2021?

Justin Thomas: Challenge the notion that 'men are from Mars, women are from Venus'

Wicked: For Good

Director: Jon M Chu

Starring: Ariana Grande, Cynthia Erivo, Jonathan Bailey, Jeff Goldblum, Michelle Yeoh, Ethan Slater

Rating: 4/5

While you're here

Sulaiman Hakemy: Why it's important to lose elections

Rashmee Roshan Lall: US race relations in three words

Michael Goldfarb: First debate marks the end of an era

Mercer, the investment consulting arm of US services company Marsh & McLennan, expects its wealth division to at least double its assets under management (AUM) in the Middle East as wealth in the region continues to grow despite economic headwinds, a company official said.

Mercer Wealth, which globally has $160 billion in AUM, plans to boost its AUM in the region to $2-$3bn in the next 2-3 years from the present $1bn, said Yasir AbuShaban, a Dubai-based principal with Mercer Wealth.

“Within the next two to three years, we are looking at reaching $2 to $3 billion as a conservative estimate and we do see an opportunity to do so,” said Mr AbuShaban.

Mercer does not directly make investments, but allocates clients’ money they have discretion to, to professional asset managers. They also provide advice to clients.

“We have buying power. We can negotiate on their (client’s) behalf with asset managers to provide them lower fees than they otherwise would have to get on their own,” he added.

Mercer Wealth’s clients include sovereign wealth funds, family offices, and insurance companies among others.

From its office in Dubai, Mercer also looks after Africa, India and Turkey, where they also see opportunity for growth.

Wealth creation in Middle East and Africa (MEA) grew 8.5 per cent to $8.1 trillion last year from $7.5tn in 2015, higher than last year’s global average of 6 per cent and the second-highest growth in a region after Asia-Pacific which grew 9.9 per cent, according to consultancy Boston Consulting Group (BCG). In the region, where wealth grew just 1.9 per cent in 2015 compared with 2014, a pickup in oil prices has helped in wealth generation.

BCG is forecasting MEA wealth will rise to $12tn by 2021, growing at an annual average of 8 per cent.

Drivers of wealth generation in the region will be split evenly between new wealth creation and growth of performance of existing assets, according to BCG.

Another general trend in the region is clients’ looking for a comprehensive approach to investing, according to Mr AbuShaban.

“Institutional investors or some of the families are seeing a slowdown in the available capital they have to invest and in that sense they are looking at optimizing the way they manage their portfolios and making sure they are not investing haphazardly and different parts of their investment are working together,” said Mr AbuShaban.

Some clients also have a higher appetite for risk, given the low interest-rate environment that does not provide enough yield for some institutional investors. These clients are keen to invest in illiquid assets, such as private equity and infrastructure.

“What we have seen is a desire for higher returns in what has been a low-return environment specifically in various fixed income or bonds,” he said.

“In this environment, we have seen a de facto increase in the risk that clients are taking in things like illiquid investments, private equity investments, infrastructure and private debt, those kind of investments were higher illiquidity results in incrementally higher returns.”

The Abu Dhabi Investment Authority, one of the largest sovereign wealth funds, said in its 2016 report that has gradually increased its exposure in direct private equity and private credit transactions, mainly in Asian markets and especially in China and India. The authority’s private equity department focused on structured equities owing to “their defensive characteristics.”

On Women's Day

Dr Nawal Al-Hosany: Why more women should be on the frontlines of climate action

Shelina Janmohamed: Why shouldn't a spouse be compensated fairly for housework?

Justin Thomas: Challenge the notion that 'men are from Mars, women are from Venus'

The National Editorial: Is there much to celebrate on International Women's Day 2021?

Tank warfare

Lt Gen Erik Petersen, deputy chief of programs, US Army, has argued it took a “three decade holiday” on modernising tanks.

“There clearly remains a significant armoured heavy ground manoeuvre threat in this world and maintaining a world class armoured force is absolutely vital,” the general said in London last week.

“We are developing next generation capabilities to compete with and deter adversaries to prevent opportunism or miscalculation, and, if necessary, defeat any foe decisively.”

Sri Lanka-India Test series schedule

- 1st Test India won by 304 runs at Galle

- 2nd Test Thursday-Monday at Colombo

- 3rd Test August 12-16 at Pallekele

FIXTURES

Fixtures for Round 15 (all times UAE)

Friday

Inter Milan v AS Roma (11.45pm)

Saturday

Atalanta v Verona (6pm)

Udinese v Napoli (9pm)

Lazio v Juventus (11.45pm)

Sunday

Lecce v Genoa (3.30pm)

Sassuolo v Cagliari (6pm)

SPAL v Brescia (6pm)

Torino v Fiorentina (6pm)

Sampdoria v Parma (9pm)

Bologna v AC Milan (11.45pm)