The temporary closure of Libya’s largest oilfield this month following protests underlines the lingering shadow of political instability on the North African country’s embattled oil and gas industry.

The Sharara oilfield, with a capacity of 300,000 barrels per day, was shut down on January 7 following protests by residents demanding better infrastructure and economic opportunities.

Libya's state-owned National Oil Corporation (NOC) announced the resumption of operations at the facility on Sunday.

The field represents roughly a fourth of the country’s total output of about 1.2 million barrels per day.

Such protests, which target the country's vital oil infrastructure, may affect the Opec member’s ability to meet its lofty production target and grow its gross domestic product over the next few years, according to analysts.

Despite having Africa’s largest crude reserves, a third of Libya’s population lives below the poverty line and parts of the country suffer chronic shortages of petrol and gas due to inadequate investment in pipelines and refining capabilities.

“Considering that the Sharara oilfield is the largest one in Libya, recovering or falling production from that field has a big impact on revenues of the NOC,” Giovanni Staunovo, a strategist at Swiss bank UBS told The National.

“International oil companies (IOCs) are likely [to have] a cautious approach in respect to returning to the country considering the political instability and risk of production disruptions,” he said.

Last week, the country's oil minister said that the continued shutdown of the key oilfield could potentially impact the nation's GDP and undermine Libya's reputation as a reliable energy supplier.

“We believed the country had achieved stability, and customers had confidence in receiving consistent oil quantities. Losing customers is a real risk, jeopardising the future for everyone,” Mohamed Oun told reporters at an event in Tripoli.

“It's crucial for people in Libya to understand that the NOC and the Ministry of Oil and Gas are primarily focused on oil and gas exploration, extraction, production, and contributing revenue to the country's state treasury,” he said.

The last time Libya suffered a major supply disruption was in 2022.

Military commander Field Marshal Khalifa Haftar, whose forces control the oil-rich eastern Libya, orchestrated a blockade on fields and ports that year, prompting NOC to declare force majeure for exports.

The blockade was lifted following the appointment of Farhat Bengdara as NOC chairman.

Political tangle

Libya has remained divided since the civil war that ensued following the 2011 revolution.

The western part of the country is governed by the internationally recognised administration known as the Government of National Unity (GNU), which was established through a UN-led political process ahead of elections scheduled for December 2021.

However, these elections did not take place, leading to challenges from opponents questioning the legitimacy of the GNU's authority.

In the eastern region, a rival government called the Government of National Stability emerged in March 2022, taking control of about three-quarters of the country's oil production capacity.

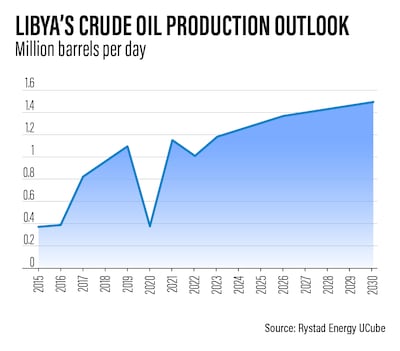

NOC, which restored its output to 1.2 million bpd last year, said in October that it planned to increase its crude production to 2 million bpd over the next three to five years.

The state-run energy company, seeking to reactivate old oil wells and launch fresh exploration activity, aims to bring in IOCs.

Mr Bengdara has indicated that the planned output increase would necessitate $17 billion in investments across 45 projects.

“[It is] a huge commitment for IOCs when it comes to Libya, considering the unstable atmosphere,” Rystad Energy said.

“Additionally, Libya currently still has two parallel governments with no centralised decision-making body, making announcements such as elections potential triggers that could once again lead to production losses,” the Norway-based consultancy said.

Rystad Energy expects Libya to reach a production level of 1.4 million bpd by 2027 in its base case scenario and 1.8 million bpd in its high case scenario.

Wood Mackenzie said the target of 2 million bpd would not be reached even in the US-based consultancy’s most bullish case.

“The spectre of oil production shut-ins continues to hang over Libya. And alongside outages from ageing infrastructure, investment will remain too low to achieve significant increases in the short to medium term,” Wood Mackenzie said in November.

