With the world gradually recovering from the effects of Covid-19, despite the onset of the Omicron variant, the New Year's holiday season will be characterised by shopping sprees. But it is important to guarantee that you make every penny count.

About 62 per cent of households in the Middle East reported a reduction in income and 49 per cent registered an increase in expenses during Covid-19, a study by PricewaterhouseCoopers found last year. The topic of saving, therefore, assumes even more importance during the festive season.

Life is unpredictable. With no indication of what lies in store for us, it is best to be prepared in every aspect possible.

We have imbibed an important life lesson from our parents: saving money. However, it becomes far more important in the latter phase of our lives as saving money is a necessity for every individual at a personal level.

Managing your money and finances is no rocket science. Neither is it the hegemony of professional financial advisers. Usually, people who struggle to save money are victims of bad spending habits.

We have all been there – an indulgent purchase, an impulsive vacation, an unforeseen emergency – these are inevitable situations in everyday life. But, you can easily adapt to these circumstances if you only spend after you save.

Putting money away in savings or investments in a systematic manner can help you avoid financial problems. It can help you in your hour of need and guarantee that your family has a cushion to fall back on in the event of an emergency.

Savings are essential for everyone, regardless of one’s income, expenditure or life stage. Here are some reasons why you should start saving:

- It provides peace of mind.

- It ensures a brighter future.

- It covers future expected liabilities such as children’s education.

- It protects your family in the event of financial turmoil.

But how does one save money? Here are a few tips:

Create a budget for savings

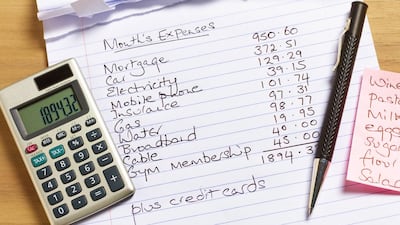

It is a good idea to create a monthly budget. You can plan at the beginning of each month to save and establish spending limits. This allows you to focus on what is essential, minimises the likelihood of overspending and put away some money as intended.

To stay on track with your budget, create a separate account for savings and transfer the planned amount on the salary date.

Record your expenses

If you find it difficult to save on a regular basis, consider keeping a record of your monthly expenditure. This will provide you with a clear picture of where your money is going. You may then identify non-essential items and strive to save more money by avoiding them.

Use your credit card smartly

Credit cards may give a momentary sense of comfort, but the hefty interest rates can quickly drain your funds.

They do offer rewards, cashback, miles or discount benefits. Prudent use of these cards will help you access easy credit and save a decent amount of money each month.

The cardinal rule for prudent use of credit cards is to pay the total outstanding bill in full every month before the due date

Nitin Agarwal,

president, Hundred Offers

The cardinal rule for prudent use of credit cards is to pay the total outstanding bill in full every month before the due date. Otherwise, the card provider charges a hefty interest from the day of transaction.

Track discounts on your credit cards

It is difficult to be fully aware of relevant offers, especially with cards and loyalty programmes offering thousands of deals. Use aggregator apps to identify the best deals, which help you save money while purchasing everyday essentials.

Invest in long-term financial plans

It is essential to watch your money develop over time while you save. Investing in a long-term plan provides a decent rate of interest or return and allows your money to retain its value and outperform inflation.

Nitin Agarwal is the president of Hundred Offers.

GIANT REVIEW

Starring: Amir El-Masry, Pierce Brosnan

Director: Athale

Rating: 4/5

WWE Super ShowDown results

Seth Rollins beat Baron Corbin to retain his WWE Universal title

Finn Balor defeated Andrade to stay WWE Intercontinental Championship

Shane McMahon defeated Roman Reigns

Lars Sullivan won by disqualification against Lucha House Party

Randy Orton beats Triple H

Braun Strowman beats Bobby Lashley

Kofi Kingston wins against Dolph Zigggler to retain the WWE World Heavyweight Championship

Mansoor Al Shehail won the 50-man Battle Royal

The Undertaker beat Goldberg

'The Lost Daughter'

