Live updates: Follow the latest news on Israel-Gaza

We are in the third week of the Israel-Gaza war with a growing risk of it becoming yet another drawn-out battle that will leave severe economic scars.

This and previous wars mean horrendous loss of life and human capital, forced migration and displacement, destruction of infrastructure, housing, businesses and productive capacity, of cuts to public utilities, water, power, fuel – all threatening the survival of the remaining population. Overpopulated Gaza is already “de-developed” and deconstructed.

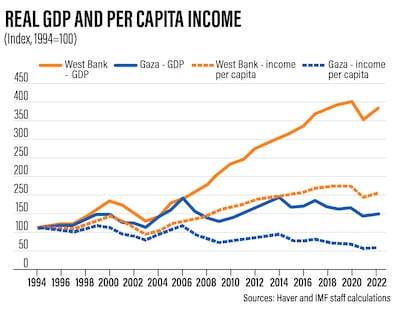

The International Monetary Fund’s September report on Gaza highlighted the calamitous situation in the enclave before the current war. Gaza’s real gross domestic product growth averaged just 0.4 per cent during 2007-22, with real GDP per capita declining at an annual average rate of 2.5 per cent.

By 2022, per capita income in the West Bank was four times higher than in Gaza, reflecting the blockade and recurrent wars resulting in little trade and investment. Unemployment was as high at 45 per cent in 2022 and 53 per cent of the population lived below the poverty line.

By contrast, Israel’s per capita income was eight times higher than in the West Bank and Gaza.

Reconstruction was one of the only “growth” sectors: in 2022, between $345 million and $485 million was required for immediate and short-term recovery and reconstruction needs in Gaza.

Israel’s policy of economic warfare against Gaza has been very costly.

Will the current war engulf Lebanon, Syria, Iran, Iraq and the Gulf? We don’t know yet.

Past wars have disfigured the Middle East. Beyond the human cost and war-related destruction of physical assets, war-affected countries witnessed a sharp contraction in economic activity, as well as fiscal, current account and balance of payments deficits, currency crises and high inflation.

They also faced sector-specific collapses – tourism, trade, manufacturing, weaker financial systems – along with a diversion of resources to the military and build-up of military assets at the expense of economic and social development.

Wars result in large-scale displacement of populations and forced migration, with the Mena region already hosting (end-2022) about 2.4 million refugees, in addition to about 12.6 million internally displaced persons, according to the UN refugee agency.

More displacement will put severe strain on the hosting nations’ budgets and finances as well as their socioeconomic-political stability.

A collapse in investor confidence in the conflict and neighbouring nations results in lower domestic and foreign direct investment flows. An estimate of the opportunity costs in financial, economic, social, political, military, environmental and diplomatic terms for the entire region for the period 1991-2015 is a staggering $15 trillion.

With the global economy tentatively recovering from the aftermath of the Covid-19 pandemic, the Russia-Ukraine war, high inflation and slow growth, the continuing war generates greater global geo-eco-political risk and uncertainty.

Global markets have already reacted. Safe-haven assets, including the dollar and gold, gained, while credit default swaps on Middle Eastern nations' debt (including Saudi Arabia and Qatar) have spiked.

The current surge in oil prices could accelerate with a further escalation or broadening of the war, with the Middle East accounting for more than one third of the world’s seaborne oil trade and the Suez Canal about 15 per cent of world trade.

An oil and commodity shock resulting from the likely disruption in transport and logistics would cut growth and raise inflation rates. A scenario emerges of continued monetary policy tightening by central banks, slower credit growth (affecting both households and businesses alike), increased refinancing risks and, potentially, debt crises or defaults and a global recession.

The future is clouded by the fog of war. A priority is to address humanitarian concerns: amid the massive human toll, Gaza’s citizens run the risk of starvation and the spreading of diseases without access to water, food, health care and electricity.

We need to go beyond, to postwar stabilisation, recovery and reconstruction from the destruction wrought by the war and prewar economic legacy. It took 20 years after the Lebanese civil war for real GDP to recover to its prewar level, seven years in Kuwait after the Gulf War.

In the case of Gaza, there is still no consensus what a postwar Gaza would look like. With its economy intrinsically tied to Israel, and the lack of its own (or stand-alone) fiscal, financial or infrastructure resources begs the question of how postwar recovery would be undertaken.

