I’m going to try to put my childhood into visual context: I grew up in what most definitely was a museum and what most certainly seemed like an endless vernissage with artists, intellectuals, cultural aficionados, wealthy patrons and journalists mingling in our home.

This ambiance was largely due to my legendary mother, Sherwet Shafei, whose foray into the art world began in 1960 with Egyptian television. She hosted a weekly show on modern Egyptian art. My mother fell in love with the genre, became a confidant to its artists and avidly collected their work (making her collection one of the finest in its field).

In 1989, she took over Safarkhan Gallery, founded in 1968 as a space that exhibited Islamic art, and which she baptised as one of Cairo's – and the world’s – preeminent galleries to explore modern and contemporary Egyptian art. So, my life was and still is replete with visual delight and intellectual stimulation.

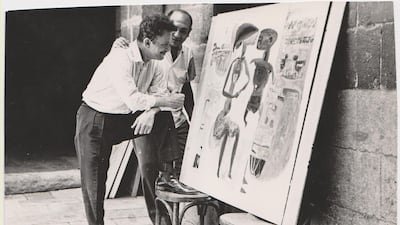

As a child, I remember staring in awe at the art around me. So intrigued, I was desperate to know what the artists were trying to say through their work. Amidst the sound of chatter, laughter, clinking glass and music, the five-year-old me remained oblivious to the many anonymous faces mingling in our home, save for one, a very gentle-looking one, and it belonged to Hamed Nada.

He smiled continuously and emanated a pureness and a warmth, as though there were an aura of kindness surrounding him. I guess he also stood out because of his height and the helmet of white hair on his head, which to me, made it seem as though he were glowing. Actually, he glowed because a light radiated from him.

Nada was always laughing; he laughed and talked at once, making him such a bubbly and pleasant person. Every time he showed up, I became giddy and just gravitated towards his energy.

He knew he was different [and so did we] and perhaps that made him feel like he had less to offer, meaning he struggled more

Mona Said,

director of Safarkhan Gallery

Nada was low-voiced because of a speech and hearing impairment, making it difficult to hear what he was saying, but it didn’t matter because somehow my parents and I understood. Nada dealt with it well, largely because he was a pure soul and one who accepted his fate.

He talked in such a cultured way, and always laced with humour. Very quickly, I got the impression that he wasn’t just an artist who frequented our home, but a sincere friend to my parents. I feel so honoured to say that he was my friend, too.

My mother, being her intuitive self, noted a strong connection between Nada and I, and in the name of further nurturing my art education, promptly arranged for weekly visits to his studio in Gamaliya, in Old Cairo, a Unesco World Heritage Site also known as Islamic Cairo.

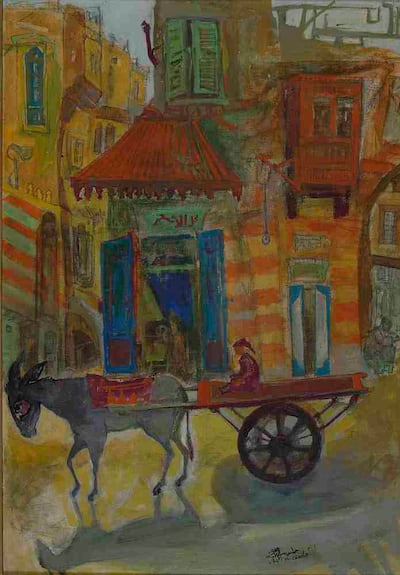

Nada was born in the nearby Al Khalifa neighbourhood and was brought up in a devout home to a father who was a sheikh. The everyday sights and sounds of different areas in this religious vicinity, including the Al Sayeda Zainab Mosque, came to have a lasting impact on him – it can be felt in the djinns, symbolism and superstition within his stylised figures of later works.

At school, Nada gravitated towards art, psychology and philosophy, and as fate would have it, met Hussein Youssef Amin, an artist, mentor and scholar, who gathered his proteges at his home on a weekly basis and encouraged them to speak for those less fortunate.