Director: Maggie Gyllenhaal

Starring: Olivia Colman, Jessie Buckley, Dakota Johnson

Rating: 4/5

Racecard

6.35pm: American Business Council – Maiden (PA) Dh80,000 (Dirt) 1,600m

7.10pm: British Business Group – Maiden (TB) Dh82,500 (D) 1,200m

7.45pm: CCI France UAE – Handicap (TB) Dh87,500 (D) 1,400m

8.20pm: Czech Business Council – Rated Conditions (TB) Dh105,000 (D) 1,400m

8.55pm: Netherlands Business Council – Rated Conditions (TB) Dh95,000 (D) 1,600m

9.30pm: Indian Business and Professional Council – Handicap (TB) Dh95,000 (D) 1,200m

Company%20profile

%3Cp%3EDate%20started%3A%20January%202022%3Cbr%3EFounders%3A%20Omar%20Abu%20Innab%2C%20Silvia%20Eldawi%2C%20Walid%20Shihabi%3Cbr%3EBased%3A%20Dubai%3Cbr%3ESector%3A%20PropTech%20%2F%20investment%3Cbr%3EEmployees%3A%2040%3Cbr%3EStage%3A%20Seed%3Cbr%3EInvestors%3A%20Multiple%3C%2Fp%3E%0A

Captain Marvel

Director: Anna Boden, Ryan Fleck

Starring: Brie Larson, Samuel L Jackson, Jude Law, Ben Mendelsohn

4/5 stars

6.30pm: Al Maktoum Challenge Round-3 Group 1 (PA) | US$95,000 | (Dirt) 2,000m

7.05pm: Meydan Classic Listed (TB) ) | $175,000) | (Turf) 1,600m

7.40pm: Handicap (TB) ) | $135,000 ) | (D) 1,600m

8.15pm: Nad Al Sheba Trophy Group 3 (TB) ) | $300,000) | (T) 2,810m

8.50pm: Curlin Handicap Listed (TB)) | $160,000) | (D) 2,000m

9.25pm: Handicap (TB)) | $175,000) | (T) 1,400m

10pm: Handicap (TB) ) | $135,000 ) | (T) 2,000m

MATCH INFO

Uefa Champions League final:

Who: Real Madrid v Liverpool

Where: NSC Olimpiyskiy Stadium, Kiev, Ukraine

When: Saturday, May 26, 10.45pm (UAE)

TV: Match on BeIN Sports

Dr Graham's three goals

Short term

Establish logistics and systems needed to globally deploy vaccines

Intermediate term

Build biomedical workforces in low- and middle-income nations

Long term

A prototype pathogen approach for pandemic preparedness

How the UAE gratuity payment is calculated now

Employees leaving an organisation are entitled to an end-of-service gratuity after completing at least one year of service.

The tenure is calculated on the number of days worked and does not include lengthy leave periods, such as a sabbatical. If you have worked for a company between one and five years, you are paid 21 days of pay based on your final basic salary. After five years, however, you are entitled to 30 days of pay. The total lump sum you receive is based on the duration of your employment.

1. For those who have worked between one and five years, on a basic salary of Dh10,000 (calculation based on 30 days):

a. Dh10,000 ÷ 30 = Dh333.33. Your daily wage is Dh333.33

b. Dh333.33 x 21 = Dh7,000. So 21 days salary equates to Dh7,000 in gratuity entitlement for each year of service. Multiply this figure for every year of service up to five years.

2. For those who have worked more than five years

c. 333.33 x 30 = Dh10,000. So 30 days’ salary is Dh10,000 in gratuity entitlement for each year of service.

Note: The maximum figure cannot exceed two years total salary figure.

More from Neighbourhood Watch

Ten tax points to be aware of in 2026

1. Domestic VAT refund amendments: request your refund within five years

If a business does not apply for the refund on time, they lose their credit.

2. E-invoicing in the UAE

Businesses should continue preparing for the implementation of e-invoicing in the UAE, with 2026 a preparation and transition period ahead of phased mandatory adoption.

3. More tax audits

Tax authorities are increasingly using data already available across multiple filings to identify audit risks.

4. More beneficial VAT and excise tax penalty regime

Tax disputes are expected to become more frequent and more structured, with clearer administrative objection and appeal processes. The UAE has adopted a new penalty regime for VAT and excise disputes, which now mirrors the penalty regime for corporate tax.

