Telecoms operator T-Mobile US is buying Ka’ena Corporation for up to $1.35 billion to boost its growth in the competitive prepaid phone market and gain more lower-income users.

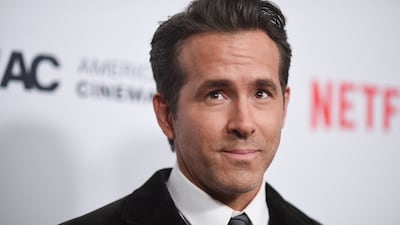

The second-largest US wireless provider will also acquire Ka’ena’s subsidiaries and brands, including Mint Mobile, which is a direct-to-consumer prepaid wireless brand backed by actor Ryan Reynolds.

They also include Ultra Mobile, a wireless service offering international calling options to communities across the country, and wholesaler Plum.

T-Mobile will acquire the company with a combination of 39 per cent cash and 61 per cent stock, the Washington-based company said.

But the actual price will be based on Ka’ena’s performance during certain periods before and after the closing.

T-Mobile said it was acquiring the brands' sales, marketing, digital and service operations.

It plans to use its supplier relationships and distribution scale to help the brands grow and offer competitive pricing and greater device inventory to more US consumers seeking value.

The deal will bolster T-Mobile's efforts to increase its market share and number of subscribers as it wrestles with rivals Verizon and AT&T, which are known for their competitive promotions and deals.

After the announcement, T-Mobile’s share price rose more than 1.25 per cent to trade at $144.82 a share at 2.40pm New York time on Wednesday.

“Mint has built an incredibly successful digital direct-to-consumer business … we are excited to use our scale and owners' economics to help supercharge it,” said Mike Sievert, chief executive of T-Mobile.

“Over the long-term, we will also benefit from applying the marketing formula Mint has become famous for across more parts of T-Mobile.

“We think customers are really going to win with a more competitive and expansive Mint and Ultra.”

T-Mobile, which expects the deal to be closed later this year, said it did not expect the transaction to have any impact on the company’s 2023 guidance or its continuing stock buyback programme.

After the deal’s close, Mint's founders David Glickman and Rizwan Kassim will remain at T-Mobile to manage the brands, the company said.

“Our brands have thrived on the T-Mobile network, and we are thrilled that this agreement will take them even further, bringing the many benefits of 5G to even more Americans,” Mr Glickman said.

“This transaction validates our meteoric success and will unite two proven industry innovators committed to doing things differently in the wireless industry.”

Mint is famous for its engaging marketing campaigns, which many times feature the Deadpool star Reynolds.

During the Covid-19 pandemic in 2020, he left a voicemail for customers notifying them that the company had offered them free data.

Reynolds, whose portfolio includes Welsh football team Wrexham, also featured in a promotional video on YouTube with Mr Sievert on Wednesday, announcing the deal.

“Mint Mobile is the best deal in wireless and today’s news only enhances our ability to deliver for our customers … I am so proud of the entire Mint team and so excited for what’s to come,” he said.

Reynolds owns an undisclosed but “significant” stake in Mint, Bloomberg reported.

“I never dreamt I’d own a wireless company and I certainly never dreamt I’d sell it to T-Mobile. Life is strange and I’m incredibly proud and grateful,” he said on Twitter.

Mint offers some of the lowest mobile plans, starting at $15 a month for 4 gigabytes of wireless data.

It competes with other prepaid phone brands, including Cricket from AT&T and Total from Verizon.