In 1946, together with fellow artists including Samir Rafi, Kamal Youssef and Abdel Hadi El Gazzar, Nada formed the Contemporary Art Group, which celebrated Egyptian-ness through socially realistic works that tackled popular tradition and folk symbolism.

Two years later, in 1948, Nada joined the School of Fine Arts in Cairo, and in parallel, worked as an illustrator and critic to Al Thaqafa, a popular periodical. After graduating in 1951, the Egyptian working class dominated his paintings, and in 1957, he taught at the faculty of fine arts in Alexandria University.

He was awarded a scholarship in 1960 to study mural painting at the San Fernando Royal Academy of Fine Arts in Madrid. He returned to Cairo where he taught at his alma mater, later heading its painting department and continuing to teach after his retirement in 1984. It was during this time that my visits to his studio began.

Where our home was a carefully curated, pristine and organised space, Nada’s studio was a chaotic, awesome expanse. Looking back, his bedlam reminds me of a verse in Shakespeare’s Hamlet: “Though this be madness, yet there is method in it.”

Immediately, I understood that his studio was his sanctuary; it was where he spoke through painting and where he reconciled the unkindness he’d seen outside. Washed with light, the space resembled an ancient Roman relic – at least that’s the sense I got because it felt packed with history and stories.

Being there was liberating for me on so many fronts: I could pick up brushes, dip my fingers in paint, open drawers and cupboards and never felt bored. In there, I felt like a friend, and he didn’t speak to me as a child. I wholly related to his paintings and why wouldn’t I? The cats, exotic birds, musical instruments, lamps, chairs and dancing people all looked like things I would draw.

The time between each visit felt like an eternity. As I yearned for the next trip, somehow, though it was palpable that his paintings oozed a rhythm and a prance, and transmitted an exchange between all elements, I started to feel like I could hear someone screaming, someone wanting to be heard.

I could sense there was pain, and I knew it came from Nada’s empathy with the plight of his countrymen, and his bad luck with women. He knew he was different [and so did we] and perhaps that made him feel like he had less to offer, meaning he struggled more.

The thing is, Nada contributed something that no one else did: a unique language, a Nada semantic, which he forced us to decipher. And once we did, we understood that painting for him was a healing mechanism, but it was an aide-memoire for us to really see the plight of our brethren. Some artists remain artists, others become great, and Nada was brilliant. I can still see him glowing.

Remembering the Artist is our series that features artists from the region

Mercer, the investment consulting arm of US services company Marsh & McLennan, expects its wealth division to at least double its assets under management (AUM) in the Middle East as wealth in the region continues to grow despite economic headwinds, a company official said.

Mercer Wealth, which globally has $160 billion in AUM, plans to boost its AUM in the region to $2-$3bn in the next 2-3 years from the present $1bn, said Yasir AbuShaban, a Dubai-based principal with Mercer Wealth.

“Within the next two to three years, we are looking at reaching $2 to $3 billion as a conservative estimate and we do see an opportunity to do so,” said Mr AbuShaban.

Mercer does not directly make investments, but allocates clients’ money they have discretion to, to professional asset managers. They also provide advice to clients.

“We have buying power. We can negotiate on their (client’s) behalf with asset managers to provide them lower fees than they otherwise would have to get on their own,” he added.

Mercer Wealth’s clients include sovereign wealth funds, family offices, and insurance companies among others.

From its office in Dubai, Mercer also looks after Africa, India and Turkey, where they also see opportunity for growth.

Wealth creation in Middle East and Africa (MEA) grew 8.5 per cent to $8.1 trillion last year from $7.5tn in 2015, higher than last year’s global average of 6 per cent and the second-highest growth in a region after Asia-Pacific which grew 9.9 per cent, according to consultancy Boston Consulting Group (BCG). In the region, where wealth grew just 1.9 per cent in 2015 compared with 2014, a pickup in oil prices has helped in wealth generation.

BCG is forecasting MEA wealth will rise to $12tn by 2021, growing at an annual average of 8 per cent.

Drivers of wealth generation in the region will be split evenly between new wealth creation and growth of performance of existing assets, according to BCG.