5. Greater emphasis on statutory audit

There is a greater need for the accuracy of financial statements. The International Financial Reporting Standards standards need to be strictly adhered to and, as a result, the quality of the audits will need to increase.

6. Further transfer pricing enforcement

Transfer pricing enforcement, which refers to the practice of establishing prices for internal transactions between related entities, is expected to broaden in scope. The UAE will shortly open the possibility to negotiate advance pricing agreements, or essentially rulings for transfer pricing purposes.

7. Limited time periods for audits

Recent amendments also introduce a default five-year limitation period for tax audits and assessments, subject to specific statutory exceptions. While the standard audit and assessment period is five years, this may be extended to up to 15 years in cases involving fraud or tax evasion.

8. Pillar 2 implementation

Many multinational groups will begin to feel the practical effect of the Domestic Minimum Top-Up Tax (DMTT), the UAE's implementation of the OECD’s global minimum tax under Pillar 2. While the rules apply for financial years starting on or after January 1, 2025, it is 2026 that marks the transition to an operational phase.

9. Reduced compliance obligations for imported goods and services

Businesses that apply the reverse-charge mechanism for VAT purposes in the UAE may benefit from reduced compliance obligations.

10. Substance and CbC reporting focus

Tax authorities are expected to continue strengthening the enforcement of economic substance and Country-by-Country (CbC) reporting frameworks. In the UAE, these regimes are increasingly being used as risk-assessment tools, providing tax authorities with a comprehensive view of multinational groups’ global footprints and enabling them to assess whether profits are aligned with real economic activity.

Contributed by Thomas Vanhee and Hend Rashwan, Aurifer

JOKE'S%20ON%20YOU

%3Cp%3EGoogle%20wasn't%20new%20to%20busting%20out%20April%20Fool's%20jokes%3A%20before%20the%20Gmail%20%22prank%22%2C%20it%20tricked%20users%20with%20%3Ca%20href%3D%22https%3A%2F%2Farchive.google%2Fmentalplex%2F%22%20target%3D%22_blank%22%3Emind-reading%20MentalPlex%20responses%3C%2Fa%3E%20and%20said%3Ca%20href%3D%22https%3A%2F%2Farchive.google%2Fpigeonrank%2F%22%20target%3D%22_blank%22%3E%20well-fed%20pigeons%20were%20running%20its%20search%20engine%20operations%3C%2Fa%3E%20.%3C%2Fp%3E%0A%3Cp%3EIn%20subsequent%20years%2C%20they%20announced%20home%20internet%20services%20through%20your%20toilet%20with%20its%20%22%3Ca%20href%3D%22https%3A%2F%2Farchive.google%2Ftisp%2Finstall.html%22%20target%3D%22_blank%22%3Epatented%20GFlush%20system%3C%2Fa%3E%22%2C%20made%20us%20believe%20the%20Moon's%20surface%20was%20made%20of%20cheese%20and%20unveiled%20a%20dating%20service%20in%20which%20they%20called%20founders%20Sergey%20Brin%20and%20Larry%20Page%20%22%3Ca%20href%3D%22https%3A%2F%2Farchive.google%2Fromance%2Fpress.html%22%20target%3D%22_blank%22%3EStanford%20PhD%20wannabes%3C%2Fa%3E%20%22.%3C%2Fp%3E%0A%3Cp%3EBut%20Gmail%20was%20all%20too%20real%2C%20purportedly%20inspired%20by%20one%20%E2%80%93%20a%20single%20%E2%80%93%20Google%20user%20complaining%20about%20the%20%22poor%20quality%20of%20existing%20email%20services%22%20and%20born%20%22%3Ca%20href%3D%22https%3A%2F%2Fgooglepress.blogspot.com%2F2004%2F04%2Fgoogle-gets-message-launches-gmail.html%22%20target%3D%22_blank%22%3Emillions%20of%20M%26amp%3BMs%20later%3C%2Fa%3E%22.%3C%2Fp%3E%0A

Benefits of first-time home buyers' scheme

- Priority access to new homes from participating developers

- Discounts on sales price of off-plan units

- Flexible payment plans from developers

- Mortgages with better interest rates, faster approval times and reduced fees

- DLD registration fee can be paid through banks or credit cards at zero interest rates

Mercer, the investment consulting arm of US services company Marsh & McLennan, expects its wealth division to at least double its assets under management (AUM) in the Middle East as wealth in the region continues to grow despite economic headwinds, a company official said.

