Turkey’s central bank, under new governor Hafize Gaye Erkan, will ease banks’ security maintenance rule as its first step to simplifying policies that were previously adopted to boost Turkish lira savings.

The securities maintenance ratio has been lowered to 5 per cent from 10 per cent effective immediately, according to a decree published in the official gazette on Sunday.

This ratio was increased twice from 3 per cent to 10 per cent in the last two years in order to support the conversion of foreign currency deposits to lira deposits as a part of the “liraisation strategy”.

According to tweaks in the rule, if their share of lira deposits to total deposits is below 57 per cent, banks will need to increase the securities maintenance ratio by an additional 7 percentage points.

The previous threshold was 60 per cent. Banks will get a discounted securities maintenance ratio if they increase the share of their lira deposits to above 70 per cent.

The easing comes after Turkey’s Treasury and Finance Minister Mehmet Simsek promised a return to “rational” policies.

At Ms Erkan’s first monetary policy meeting last week, the central bank raised the interest rate by 650 base points to 15 per cent and signalled a “gradual tightening”.

Ms Erkan met bankers on Friday, and during her first ever public appearance she stated that they had requested a simplification of rules.

The securities maintenance regulation was simplified to increase the functionality of market mechanisms and strengthen macro financial stability, the central bank said in a statement published right after the publication of the official gazette.

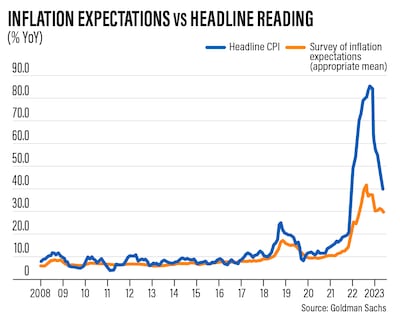

Sahap Kavcioglu, who was the previous central bank governor, lowered the interest rate and followed unconventional economic policies, which fuelled the worst inflation crisis in decades and repelled foreign investors that Turkey relies on to plug its perennial current-account deficit.

You might also like

What's%20in%20my%20pazhamkootan%3F

Inside Palestine-Israel

Saeb Erakat: Palestine can overcome coronavirus

Michael Young: The issue with Israel's 'iron wall'

Michael Young: What Israel's divisions mean for Arabs

The specs

Engine: 3.8-litre twin-turbo flat-six

Power: 650hp at 6,750rpm

Torque: 800Nm from 2,500-4,000rpm

Transmission: 8-speed dual-clutch auto

Fuel consumption: 11.12L/100km

Price: From Dh796,600

On sale: now

The specs

Engine: 0.8-litre four cylinder

Power: 70bhp

Torque: 66Nm

Transmission: four-speed manual

Price: $1,075 new in 1967, now valued at $40,000

On sale: Models from 1966 to 1970

Our family matters legal consultant

Name: Hassan Mohsen Elhais

Position: legal consultant with Al Rowaad Advocates and Legal Consultants.

Company%20Profile

Kareem Shaheen on Canada

Investing in the future

Living in...

This article is part of a guide on where to live in the UAE. Our reporters will profile some of the country’s most desirable districts, provide an estimate of rental prices and introduce you to some of the residents who call each area home.

SPEC%20SHEET%3A%20NOTHING%20PHONE%20(2)

UAE Rugby finals day

Games being played at The Sevens, Dubai

2pm, UAE Conference final

Dubai Tigers v Al Ain Amblers

4pm, UAE Premiership final

Abu Dhabi Harlequins v Jebel Ali Dragons

Tips for avoiding trouble online

- Do not post incorrect information and beware of fake news

- Do not publish or repost racist or hate speech, yours or anyone else’s

- Do not incite violence and be careful how to phrase what you want to say

- Do not defame anyone. Have a difference of opinion with someone? Don’t attack them on social media

- Do not forget your children and monitor their online activities

Our legal consultant

Name: Hassan Mohsen Elhais

Position: legal consultant with Al Rowaad Advocates and Legal Consultants.

While you're here

Kareem Shaheen: Even a pandemic could not unite today's America

Michele Wucker: The difference between a black swan and a grey rhino

Robert Matthews: Has flawed science and rushed research failed us?