Another general trend in the region is clients’ looking for a comprehensive approach to investing, according to Mr AbuShaban.

“Institutional investors or some of the families are seeing a slowdown in the available capital they have to invest and in that sense they are looking at optimizing the way they manage their portfolios and making sure they are not investing haphazardly and different parts of their investment are working together,” said Mr AbuShaban.

Some clients also have a higher appetite for risk, given the low interest-rate environment that does not provide enough yield for some institutional investors. These clients are keen to invest in illiquid assets, such as private equity and infrastructure.

“What we have seen is a desire for higher returns in what has been a low-return environment specifically in various fixed income or bonds,” he said.

“In this environment, we have seen a de facto increase in the risk that clients are taking in things like illiquid investments, private equity investments, infrastructure and private debt, those kind of investments were higher illiquidity results in incrementally higher returns.”

The Abu Dhabi Investment Authority, one of the largest sovereign wealth funds, said in its 2016 report that has gradually increased its exposure in direct private equity and private credit transactions, mainly in Asian markets and especially in China and India. The authority’s private equity department focused on structured equities owing to “their defensive characteristics.”

How to keep control of your emotions

If your investment decisions are being dictated by emotions such as fear, greed, hope, frustration and boredom, it is time for a rethink, Chris Beauchamp, chief market analyst at online trading platform IG, says.

Greed

Greedy investors trade beyond their means, open more positions than usual or hold on to positions too long to chase an even greater gain. “All too often, they incur a heavy loss and may even wipe out the profit already made.

Tip: Ignore the short-term hype, noise and froth and invest for the long-term plan, based on sound fundamentals.

Fear

The risk of making a loss can cloud decision-making. “This can cause you to close out a position too early, or miss out on a profit by being too afraid to open a trade,” he says.

Tip: Start with a plan, and stick to it. For added security, consider placing stops to reduce any losses and limits to lock in profits.

Hope

While all traders need hope to start trading, excessive optimism can backfire. Too many traders hold on to a losing trade because they believe that it will reverse its trend and become profitable.

Tip: Set realistic goals. Be happy with what you have earned, rather than frustrated by what you could have earned.

Frustration

Traders can get annoyed when the markets have behaved in unexpected ways and generates losses or fails to deliver anticipated gains.

Tip: Accept in advance that asset price movements are completely unpredictable and you will suffer losses at some point. These can be managed, say, by attaching stops and limits to your trades.

Boredom

Too many investors buy and sell because they want something to do. They are trading as entertainment, rather than in the hope of making money. As well as making bad decisions, the extra dealing charges eat into returns.

Tip: Open an online demo account and get your thrills without risking real money.

Sole survivors

- Cecelia Crocker was on board Northwest Airlines Flight 255 in 1987 when it crashed in Detroit, killing 154 people, including her parents and brother. The plane had hit a light pole on take off

- George Lamson Jr, from Minnesota, was on a Galaxy Airlines flight that crashed in Reno in 1985, killing 68 people. His entire seat was launched out of the plane

- Bahia Bakari, then 12, survived when a Yemenia Airways flight crashed near the Comoros in 2009, killing 152. She was found clinging to wreckage after floating in the ocean for 13 hours.

- Jim Polehinke was the co-pilot and sole survivor of a 2006 Comair flight that crashed in Lexington, Kentucky, killing 49.

What can you do?

Document everything immediately; including dates, times, locations and witnesses

Seek professional advice from a legal expert

You can report an incident to HR or an immediate supervisor

You can use the Ministry of Human Resources and Emiratisation’s dedicated hotline

In criminal cases, you can contact the police for additional support

THE BIO

Born: Mukalla, Yemen, 1979

Education: UAE University, Al Ain

Family: Married with two daughters: Asayel, 7, and Sara, 6

Favourite piece of music: Horse Dance by Naseer Shamma

Favourite book: Science and geology

Favourite place to travel to: Washington DC

Best advice you’ve ever been given: If you have a dream, you have to believe it, then you will see it.