Mercer Wealth, which globally has $160 billion in AUM, plans to boost its AUM in the region to $2-$3bn in the next 2-3 years from the present $1bn, said Yasir AbuShaban, a Dubai-based principal with Mercer Wealth.

“Within the next two to three years, we are looking at reaching $2 to $3 billion as a conservative estimate and we do see an opportunity to do so,” said Mr AbuShaban.

Mercer does not directly make investments, but allocates clients’ money they have discretion to, to professional asset managers. They also provide advice to clients.

“We have buying power. We can negotiate on their (client’s) behalf with asset managers to provide them lower fees than they otherwise would have to get on their own,” he added.

Mercer Wealth’s clients include sovereign wealth funds, family offices, and insurance companies among others.

From its office in Dubai, Mercer also looks after Africa, India and Turkey, where they also see opportunity for growth.

Wealth creation in Middle East and Africa (MEA) grew 8.5 per cent to $8.1 trillion last year from $7.5tn in 2015, higher than last year’s global average of 6 per cent and the second-highest growth in a region after Asia-Pacific which grew 9.9 per cent, according to consultancy Boston Consulting Group (BCG). In the region, where wealth grew just 1.9 per cent in 2015 compared with 2014, a pickup in oil prices has helped in wealth generation.

BCG is forecasting MEA wealth will rise to $12tn by 2021, growing at an annual average of 8 per cent.

Drivers of wealth generation in the region will be split evenly between new wealth creation and growth of performance of existing assets, according to BCG.

Another general trend in the region is clients’ looking for a comprehensive approach to investing, according to Mr AbuShaban.

“Institutional investors or some of the families are seeing a slowdown in the available capital they have to invest and in that sense they are looking at optimizing the way they manage their portfolios and making sure they are not investing haphazardly and different parts of their investment are working together,” said Mr AbuShaban.

Some clients also have a higher appetite for risk, given the low interest-rate environment that does not provide enough yield for some institutional investors. These clients are keen to invest in illiquid assets, such as private equity and infrastructure.

“What we have seen is a desire for higher returns in what has been a low-return environment specifically in various fixed income or bonds,” he said.

“In this environment, we have seen a de facto increase in the risk that clients are taking in things like illiquid investments, private equity investments, infrastructure and private debt, those kind of investments were higher illiquidity results in incrementally higher returns.”

The Abu Dhabi Investment Authority, one of the largest sovereign wealth funds, said in its 2016 report that has gradually increased its exposure in direct private equity and private credit transactions, mainly in Asian markets and especially in China and India. The authority’s private equity department focused on structured equities owing to “their defensive characteristics.”

The Matrix Resurrections

Director: Lana Wachowski

Stars: Keanu Reeves, Carrie-Anne Moss, Jessica Henwick

Rating:****

Abdul Jabar Qahraman was meeting supporters in his campaign office in the southern Afghan province of Helmand when a bomb hidden under a sofa exploded on Wednesday.

The blast in the provincial capital Lashkar Gah killed the Afghan election candidate and at least another three people, Interior Minister Wais Ahmad Barmak told reporters. Another three were wounded, while three suspects were detained, he said.

The Taliban – which controls much of Helmand and has vowed to disrupt the October 20 parliamentary elections – claimed responsibility for the attack.

Mr Qahraman was at least the 10th candidate killed so far during the campaign season, and the second from Lashkar Gah this month. Another candidate, Saleh Mohammad Asikzai, was among eight people killed in a suicide attack last week. Most of the slain candidates were murdered in targeted assassinations, including Avtar Singh Khalsa, the first Afghan Sikh to run for the lower house of the parliament.

The same week the Taliban warned candidates to withdraw from the elections. On Wednesday the group issued fresh warnings, calling on educational workers to stop schools from being used as polling centres.

