Global fashion sales are set to surpass 2019 levels by 3 per cent to 8 per cent in 2022, according to McKinsey and fashion media company The Business of Fashion.

The industry’s recovery is set to be strongest across China and the US, with Europe lagging behind, according to the report, which interviewed top industry executives and surveyed more than 220 international fashion executives and experts.

Supply chain pressures will be the main challenge for the industry, posing a risk to the pace of the recovery, with 49 per cent of fashion executives citing supply chain disruptions as the leading factor that could impact their businesses in 2022, the report found.

The global personal luxury goods market could shrug off the hit from the coronavirus crisis as early as this year as Chinese and US shoppers help sales recover to pre-pandemic levels, Bain & Company said in May. The market could generate €280 billion ($324.46bn) to €295bn in sales this year.

“We are emerging from the worst crisis the industry has ever seen. Value destroyers [those that delivered negative economic profit] hit new depths of losses – the share of value destroyers is estimated to be [a] record high 69 per cent of listed companies in 2020,” Achim Berg, senior partner and global leader of apparel, fashion and luxury at McKinsey, said.

“Industry profits continued to concentrate within a few players. That’s why when looking ahead with the prospect of normalisation, it is even more important that players in the industry pursue five key topics in 2022: growth and innovation, margin control, flexibility and resilience, sustainability strategy and digital frontiers.”

The industry's profitability contracted in 2020 for the first time in at least a decade, leading to all-time high levels of consolidation last year and in 2021, according to the McKinsey Global Fashion Index.

However, the index showed the fashion industry’s recovery looks set to be V-shaped, as performance in the first half of 2021 points to a possible return to profitability by 2022, according to the report.

A combination of material shortages, transportation bottlenecks and rising shipping costs will further inflate input costs, consequently forcing businesses to increase prices for consumers, the report said.

“Businesses must deal with major issues within the supply chain where rising costs and logistical bottlenecks will mean pressures are passed onto the consumer in the form of price hikes and delays,” Imran Amed, founder and chief executive of The Business of Fashion, said.

“Businesses must look at their supply chain models and focus on making these as flexible and resilient as possible to navigate the year ahead.”

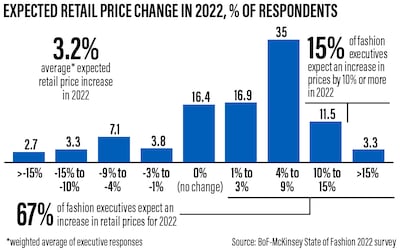

About 67 per cent of businesses expect to increase retail prices next year, with an average uplift of 3 per cent, while 15 per cent of executives even expect to increase prices by 10 per cent or more, the research found. Also, 87 per cent of fashion executives expect supply chain disruptions to negatively impact margins next year.

Sustainability also ranks high on the global fashion industry’s agenda, with 60 per cent of businesses ramping up investment in closed-loop recycling solutions to reduce environmental impact, according to the McKinsey report.

At present, less than 10 per cent of the global textile market is composed of recycled materials, according to the non-profit organisation Textile Exchange.

It will require industry-wide investment to scale closed-loop recycling technologies and processes that could enable businesses to reduce their impact on the environment, the report suggested.

Meanwhile, fashion brands looking to engage with high-value young consumers must explore the potential of non-fungible tokens (NFTs), gaming and virtual fashion as new routes to commerce, the McKinsey research suggested.

About 32 per cent of executives surveyed identified digital as the biggest opportunity for growth, while 37 per cent cited social commerce as one of the top three themes that will impact their business in 2022, the research found.

International tourism will not fully recover until at least 2023, the report said. To compensate for the loss of international shoppers, luxury brands should engage further with domestic consumers to capture a bigger share of the domestic market, McKinsey suggested.

Also, businesses face more threats of cyber attacks and risks of improper data handling than ever before. Fashion players must, therefore, urgently invest to make digital security a strategic imperative, the report said.

About 53 per cent of fashion executives said it is likely or very likely their company will experience a significant cyber attack in 2022, according to McKinsey.