The 2026 cultural calendar is already moving quickly in the UAE.

That was evident this week in Abu Dhabi, where the UAE National Orchestra opened its inaugural season at Emirates Palace with a concert titled The Beginning.

For the ensemble’s leadership, the name was deliberate.

“This is the beginning of a new chapter,” said managing director Sheikha Alia bint Khalid Al Qassimi, as the orchestra set out its intention to blend classical repertoire with the sounds and stories of the Emirates.

The opening programme included Arabic instruments such as the oud and qanun, alongside a world-premiere symphony by Nadim Tarabay that reimagines Emirati folk forms within a contemporary orchestral framework.

The orchestra plans to tour all seven emirates this season, signalling an ambition that extends well beyond a single stage.

Heritage takes centre stage elsewhere in the capital as the annual Al Hosn Festival returns to Qasr Al Hosn.

Set within Abu Dhabi’s oldest standing structure, the programme moves from evening musical performances and poetry to craft demonstrations and gahwa rituals that foreground the social traditions of daily life.

Visitors are invited into majlis conversations, artisan workshops and performances that unfold after sunset, reinforcing the festival’s focus on participation as much as presentation. The festival runs until February 1.

The Ras Al Khaimah Arts Festival is now under way, with this year marking the introduction of the emirate’s first contemporary art biennale.

Works are organised across thematic pavilions exploring spirituality, craft, heritage and future horizons, alongside markets, performances and the return of The Hidden Table dining experience. The setting remains rooted in history, while the programme looks firmly outward.

Live music continues to draw large crowds to the capital with the Saadiyat Nights concert series continuing until February 15. After another charming performance from Scottish performer Lewis Capaldi on Saturday, the relaxed outdoor atmosphere still awaits Max Richter, Mariah Carey, and John Mayer, to name just a few.

In Dubai, the Emirates Airline Festival of Literature returns for an 18th year. Taking place at InterContinental Dubai Festival City, the event brings together more than 200 speakers from 40 countries, with sessions spanning fiction, non-fiction, poetry and Arabic literature.

While many headline events have sold out, there are still tickets available for a wide range of talks and workshops. As chief executive Ahlam Bolooki put it: “The festival continues to inspire curiosity and foster connection, offering something for everyone."

Speaking to Saeed Saeed, famed crime writer Scott Turow, whose work has shaped modern legal thrillers for decades, reflected on storytelling, morality and the responsibilities that come with a long writing life.

Taken together, this week’s events offer a clear snapshot of a cultural season in full swing.

Oussama Rahbani details his family's 'Greek tragedy'

What does it mean to create in the face of loss? Or to pay tribute to a rich history when the present moment is coloured by grief?

These are the questions Lebanese composer Oussama Rahbani has been confronting over the past 12 months, as he completes the oratorio Ousafirou Wahdi Malikan (I Travel Alone, As a King), composed as part of centenary celebrations marking the birth of his father, composer, poet and playwright Mansour Rahbani.

It was also a period marked by personal loss, with the death of his cousin, composer Ziad Rahbani, aged 69, in July, followed by the passing of another cousin, Hali Rahbani, 68, earlier this month. Ziad and Hali were the sons of renowned Lebanese singer Fairuz and her late husband, composer Assi Rahbani.

Speaking to The National from Beirut after the oratorio’s debut last week, Oussama Rahbani shares how he's moved forward.

“I see what the Rahbani family has lived through as something close to Greek tragedy,” he says. “Loss happens. People leave. But the work continues. Theatre remains. Concerts continue. This is not sentiment. This is how we live art as a profession."

Find more here.

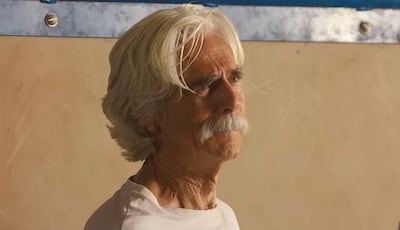

Sam Elliott: ‘I’m not sure there are many American men left to look up to’

Sam Elliott has spent a lifetime embodying the American man on screen. Now, he’s not sure there are many left.

“You look at the current climate, it’s hard to find, from my perspective, who most represents the American man that I would look up to,” Elliott tells The National. “It’s pretty dark out there.”

But at 81, Elliott isn’t ready to give up on the country he loves just yet. It’s what gets him out of bed in the morning – and what has brought him back to work after three years away.

“I’m more hopeful now than I have been for quite a while about where we’re headed,” he says. “And I find that hope in the American people. Things come around.

“What we need to do is talk to each other. We need to stop hating each other. And I think that’s not just in this country – that’s a worldwide problem. It’s pretty simple.”

Find more here.

Dates for your diary

- Rob Beckett at Dubai Opera – January 22

- Dream Theatre at Coca-Cola Arena, Dubai – January 27

- Jason Momoa and Oof Tatata at The Agenda, Dubai – January 28

Other highlights

The National produces a variety of newsletters across an array of subjects. You can sign up here.