The Settlers

Director: Louis Theroux

Starring: Daniella Weiss, Ari Abramowitz

Rating: 5/5

India team for Sri Lanka series

Test squad: Rohit Sharma (captain), Priyank Panchal, Mayank Agarwal, Virat Kohli, Shreyas Iyer, Hanuma Vihari, Shubhman Gill, Rishabh Pant (wk), KS Bharath (wk), Ravindra Jadeja, Jayant Yadav, Ravichandran Ashwin, Kuldeep Yadav, Sourabh Kumar, Mohammed Siraj, Umesh Yadav, Mohammed Shami, Jasprit Bumrah.

T20 squad: Rohit Sharma (captain), Ruturaj Gaikwad, Shreyas Iyer, Surya Kumar Yadav, Sanju Samson, Ishan Kishan (wk), Venkatesh Iyer, Deepak Chahar, Deepak Hooda, Ravindra Jadeja, Yuzvendra Chahal, Ravi Bishnoi, Kuldeep Yadav, Mohammed Siraj, Bhuvneshwar Kumar, Harshal Patel, Jasprit Bumrah, Avesh Khan

The specs: 2019 BMW X4

Price, base / as tested: Dh276,675 / Dh346,800

Engine: 3.0-litre turbocharged in-line six-cylinder

Transmission: Eight-speed automatic

Power: 354hp @ 5,500rpm

Torque: 500Nm @ 1,550rpm

Fuel economy, combined: 9.0L / 100km

Company%C2%A0profile

%3Cp%3E%3Cstrong%3EName%3A%20%3C%2Fstrong%3EPyppl%3C%2Fp%3E%0A%3Cp%3E%3Cstrong%3EEstablished%3A%20%3C%2Fstrong%3E2017%3C%2Fp%3E%0A%3Cp%3E%3Cstrong%3EFounders%3A%20%3C%2Fstrong%3EAntti%20Arponen%20and%20Phil%20Reynolds%26nbsp%3B%3C%2Fp%3E%0A%3Cp%3E%3Cstrong%3EBased%3A%3C%2Fstrong%3E%20UAE%3C%2Fp%3E%0A%3Cp%3E%3Cstrong%3ESector%3A%3C%2Fstrong%3E%20financial%20services%3C%2Fp%3E%0A%3Cp%3E%3Cstrong%3EInvestment%3A%3C%2Fstrong%3E%20%2418.5%20million%3C%2Fp%3E%0A%3Cp%3E%3Cstrong%3EEmployees%3A%3C%2Fstrong%3E%20150%3C%2Fp%3E%0A%3Cp%3E%3Cstrong%3EFunding%20stage%3A%3C%2Fstrong%3E%20series%20A%2C%20closed%20in%202021%3C%2Fp%3E%0A%3Cp%3E%3Cstrong%3EInvestors%3A%3C%2Fstrong%3E%20venture%20capital%20companies%2C%20international%20funds%2C%20family%20offices%2C%20high-net-worth%20individuals%3C%2Fp%3E%0A

Who's who in Yemen conflict

Houthis: Iran-backed rebels who occupy Sanaa and run unrecognised government

Yemeni government: Exiled government in Aden led by eight-member Presidential Leadership Council

Southern Transitional Council: Faction in Yemeni government that seeks autonomy for the south

Habrish 'rebels': Tribal-backed forces feuding with STC over control of oil in government territory

UAE currency: the story behind the money in your pockets

Zayed Sustainability Prize

The 12 breakaway clubs

England

Arsenal, Chelsea, Liverpool, Manchester City, Manchester United, Tottenham Hotspur

Italy

AC Milan, Inter Milan, Juventus

Spain

Atletico Madrid, Barcelona, Real Madrid

TEAMS

US Team

Dustin Johnson, Jordan Spieth

Justin Thomas, Daniel Berger

Brooks Koepka, Rickie Fowler

Kevin Kisner, Patrick Reed

Matt Kuchar, Kevin Chappell

Charley Hoffman*, Phil Mickelson*

International Team

Hideki Matsuyama, Jason Day

Adam Scott, Louis Oosthuizen

Marc Leishman, Charl Schwartzel

Branden Grace, Si Woo Kim

Jhonattan Vegas, Adam Hadwin

Emiliano Grillo*, Anirban Lahiri*

* denotes captain's picks