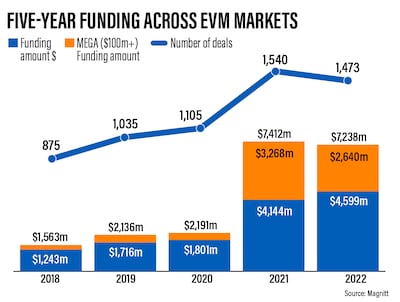

Start-ups across the Middle East, Africa, Pakistan and Turkey raised $7.2 billion through 1,473 deals last year, despite macroeconomic and geopolitical uncertainty, according to a report by data platform Magnitt.

The funding value reduced by 2 per cent annually and was driven by a decrease in the value of late-stage mega deals, researchers said.

The number of deals recorded a faster decline of 4.4 per cent.

FinTech led both funding and number of deals in the MEAPT region, Magnitt data found. The sector's funding reached $2.25 billion across 351 deals in 2022.

The FinTech sector closed four out of the 13 mega deals in the region last year, which included Bahrain’s $110 million Rain deal and Saudi Arabia’s $100 million Tamara deal, the report said.

Funding for Mena start-ups crossed the $3 billion mark last year, an annual increase of 8.3 per cent, the researchers found.

“Our report reflected a strong first quarter for venture capital in the Middle East, Africa, Pakistan and Turkey. However, this was driven by the hangover of post-pandemic positivity, which distorted the delayed impact of global macroeconomic challenges and was not grounded in real-world sentiment,” said Philip Bahoshy, founder and chief executive of Magnitt.

“Funding and deal levels in emerging venture capital markets were quickly tempered by the slowdown that the global venture capital industry experienced as a whole, amidst a backdrop of economic uncertainty and geopolitical tension.”

Fears of a looming recession and spiralling inflation that drove the equities market rout globally have affected asset valuations in private markets, opening up new investment opportunities for venture capital investors, alternative assets industry data and analytics specialist Preqin said in a December report.

Entry valuations have reduced significantly and competition for deals has softened amid the global economic headwinds, it said.

Venture capital financing for start-ups in Mena rose 20 per cent annually to more than $2.3 billion in the first three quarters of 2022, putting it on track to potentially surpass the total investments attracted in 2021, Magnitt said in a separate report.

Turkey was the leading country in the MEAPT region in terms of start-up funding and deals, the report showed. It recorded 295 deals, followed by Nigeria with 198 deals and Egypt stood third with 160 deals.

Turkey captured 23 per cent of total funding, driven by three mega deals. The UAE was second, accounting for 16 per cent of funding, and Saudi Arabia followed with a share of 14 per cent, according to Magnitt.

The MEAPT region recorded 13 mega deals (worth more than $100 million), which accounted for 37 per cent of total start-up funding. Round sizes of more than $1 million shared around 25 per cent of the proportion.

While the number of mega deals was one less than in 2021, the value of these late-stage investments fell by 19 per cent, the report found.

“The tighter liquidity imposed by rising interest rates has made funding harder to secure for larger investments, leaving the $1 million to $5 million round size as the most attractive,” it said.

“Late-stage investment will be hard to come by in 2023 due to lack of liquidity in the market. We expect an increase in deal flow towards start-ups raising seed rounds or early series A as the sweet spot for potential investment.”

Start-up exits in the MEAPT region recorded a 36 per cent increase from 2021, with 144 exits closed in 2022. The Mena region accounted for 50 per cent of these exits.

“Valuations will return to pre-pandemic norms in 2023. The reduced availability of capital to fund an ever-increasing number of start-ups, combined with broader macroeconomic conditions, has and will continue to lead to the normalisation of start-up valuations,” Magnitt said.

“Countries with strong government support and policies like the UAE and Saudi Arabia will continue to see further funds and funds of funds deployed to support start-ups within their borders, while start-ups in geographies that do not have a focus on innovation in the current economic environment are likely to struggle.”