This is a time to develop a new vision for the Mena region. In a multipolar world, the Arab world needs to take the initiative to set up an Arab Bank for Reconstruction and Development (ABRD), backed by the GCC.

Unlike other regions, Mena lacks a regional development bank. This is the historic moment to set up the ABRD given the need for reconstructing places already devastated by war and violence, such as Palestine, Iraq, Syria, Lebanon, Libya, Sudan and Yemen.

The ABRD would be set up by the region’s sovereign wealth funds and existing development funds.

Prior to the latest Israel-Gaza war, a rough estimate of the cost of development and reconstruction of the region’s countries destroyed by war and violence was upwards of $1.5 trillion, to which must be added the massive costs of reconstructing Gaza.

Nasser Saidi is the president of Nasser Saidi and Associates. He was formerly Lebanon's economy minister and a vice-governor of the Central Bank of Lebanon

HIJRA

Starring: Lamar Faden, Khairiah Nathmy, Nawaf Al-Dhufairy

Director: Shahad Ameen

Rating: 3/5

First Person

Richard Flanagan

Chatto & Windus

Who's who in Yemen conflict

Houthis: Iran-backed rebels who occupy Sanaa and run unrecognised government

Yemeni government: Exiled government in Aden led by eight-member Presidential Leadership Council

Southern Transitional Council: Faction in Yemeni government that seeks autonomy for the south

Habrish 'rebels': Tribal-backed forces feuding with STC over control of oil in government territory

Red flags

- Promises of high, fixed or 'guaranteed' returns.

- Unregulated structured products or complex investments often used to bypass traditional safeguards.

- Lack of clear information, vague language, no access to audited financials.

- Overseas companies targeting investors in other jurisdictions - this can make legal recovery difficult.

- Hard-selling tactics - creating urgency, offering 'exclusive' deals.

Courtesy: Carol Glynn, founder of Conscious Finance Coaching

MATCH INFO

Uefa Champions League semi-final, first leg

Bayern Munich v Real Madrid

When: April 25, 10.45pm kick-off (UAE)

Where: Allianz Arena, Munich

Live: BeIN Sports HD

Second leg: May 1, Santiago Bernabeu, Madrid

Company%20Profile

%3Cp%3E%3Cstrong%3EName%3A%3C%2Fstrong%3E%20Neo%20Mobility%3Cbr%3E%3Cstrong%3EStarted%3A%3C%2Fstrong%3E%20February%202023%3Cbr%3E%3Cstrong%3ECo-founders%3A%3C%2Fstrong%3E%20Abhishek%20Shah%20and%20Anish%20Garg%3Cbr%3E%3Cstrong%3EBased%3A%3C%2Fstrong%3E%20Dubai%3Cbr%3E%3Cstrong%3EIndustry%3A%3C%2Fstrong%3E%20Logistics%3Cbr%3E%3Cstrong%3EFunding%3A%3C%2Fstrong%3E%20%2410%20million%3Cbr%3E%3Cstrong%3EInvestors%3A%3C%2Fstrong%3E%20Delta%20Corp%2C%20Pyse%20Sustainability%20Fund%2C%20angel%20investors%3C%2Fp%3E%0A

Inside%20Out%202

%3Cp%3E%3Cstrong%3EDirector%3A%C2%A0%3C%2Fstrong%3EKelsey%20Mann%3C%2Fp%3E%0A%3Cp%3E%3Cstrong%3EStarring%3A%3C%2Fstrong%3E%C2%A0Amy%20Poehler%2C%20Maya%20Hawke%2C%20Ayo%20Edebiri%3C%2Fp%3E%0A%3Cp%3E%3Cstrong%3ERating%3A%20%3C%2Fstrong%3E4.5%2F5%3C%2Fp%3E%0A

Did you know?

Brunch has been around, is some form or another, for more than a century. The word was first mentioned in print in an 1895 edition of Hunter’s Weekly, after making the rounds among university students in Britain. The article, entitled Brunch: A Plea, argued the case for a later, more sociable weekend meal. “By eliminating the need to get up early on Sunday, brunch would make life brighter for Saturday night carousers. It would promote human happiness in other ways as well,” the piece read. “It is talk-compelling. It puts you in a good temper, it makes you satisfied with yourself and your fellow beings, it sweeps away the worries and cobwebs of the week.” More than 100 years later, author Guy Beringer’s words still ring true, especially in the UAE, where brunches are often used to mark special, sociable occasions.