Selected fixtures

All times UAE

Wednesday

Poland v Portugal 10.45pm

Russia v Sweden 10.45pm

Friday

Belgium v Switzerland 10.45pm

Croatia v England 10.45pm

Saturday

Netherlands v Germany 10.45pm

Rep of Ireland v Denmark 10.45pm

Sunday

Poland v Italy 10.45pm

Monday

Spain v England 10.45pm

Tuesday

France v Germany 10.45pm

Rep of Ireland v Wales 10.45pm

Fixtures

50-over match

UAE v Lancashire, starts at 10am

Champion County match

MCC v Surrey, four-day match, starting on Sunday, March 24, play starts at 10am

Both matches are at ICC Academy, Dubai Sports City. Admission is free.

Meydan card

6.30pm: Al Maktoum Challenge Round-1 (PA) Group 1 US$65,000 (Dirt) 1,600m

7.05pm: Conditions (TB) $100,000 (Turf) 1,400m

7.40pm: UAE 2000 Guineas Trial (TB) $100,000 (D) 1,600m

8.15pm: Handicap (TB) $175,000 (T) 1,200m

8.50pm: Al Maktoum Challenge Round-1 (TB) Group 2 $350,000 (D) 1,600m

9.25pm: Handicap (TB) $175,000 (D) 1,900m

10pm: Handicap (TB) $135,000 (T) 1,600m

What are the GCSE grade equivalents?

- Grade 9 = above an A*

- Grade 8 = between grades A* and A

- Grade 7 = grade A

- Grade 6 = just above a grade B

- Grade 5 = between grades B and C

- Grade 4 = grade C

- Grade 3 = between grades D and E

- Grade 2 = between grades E and F

- Grade 1 = between grades F and G

UAE%20athletes%20heading%20to%20Paris%202024

Desert Warrior

Starring: Anthony Mackie, Aiysha Hart, Ben Kingsley

Director: Rupert Wyatt

Rating: 3/5

Name: Colm McLoughlin

Country: Galway, Ireland

Job: Executive vice chairman and chief executive of Dubai Duty Free

Favourite golf course: Dubai Creek Golf and Yacht Club

Favourite part of Dubai: Palm Jumeirah

TOURNAMENT INFO

Opening fixtures:

Friday, Oct 5

8pm: Kabul Zwanan v Paktia Panthers

Saturday, Oct 6

4pm: Nangarhar Leopards v Kandahar Knights

8pm: Kabul Zwanan v Balkh Legends

Tickets

Tickets can be bought online at https://www.q-tickets.com/apl/eventlist and at the ticket office at the stadium.

TV info

The tournament will be broadcast live in the UAE on OSN Sports.

The burning issue

The internal combustion engine is facing a watershed moment – major manufacturer Volvo is to stop producing petroleum-powered vehicles by 2021 and countries in Europe, including the UK, have vowed to ban their sale before 2040. The National takes a look at the story of one of the most successful technologies of the last 100 years and how it has impacted life in the UAE.

Part three: an affection for classic cars lives on

Read part two: how climate change drove the race for an alternative

Read part one: how cars came to the UAE

Series information

Pakistan v Dubai

First Test, Dubai International Stadium

Sun Oct 6 to Thu Oct 11

Second Test, Zayed Stadium, Abu Dhabi

Tue Oct 16 to Sat Oct 20

Play starts at 10am each day

Teams

Pakistan

1 Mohammed Hafeez, 2 Imam-ul-Haq, 3 Azhar Ali, 4 Asad Shafiq, 5 Haris Sohail, 6 Babar Azam, 7 Sarfraz Ahmed, 8 Bilal Asif, 9 Yasir Shah, 10, Mohammed Abbas, 11 Wahab Riaz or Mir Hamza

Australia

1 Usman Khawaja, 2 Aaron Finch, 3 Shaun Marsh, 4 Mitchell Marsh, 5 Travis Head, 6 Marnus Labuschagne, 7 Tim Paine, 8 Mitchell Starc, 9 Peter Siddle, 10 Nathan Lyon, 11 Jon Holland

Why it pays to compare

A comparison of sending Dh20,000 from the UAE using two different routes at the same time - the first direct from a UAE bank to a bank in Germany, and the second from the same UAE bank via an online platform to Germany - found key differences in cost and speed. The transfers were both initiated on January 30.