TO A LAND UNKNOWN

Director: Mahdi Fleifel

Starring: Mahmoud Bakri, Aram Sabbah, Mohammad Alsurafa

Rating: 4.5/5

Timeline

2012-2015

The company offers payments/bribes to win key contracts in the Middle East

May 2017

The UK SFO officially opens investigation into Petrofac’s use of agents, corruption, and potential bribery to secure contracts

September 2021

Petrofac pleads guilty to seven counts of failing to prevent bribery under the UK Bribery Act

October 2021

Court fines Petrofac £77 million for bribery. Former executive receives a two-year suspended sentence

December 2024

Petrofac enters into comprehensive restructuring to strengthen the financial position of the group

May 2025

The High Court of England and Wales approves the company’s restructuring plan

July 2025

The Court of Appeal issues a judgment challenging parts of the restructuring plan

August 2025

Petrofac issues a business update to execute the restructuring and confirms it will appeal the Court of Appeal decision

October 2025

Petrofac loses a major TenneT offshore wind contract worth €13 billion. Holding company files for administration in the UK. Petrofac delisted from the London Stock Exchange

November 2025

180 Petrofac employees laid off in the UAE

ESSENTIALS

The flights

Etihad (etihad.com) flies from Abu Dhabi to Mykonos, with a flight change to its partner airline Olympic Air in Athens. Return flights cost from Dh4,105 per person, including taxes.

Where to stay

The modern-art-filled Ambassador hotel (myconianambassador.gr) is 15 minutes outside Mykonos Town on a hillside 500 metres from the Platis Gialos Beach, with a bus into town every 30 minutes (a taxi costs €15 [Dh66]). The Nammos and Scorpios beach clubs are a 10- to 20-minute walk (or water-taxi ride) away. All 70 rooms have a large balcony, many with a Jacuzzi, and of the 15 suites, five have a plunge pool. There’s also a private eight-bedroom villa. Double rooms cost from €240 (Dh1,063) including breakfast, out of season, and from €595 (Dh2,636) in July/August.

Springsteen: Deliver Me from Nowhere

Director: Scott Cooper

Starring: Jeremy Allen White, Odessa Young, Jeremy Strong

Rating: 4/5

UK%20record%20temperature

%3Cp%3E38.7C%20(101.7F)%20set%20in%20Cambridge%20in%202019%3C%2Fp%3E%0A

Williams at Wimbledon

Venus Williams - 5 titles (2000, 2001, 2005, 2007 and 2008)

Serena Williams - 7 titles (2002, 2003, 2009, 2010, 2012, 2015 and 2016)

COMPANY PROFILE

Name: Qyubic

Started: October 2023

Founder: Namrata Raina

Based: Dubai

Sector: E-commerce

Current number of staff: 10

Investment stage: Pre-seed

Initial investment: Undisclosed

Classification of skills

A worker is categorised as skilled by the MOHRE based on nine levels given in the International Standard Classification of Occupations (ISCO) issued by the International Labour Organisation.

A skilled worker would be someone at a professional level (levels 1 – 5) which includes managers, professionals, technicians and associate professionals, clerical support workers, and service and sales workers.

The worker must also have an attested educational certificate higher than secondary or an equivalent certification, and earn a monthly salary of at least Dh4,000.

The language of diplomacy in 1853

Treaty of Peace in Perpetuity Agreed Upon by the Chiefs of the Arabian Coast on Behalf of Themselves, Their Heirs and Successors Under the Mediation of the Resident of the Persian Gulf, 1853

(This treaty gave the region the name “Trucial States”.)

We, whose seals are hereunto affixed, Sheikh Sultan bin Suggar, Chief of Rassool-Kheimah, Sheikh Saeed bin Tahnoon, Chief of Aboo Dhebbee, Sheikh Saeed bin Buyte, Chief of Debay, Sheikh Hamid bin Rashed, Chief of Ejman, Sheikh Abdoola bin Rashed, Chief of Umm-ool-Keiweyn, having experienced for a series of years the benefits and advantages resulting from a maritime truce contracted amongst ourselves under the mediation of the Resident in the Persian Gulf and renewed from time to time up to the present period, and being fully impressed, therefore, with a sense of evil consequence formerly arising, from the prosecution of our feuds at sea, whereby our subjects and dependants were prevented from carrying on the pearl fishery in security, and were exposed to interruption and molestation when passing on their lawful occasions, accordingly, we, as aforesaid have determined, for ourselves, our heirs and successors, to conclude together a lasting and inviolable peace from this time forth in perpetuity.

Taken from Britain and Saudi Arabia, 1925-1939: the Imperial Oasis, by Clive Leatherdale

Nepotism is the name of the game

Salman Khan’s father, Salim Khan, is one of Bollywood’s most legendary screenwriters. Through his partnership with co-writer Javed Akhtar, Salim is credited with having paved the path for the Indian film industry’s blockbuster format in the 1970s. Something his son now rules the roost of. More importantly, the Salim-Javed duo also created the persona of the “angry young man” for Bollywood megastar Amitabh Bachchan in the 1970s, reflecting the angst of the average Indian. In choosing to be the ordinary man’s “hero” as opposed to a thespian in new Bollywood, Salman Khan remains tightly linked to his father’s oeuvre. Thanks dad.