Iran's dirty tricks to dodge sanctions

There’s increased scrutiny on the tricks being used to keep commodities flowing to and from blacklisted countries. Here’s a description of how some work.

1 Going Dark

A common method to transport Iranian oil with stealth is to turn off the Automatic Identification System, an electronic device that pinpoints a ship’s location. Known as going dark, a vessel flicks the switch before berthing and typically reappears days later, masking the location of its load or discharge port.

2. Ship-to-Ship Transfers

A first vessel will take its clandestine cargo away from the country in question before transferring it to a waiting ship, all of this happening out of sight. The vessels will then sail in different directions. For about a third of Iranian exports, more than one tanker typically handles a load before it’s delivered to its final destination, analysts say.

3. Fake Destinations

Signaling the wrong destination to load or unload is another technique. Ships that intend to take cargo from Iran may indicate their loading ports in sanction-free places like Iraq. Ships can keep changing their destinations and end up not berthing at any of them.

4. Rebranded Barrels

Iranian barrels can also be rebranded as oil from a nation free from sanctions such as Iraq. The countries share fields along their border and the crude has similar characteristics. Oil from these deposits can be trucked out to another port and documents forged to hide Iran as the origin.

* Bloomberg

Habib El Qalb

Assi Al Hallani

(Rotana)

2020 Oscars winners: in numbers

- Parasite – 4

- 1917– 3

- Ford v Ferrari – 2

- Joker – 2

- Once Upon a Time ... in Hollywood – 2

- American Factory – 1

- Bombshell – 1

- Hair Love – 1

- Jojo Rabbit – 1

- Judy – 1

- Little Women – 1

- Learning to Skateboard in a Warzone (If You're a Girl) – 1

- Marriage Story – 1

- Rocketman – 1

- The Neighbors' Window – 1

- Toy Story 4 – 1

The specs

Engine: 4.0-litre flat-six

Torque: 450Nm at 6,100rpm

Transmission: 7-speed PDK auto or 6-speed manual

Fuel economy, combined: 13.8L/100km

On sale: Available to order now

Studying addiction

This month, Dubai Medical College launched the Middle East’s first master's programme in addiction science.

Together with the Erada Centre for Treatment and Rehabilitation, the college offers a two-year master’s course as well as a one-year diploma in the same subject.

The move was announced earlier this year and is part of a new drive to combat drug abuse and increase the region’s capacity for treating drug addiction.

WOMAN AND CHILD

Director: Saeed Roustaee

Starring: Parinaz Izadyar, Payman Maadi

Rating: 4/5

Formula%204%20Italian%20Championship%202023%20calendar

%3Cp%3EApril%2021-23%3A%20Imola%3Cbr%3EMay%205-7%3A%20Misano%3Cbr%3EMay%2026-28%3A%20SPA-Francorchamps%3Cbr%3EJune%2023-25%3A%20Monza%3Cbr%3EJuly%2021-23%3A%20Paul%20Ricard%3Cbr%3ESept%2029-Oct%201%3A%20Mugello%3Cbr%3EOct%2013-15%3A%20Vallelunga%3C%2Fp%3E%0A

Manchester City (0) v Liverpool (3)

Uefa Champions League, quarter-final, second leg

Where: Etihad Stadium

When: Tuesday, 10.45pm

Live on beIN Sports HD

INDIA SQUADS

India squad for third Test against Sri Lanka

Virat Kohli (capt), Murali Vijay, Lokesh Rahul, Shikhar Dhawan, Cheteshwar Pujara, Ajinkya Rahane, Rohit Sharma, Wriddhiman Saha, Ravichandran Ashwin, Ravindra Jadeja, Kuldeep Yadav, Mohammed Shami, Umesh Yadav, Ishant Sharma, Vijay Shankar

India squad for ODI series against Sri Lanka

Rohit Sharma (capt), Shikhar Dhawan, Ajinkya Rahane, Shreyas Iyer, Manish Pandey, Kedar Jadhav, Dinesh Karthik, Mahendra Singh Dhoni, Hardik Pandya, Axar Patel, Kuldeep Yadav, Yuzvendra Chahal, Jasprit Bumrah, Bhuvneshwar Kumar, Siddarth Kaul

The specs

- Engine: 3.9-litre twin-turbo V8

- Power: 640hp

- Torque: 760nm

- On sale: 2026

- Price: Not announced yet