Global car sales are set for a 15 per cent drop in 2020 because of the impact of the Covid-19 pandemic, double the decline during the 2008-09 global financial crisis, according to the International Energy Agency (IEA).

Car sales are likely to slump by 13 million compared with 2019, with the largest drops to be registered in Europe, the US and China – regions hardest hit by the pandemic.

While conventional car sales were battered, sales of electric vehicles may see an upswing this year, according to the Paris-headquartered agency.

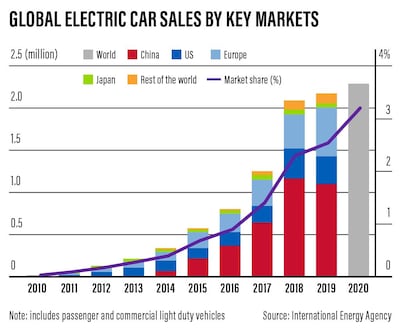

Global electric car sales are likely to exceed 2019's total to reach more than 2.3 million, taking up a record share of the car market of more than 3 per cent.

"This brings up the total number of electric cars on the road worldwide to a new record of about 10 million, around 1 per cent of the global car stock," the IEA said.

The coronavirus pandemic has hit automakers squeezed by the US-China trade war, as countries enforced lockdown measures to contain the outbreak. Car sales slumped as people worked from home and avoided public spaces for nearly four months in most countries.

Global car sales between January and April dropped by a third from the same period in 2019, according to the IEA, with around nine million fewer cars sold.

"On a monthly basis, the decline in sales was even more pronounced, mirroring the timing and stringency of the lockdowns across many countries. China, the world’s largest car market, registered its sharpest year-on-year decline in February," the agency said.

Car sales in China traditionally dip in February because of the Lunar New Year holiday, but this year sales fell by 80 per cent compared with February 2019.

Car sales in the US halved year-on-year in April, while they dropped 60 per cent in Germany. France reported a decline of 90 per cent, while the UK and Italy said sales slumped by 90 per cent.

"For India, virtually no car sales were reported," the IEA said.

India, the world's second-most populous country enforced one of the strictest lockdown measures in the world, shutting down ground transportation as well as air travel, including domestic flights.

A rebound in car sales is expected in the second half of 2020, but the pace of revival will depend on "which confinement measures are eased, potential second waves of the pandemic, the pace of economic recovery and the willingness and ability of consumers and businesses to purchase new cars", the IEA said.

Electric cars, meanwhile, are likely to have a much better outlook than the rest of the car industry on the basis of their competitive costs. However, the IEA cautioned the recent collapse in oil prices may have slightly eroded that competitiveness.

More on animal trafficking

UAE currency: the story behind the money in your pockets

5 of the most-popular Airbnb locations in Dubai

Bobby Grudziecki, chief operating officer of Frank Porter, identifies the five most popular areas in Dubai for those looking to make the most out of their properties and the rates owners can secure:

• Dubai Marina

The Marina and Jumeirah Beach Residence are popular locations, says Mr Grudziecki, due to their closeness to the beach, restaurants and hotels.

Frank Porter’s average Airbnb rent:

One bedroom: Dh482 to Dh739

Two bedroom: Dh627 to Dh960

Three bedroom: Dh721 to Dh1,104

• Downtown

Within walking distance of the Dubai Mall, Burj Khalifa and the famous fountains, this location combines business and leisure. “Sure it’s for tourists,” says Mr Grudziecki. “Though Downtown [still caters to business people] because it’s close to Dubai International Financial Centre."

Frank Porter’s average Airbnb rent:

One bedroom: Dh497 to Dh772

Two bedroom: Dh646 to Dh1,003

Three bedroom: Dh743 to Dh1,154

• City Walk

The rising star of the Dubai property market, this area is lined with pristine sidewalks, boutiques and cafes and close to the new entertainment venue Coca Cola Arena. “Downtown and Marina are pretty much the same prices,” Mr Grudziecki says, “but City Walk is higher.”

Frank Porter’s average Airbnb rent:

One bedroom: Dh524 to Dh809

Two bedroom: Dh682 to Dh1,052

Three bedroom: Dh784 to Dh1,210

• Jumeirah Lake Towers

Dubai Marina’s little brother JLT resides on the other side of Sheikh Zayed road but is still close enough to beachside outlets and attractions. The big selling point for Airbnb renters, however, is that “it’s cheaper than Dubai Marina”, Mr Grudziecki says.

