Iranian businesses in the UAE are being squeezed by tightening sanctions as visas are refused, profits are hit and banking becomes more difficult.

Tougher business conditions for Iranians outside the Islamic republic mirror the increasing problems Iran’s economy is facing at home.

The deteriorating outlook follows the US last week imposing fresh economic sanctions targeting Iran’s central bank and the financial sector.

The actions are heavily impacting commerce with an important non-oil trading partner. Iranian business people in Abu Dhabi and Dubai are feeling the strain.

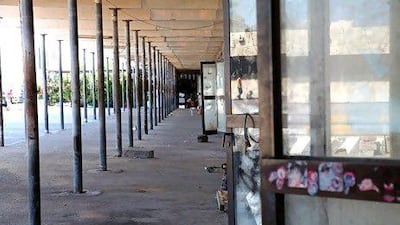

Until recently a bustling trading centre for everything from saffron to carpets, Abu Dhabi’s Iranian Souq is now largely abandoned.

Difficulties obtaining 21-day visas mean fewer Iranian traders have been making the trip to the UAE in recent months.

“Only a few months ago, this place was so busy that it would be hard for customers to walk between the stalls and items on display,” said Reza Mohamed, a stallholder who sells pots. “The traders, who used to come on a 21-day visit visa to capitalise on tourists to the city, are coming far less often.”

Iranian businessmen resident in Dubai are also facing problems.

“US sanctions have tightened the situation, particularly on the banking side, as that has affected traders dealing with Iranian businesses. Financing trade is almost impossible if you are Iranian,” said Morteza Masoumzadeh, a member of the executive committee of the Iranian Business Council in Dubai and the chairman of Jumbo Line Shipping Agency.

The bank accounts of some Iranian traders were closed in the past few months. Others had closed businesses in the emirate and relocated to countries such as Turkey or Malaysia.

Profits of Jumbo Line were down 70 per cent compared with two years ago, he said.

"A lot of our business used to be with Iran, but now we are forced to do almost no trade with Iran," he said.

For Iranians, securing letters of credit from a bank was becoming increasingly difficult, he said.

Iranian businessmen were able to obtain only cash rather than letters of credit from Bank Melli and Bank Saderat, the Iranian banks operating in the UAE.

The US, UK and Canada have stepped up sanctions against Iran since November, targeting financial institutions that do business with the country and banning exports of key goods.

The US sanctions that came into force at the weekend are the strongest yet, barring any financial institution that deals with Iran's central bank from gaining access to the US financial system.

As a major conduit for re-exports to Iran, the UAE is coming under increasing international pressure to close its own business links with the country. Re-export trade to Iran rose 36 per cent in the first six months of last year to Dh19.5 billion (US$5.3bn) compared with Dh14.3bn in the same period a year earlier.

As tensions rise between Iran and the outside world, the country's economy is becoming increasingly shaky, say analysts.

Prices of everyday items have soared as inflation has reached about 20 per cent.

"There's some economic misery in Iran and some aspects of the economy are feeling the pinch," said Ali Al Saffar, a Middle East economist at the Economist Intelligence Unit in London. "The problems are a combination of the impact of sanctions and political interventions in the economy."

International sanctions have yet to seriously hurt Iran's oil sector, its main revenue earner.

tarnold@thenational.ae

halsayegh@thenational.ae

twitter: Follow our breaking business news and retweet to your followers. Follow us

UPI facts

More than 2.2 million Indian tourists arrived in UAE in 2023

More than 3.5 million Indians reside in UAE

Indian tourists can make purchases in UAE using rupee accounts in India through QR-code-based UPI real-time payment systems

Indian residents in UAE can use their non-resident NRO and NRE accounts held in Indian banks linked to a UAE mobile number for UPI transactions

Ten tax points to be aware of in 2026

1. Domestic VAT refund amendments: request your refund within five years

If a business does not apply for the refund on time, they lose their credit.

2. E-invoicing in the UAE

Businesses should continue preparing for the implementation of e-invoicing in the UAE, with 2026 a preparation and transition period ahead of phased mandatory adoption.

3. More tax audits

Tax authorities are increasingly using data already available across multiple filings to identify audit risks.

4. More beneficial VAT and excise tax penalty regime

Tax disputes are expected to become more frequent and more structured, with clearer administrative objection and appeal processes. The UAE has adopted a new penalty regime for VAT and excise disputes, which now mirrors the penalty regime for corporate tax.

5. Greater emphasis on statutory audit

There is a greater need for the accuracy of financial statements. The International Financial Reporting Standards standards need to be strictly adhered to and, as a result, the quality of the audits will need to increase.

6. Further transfer pricing enforcement

Transfer pricing enforcement, which refers to the practice of establishing prices for internal transactions between related entities, is expected to broaden in scope. The UAE will shortly open the possibility to negotiate advance pricing agreements, or essentially rulings for transfer pricing purposes.

7. Limited time periods for audits

Recent amendments also introduce a default five-year limitation period for tax audits and assessments, subject to specific statutory exceptions. While the standard audit and assessment period is five years, this may be extended to up to 15 years in cases involving fraud or tax evasion.

8. Pillar 2 implementation

Many multinational groups will begin to feel the practical effect of the Domestic Minimum Top-Up Tax (DMTT), the UAE's implementation of the OECD’s global minimum tax under Pillar 2. While the rules apply for financial years starting on or after January 1, 2025, it is 2026 that marks the transition to an operational phase.

9. Reduced compliance obligations for imported goods and services

Businesses that apply the reverse-charge mechanism for VAT purposes in the UAE may benefit from reduced compliance obligations.

10. Substance and CbC reporting focus

Tax authorities are expected to continue strengthening the enforcement of economic substance and Country-by-Country (CbC) reporting frameworks. In the UAE, these regimes are increasingly being used as risk-assessment tools, providing tax authorities with a comprehensive view of multinational groups’ global footprints and enabling them to assess whether profits are aligned with real economic activity.

Contributed by Thomas Vanhee and Hend Rashwan, Aurifer

TRAP

Starring: Josh Hartnett, Saleka Shyamalan, Ariel Donaghue

Director: M Night Shyamalan

Rating: 3/5

TALE OF THE TAPE

Floyd Mayweather

- Height

- Weight

- Reach

- Record

Conor McGregor

- Height

- Weight

- Reach

- Record

Company profile

Company: Eighty6

Date started: October 2021

Founders: Abdul Kader Saadi and Anwar Nusseibeh

Based: Dubai, UAE

Sector: Hospitality

Size: 25 employees

Funding stage: Pre-series A

Investment: $1 million

Investors: Seed funding, angel investors

GAC GS8 Specs

Engine: 2.0-litre 4cyl turbo

Power: 248hp at 5,200rpm

Torque: 400Nm at 1,750-4,000rpm

Transmission: 8-speed auto

Fuel consumption: 9.1L/100km

On sale: Now

Price: From Dh149,900

Mina Cup winners

Under 12 – Minerva Academy

Under 14 – Unam Pumas

Under 16 – Fursan Hispania

Under 18 – Madenat