“If Libya can improve security and fiscal terms, then there is significant longer-term upside,” it said.

Before the protests this month, there had been renewed interest from energy companies in the country’s oil and gas industry.

Last year, Eni, BP and Algerian energy company Sonatrach announced the resumption of their operations in the country after a 10-year absence.

In January 2023, Eni and NOC signed an $8 billion gas production deal, which could result in a production of up to 760 million cubic feet of gas.

Libya is set to conduct a licensing round in the fourth quarter of this year, its first in almost two decades.

Banking on oil

Crude oil and natural gas export revenue account for a significant part of Libya’s economy.

In 2021, oil revenue accounted for 56.4 per cent of the country’s GDP, compared with 42.8 per cent for Iraq and 23.7 per cent for Saudi Arabia, the world’s largest oil exporter, the World Bank said.

For Nigeria, Africa’s largest crude exporter, oil revenue only made up 6.2 per cent of its GDP in 2021.

Libya's real GDP is projected to rise by 7.5 per cent this year, after growing an estimated 12.5 per cent in 2023, the International Monetary Fund said. Its economy contracted by 9.6 per cent in 2022.

Following the devastating floods that hit the country in September last year, the IMF said Libya’s medium-term economic outlook remained positive due to high oil prices.

The floods in Libya inundated about a quarter of the city of Derna after torrential rain from Storm Daniel caused two dams to collapse near the eastern port city.

However, it did not disrupt the country’s crude output.

Libya plans to increase its GDP to about $250 billion and have oil and gas as 40 per cent of the economy, Economy Minister Mohamed Al Hwej said during the Tripoli event last week. He did not provide a timeline or any further details.

Brahmastra%3A%20Part%20One%20-%20Shiva

%3Cp%3E%3Cstrong%3EDirector%3A%20%3C%2Fstrong%3EAyan%20Mukerji%3C%2Fp%3E%0A%3Cp%3E%3Cstrong%3EStars%3A%20%3C%2Fstrong%3ERanbir%20Kapoor%2C%20Alia%20Bhatt%20and%20Amitabh%20Bachchan%3C%2Fp%3E%0A%3Cp%3E%3Cstrong%3ERating%3A%3C%2Fstrong%3E%202%2F5%3C%2Fp%3E%0A

Elvis

%3Cp%3E%3Cstrong%3EDirector%3A%3C%2Fstrong%3E%20Baz%20Luhrmann%3C%2Fp%3E%0A%3Cp%3E%3Cstrong%3EStars%3A%3C%2Fstrong%3E%20Austin%20Butler%2C%20Tom%20Hanks%2C%20Olivia%20DeJonge%3C%2Fp%3E%0A%3Cp%3E%3Cstrong%3ERating%3A%3C%2Fstrong%3E%204%2F5%3C%2Fp%3E%0A

Match info

Karnataka Tuskers 110-3

J Charles 35, M Pretorius 1-19, Z Khan 0-16

Deccan Gladiators 111-5 in 8.3 overs

K Pollard 45*, S Zadran 2-18

Ten tax points to be aware of in 2026

1. Domestic VAT refund amendments: request your refund within five years

If a business does not apply for the refund on time, they lose their credit.

2. E-invoicing in the UAE

Businesses should continue preparing for the implementation of e-invoicing in the UAE, with 2026 a preparation and transition period ahead of phased mandatory adoption.

3. More tax audits

Tax authorities are increasingly using data already available across multiple filings to identify audit risks.

4. More beneficial VAT and excise tax penalty regime

Tax disputes are expected to become more frequent and more structured, with clearer administrative objection and appeal processes. The UAE has adopted a new penalty regime for VAT and excise disputes, which now mirrors the penalty regime for corporate tax.

5. Greater emphasis on statutory audit

There is a greater need for the accuracy of financial statements. The International Financial Reporting Standards standards need to be strictly adhered to and, as a result, the quality of the audits will need to increase.

6. Further transfer pricing enforcement

Transfer pricing enforcement, which refers to the practice of establishing prices for internal transactions between related entities, is expected to broaden in scope. The UAE will shortly open the possibility to negotiate advance pricing agreements, or essentially rulings for transfer pricing purposes.