Frank Porter’s average Airbnb rent:

One bedroom: Dh422 to Dh629

Two bedroom: Dh549 to Dh818

Three bedroom: Dh631 to Dh941

• Palm Jumeirah

Palm Jumeirah's proximity to luxury resorts is attractive, especially for big families, says Mr Grudziecki, as Airbnb renters can secure competitive rates on one of the world’s most famous tourist destinations.

Frank Porter’s average Airbnb rent:

One bedroom: Dh503 to Dh770

Two bedroom: Dh654 to Dh1,002

Three bedroom: Dh752 to Dh1,152

It Was Just an Accident

Director: Jafar Panahi

Stars: Vahid Mobasseri, Mariam Afshari, Ebrahim Azizi, Hadis Pakbaten, Majid Panahi, Mohamad Ali Elyasmehr

Rating: 4/5

Mercer, the investment consulting arm of US services company Marsh & McLennan, expects its wealth division to at least double its assets under management (AUM) in the Middle East as wealth in the region continues to grow despite economic headwinds, a company official said.

Mercer Wealth, which globally has $160 billion in AUM, plans to boost its AUM in the region to $2-$3bn in the next 2-3 years from the present $1bn, said Yasir AbuShaban, a Dubai-based principal with Mercer Wealth.

“Within the next two to three years, we are looking at reaching $2 to $3 billion as a conservative estimate and we do see an opportunity to do so,” said Mr AbuShaban.

Mercer does not directly make investments, but allocates clients’ money they have discretion to, to professional asset managers. They also provide advice to clients.

“We have buying power. We can negotiate on their (client’s) behalf with asset managers to provide them lower fees than they otherwise would have to get on their own,” he added.

Mercer Wealth’s clients include sovereign wealth funds, family offices, and insurance companies among others.

From its office in Dubai, Mercer also looks after Africa, India and Turkey, where they also see opportunity for growth.

Wealth creation in Middle East and Africa (MEA) grew 8.5 per cent to $8.1 trillion last year from $7.5tn in 2015, higher than last year’s global average of 6 per cent and the second-highest growth in a region after Asia-Pacific which grew 9.9 per cent, according to consultancy Boston Consulting Group (BCG). In the region, where wealth grew just 1.9 per cent in 2015 compared with 2014, a pickup in oil prices has helped in wealth generation.

BCG is forecasting MEA wealth will rise to $12tn by 2021, growing at an annual average of 8 per cent.

Drivers of wealth generation in the region will be split evenly between new wealth creation and growth of performance of existing assets, according to BCG.

Another general trend in the region is clients’ looking for a comprehensive approach to investing, according to Mr AbuShaban.

“Institutional investors or some of the families are seeing a slowdown in the available capital they have to invest and in that sense they are looking at optimizing the way they manage their portfolios and making sure they are not investing haphazardly and different parts of their investment are working together,” said Mr AbuShaban.

Some clients also have a higher appetite for risk, given the low interest-rate environment that does not provide enough yield for some institutional investors. These clients are keen to invest in illiquid assets, such as private equity and infrastructure.

“What we have seen is a desire for higher returns in what has been a low-return environment specifically in various fixed income or bonds,” he said.

“In this environment, we have seen a de facto increase in the risk that clients are taking in things like illiquid investments, private equity investments, infrastructure and private debt, those kind of investments were higher illiquidity results in incrementally higher returns.”

The Abu Dhabi Investment Authority, one of the largest sovereign wealth funds, said in its 2016 report that has gradually increased its exposure in direct private equity and private credit transactions, mainly in Asian markets and especially in China and India. The authority’s private equity department focused on structured equities owing to “their defensive characteristics.”

More on Quran memorisation:

Abu Dhabi GP schedule

Friday: First practice - 1pm; Second practice - 5pm

Saturday: Final practice - 2pm; Qualifying - 5pm

Sunday: Etihad Airways Abu Dhabi Grand Prix (55 laps) - 5.10pm

The specs

- Engine: 3.9-litre twin-turbo V8

- Power: 640hp

- Torque: 760nm

- On sale: 2026

- Price: Not announced yet