Route 1: bank transfer

The UAE bank charged Dh152.25 for the Dh20,000 transfer. On top of that, their exchange rate margin added a difference of around Dh415, compared with the mid-market rate.

Total cost: Dh567.25 - around 2.9 per cent of the total amount

Total received: €4,670.30

Route 2: online platform

The UAE bank’s charge for sending Dh20,000 to a UK dirham-denominated account was Dh2.10. The exchange rate margin cost was Dh60, plus a Dh12 fee.

Total cost: Dh74.10, around 0.4 per cent of the transaction

Total received: €4,756

The UAE bank transfer was far quicker – around two to three working days, while the online platform took around four to five days, but was considerably cheaper. In the online platform transfer, the funds were also exposed to currency risk during the period it took for them to arrive.

Traits of Chinese zodiac animals

Tiger:independent, successful, volatile

Rat:witty, creative, charming

Ox:diligent, perseverent, conservative

Rabbit:gracious, considerate, sensitive

Dragon:prosperous, brave, rash

Snake:calm, thoughtful, stubborn

Horse:faithful, energetic, carefree

Sheep:easy-going, peacemaker, curious

Monkey:family-orientated, clever, playful

Rooster:honest, confident, pompous

Dog:loyal, kind, perfectionist

Boar:loving, tolerant, indulgent

Last-16

France 4

Griezmann (13' pen), Pavard (57'), Mbappe (64', 68')

Argentina 3

Di Maria (41'), Mercado (48'), Aguero (90 3')

WOMAN AND CHILD

Director: Saeed Roustaee

Starring: Parinaz Izadyar, Payman Maadi

Rating: 4/5

Ziina users can donate to relief efforts in Beirut

Ziina users will be able to use the app to help relief efforts in Beirut, which has been left reeling after an August blast caused an estimated $15 billion in damage and left thousands homeless. Ziina has partnered with the United Nations High Commissioner for Refugees to raise money for the Lebanese capital, co-founder Faisal Toukan says. “As of October 1, the UNHCR has the first certified badge on Ziina and is automatically part of user's top friends' list during this campaign. Users can now donate any amount to the Beirut relief with two clicks. The money raised will go towards rebuilding houses for the families that were impacted by the explosion.”

Timeline

2012-2015

The company offers payments/bribes to win key contracts in the Middle East

May 2017

The UK SFO officially opens investigation into Petrofac’s use of agents, corruption, and potential bribery to secure contracts

September 2021

Petrofac pleads guilty to seven counts of failing to prevent bribery under the UK Bribery Act

October 2021

Court fines Petrofac £77 million for bribery. Former executive receives a two-year suspended sentence

December 2024

Petrofac enters into comprehensive restructuring to strengthen the financial position of the group

May 2025

The High Court of England and Wales approves the company’s restructuring plan

July 2025

The Court of Appeal issues a judgment challenging parts of the restructuring plan

August 2025

Petrofac issues a business update to execute the restructuring and confirms it will appeal the Court of Appeal decision

October 2025

Petrofac loses a major TenneT offshore wind contract worth €13 billion. Holding company files for administration in the UK. Petrofac delisted from the London Stock Exchange

November 2025

180 Petrofac employees laid off in the UAE

MORE ON TURKEY'S SYRIA OFFENCE

Editorial: Turkey using refugees as mere pawns in a dangerous game

Simon Waldman: Is Turkey creating another European migrant crisis?

Raghida Dergham: Russia is weighing its options against Turkey

The specs

While you're here

Labour dispute

The insured employee may still file an ILOE claim even if a labour dispute is ongoing post termination, but the insurer may suspend or reject payment, until the courts resolve the dispute, especially if the reason for termination is contested. The outcome of the labour court proceedings can directly affect eligibility.

- Abdullah Ishnaneh, Partner, BSA Law

The specs

- Engine: 3.9-litre twin-turbo V8

- Power: 640hp

- Torque: 760nm

- On sale: 2026

- Price: Not announced yet

While you're here

Samuel McIlhagga: William Dalrymple on the perils of empire nostalgia

Sholto Byrnes: When viewing colonialism, past feels like foreign country

Shelina Janmohamed: Britain must look forward, not pine for a lost past