The biog

Name: Fareed Lafta

Age: 40

From: Baghdad, Iraq

Mission: Promote world peace

Favourite poet: Al Mutanabbi

Role models: His parents

Ten tax points to be aware of in 2026

1. Domestic VAT refund amendments: request your refund within five years

If a business does not apply for the refund on time, they lose their credit.

2. E-invoicing in the UAE

Businesses should continue preparing for the implementation of e-invoicing in the UAE, with 2026 a preparation and transition period ahead of phased mandatory adoption.

3. More tax audits

Tax authorities are increasingly using data already available across multiple filings to identify audit risks.

4. More beneficial VAT and excise tax penalty regime

Tax disputes are expected to become more frequent and more structured, with clearer administrative objection and appeal processes. The UAE has adopted a new penalty regime for VAT and excise disputes, which now mirrors the penalty regime for corporate tax.

5. Greater emphasis on statutory audit

There is a greater need for the accuracy of financial statements. The International Financial Reporting Standards standards need to be strictly adhered to and, as a result, the quality of the audits will need to increase.

6. Further transfer pricing enforcement

Transfer pricing enforcement, which refers to the practice of establishing prices for internal transactions between related entities, is expected to broaden in scope. The UAE will shortly open the possibility to negotiate advance pricing agreements, or essentially rulings for transfer pricing purposes.

7. Limited time periods for audits

Recent amendments also introduce a default five-year limitation period for tax audits and assessments, subject to specific statutory exceptions. While the standard audit and assessment period is five years, this may be extended to up to 15 years in cases involving fraud or tax evasion.

8. Pillar 2 implementation

Many multinational groups will begin to feel the practical effect of the Domestic Minimum Top-Up Tax (DMTT), the UAE's implementation of the OECD’s global minimum tax under Pillar 2. While the rules apply for financial years starting on or after January 1, 2025, it is 2026 that marks the transition to an operational phase.

9. Reduced compliance obligations for imported goods and services

Businesses that apply the reverse-charge mechanism for VAT purposes in the UAE may benefit from reduced compliance obligations.

10. Substance and CbC reporting focus

Tax authorities are expected to continue strengthening the enforcement of economic substance and Country-by-Country (CbC) reporting frameworks. In the UAE, these regimes are increasingly being used as risk-assessment tools, providing tax authorities with a comprehensive view of multinational groups’ global footprints and enabling them to assess whether profits are aligned with real economic activity.

Contributed by Thomas Vanhee and Hend Rashwan, Aurifer

Star%20Wars%3A%20Episode%20I%20%E2%80%93%20The%20Phantom%20Menace

%3Cp%3E%3Cstrong%3EDeveloper%3A%3C%2Fstrong%3E%20Big%20Ape%20Productions%3Cbr%3E%3Cstrong%3EPublisher%3A%3C%2Fstrong%3E%20LucasArts%3Cbr%3E%3Cstrong%3EConsoles%3A%3C%2Fstrong%3E%20PC%2C%20PlayStation%3Cbr%3E%3Cstrong%3ERating%3A%3C%2Fstrong%3E%202%2F5%3C%2Fp%3E%0A

Our family matters legal consultant

Name: Dr Hassan Mohsen Elhais

Position: legal consultant with Al Rowaad Advocates and Legal Consultants.

Fast%20X

%3Cp%3E%3Cstrong%3EDirector%3A%3C%2Fstrong%3E%20Louis%20Leterrier%3C%2Fp%3E%0A%3Cp%3E%3Cstrong%3EStars%3A%3C%2Fstrong%3E%20Vin%20Diesel%2C%20Michelle%20Rodriguez%2C%20Jason%20Statham%2C%20Tyrese%20Gibson%2C%20Ludacris%2C%20Jason%20Momoa%2C%20John%20Cena%2C%20Jordana%20Brewster%2C%20Nathalie%20Emmanuel%2C%20Sung%20Kang%2C%20Brie%20Larson%2C%20Helen%20Mirren%20and%20Charlize%20Theron%3C%2Fp%3E%0A%3Cp%3E%3Cstrong%3ERating%3A%3C%2Fstrong%3E%203%2F5%3C%2Fp%3E%0A