7. Limited time periods for audits

Recent amendments also introduce a default five-year limitation period for tax audits and assessments, subject to specific statutory exceptions. While the standard audit and assessment period is five years, this may be extended to up to 15 years in cases involving fraud or tax evasion.

8. Pillar 2 implementation

Many multinational groups will begin to feel the practical effect of the Domestic Minimum Top-Up Tax (DMTT), the UAE's implementation of the OECD’s global minimum tax under Pillar 2. While the rules apply for financial years starting on or after January 1, 2025, it is 2026 that marks the transition to an operational phase.

9. Reduced compliance obligations for imported goods and services

Businesses that apply the reverse-charge mechanism for VAT purposes in the UAE may benefit from reduced compliance obligations.

10. Substance and CbC reporting focus

Tax authorities are expected to continue strengthening the enforcement of economic substance and Country-by-Country (CbC) reporting frameworks. In the UAE, these regimes are increasingly being used as risk-assessment tools, providing tax authorities with a comprehensive view of multinational groups’ global footprints and enabling them to assess whether profits are aligned with real economic activity.

Contributed by Thomas Vanhee and Hend Rashwan, Aurifer

Labour dispute

The insured employee may still file an ILOE claim even if a labour dispute is ongoing post termination, but the insurer may suspend or reject payment, until the courts resolve the dispute, especially if the reason for termination is contested. The outcome of the labour court proceedings can directly affect eligibility.

- Abdullah Ishnaneh, Partner, BSA Law

Zayed Sustainability Prize

Specs

Engine: Dual-motor all-wheel-drive electric

Range: Up to 610km

Power: 905hp

Torque: 985Nm

Price: From Dh439,000

Available: Now

Winners

Ballon d’Or (Men’s)

Ousmane Dembélé (Paris Saint-Germain / France)

Ballon d’Or Féminin (Women’s)

Aitana Bonmatí (Barcelona / Spain)

Kopa Trophy (Best player under 21 – Men’s)

Lamine Yamal (Barcelona / Spain)

Best Young Women’s Player

Vicky López (Barcelona / Spain)

Yashin Trophy (Best Goalkeeper – Men’s)

Gianluigi Donnarumma (Paris Saint-Germain and Manchester City / Italy)

Best Women’s Goalkeeper

Hannah Hampton (England / Aston Villa and Chelsea)

Men’s Coach of the Year

Luis Enrique (Paris Saint-Germain)

Women’s Coach of the Year

Sarina Wiegman (England)

57%20Seconds

%3Cp%3E%3Cstrong%3EDirector%3A%3C%2Fstrong%3E%20Rusty%20Cundieff%0D%3Cbr%3E%3Cstrong%3EStars%3A%20%3C%2Fstrong%3EJosh%20Hutcherson%2C%20Morgan%20Freeman%2C%20Greg%20Germann%2C%20Lovie%20Simone%0D%3Cbr%3E%3Cstrong%3ERating%3A%20%3C%2Fstrong%3E2%2F5%0D%3Cbr%3E%0D%3Cbr%3E%3C%2Fp%3E%0A

Brief scores:

Manchester City 2

Gundogan 27', De Bruyne 85'

Crystal Palace 3

Schlupp 33', Townsend 35', Milivojevic 51' (pen)

Man of the Match: Andros Townsend (Crystal Palace)

Mohammed bin Zayed Majlis

In Search of Mary Shelley: The Girl Who Wrote Frankenstein

By Fiona Sampson

Profile

MATCH INFO

Liverpool 0

Stoke City 0

Man of the Match: Erik Pieters (Stoke)

THE BIO

Born: Mukalla, Yemen, 1979

Education: UAE University, Al Ain

Family: Married with two daughters: Asayel, 7, and Sara, 6

Favourite piece of music: Horse Dance by Naseer Shamma

Favourite book: Science and geology

Favourite place to travel to: Washington DC

Best advice you’ve ever been given: If you have a dream, you have to believe it, then you will see it.

Timeline

2012-2015

The company offers payments/bribes to win key contracts in the Middle East

May 2017

The UK SFO officially opens investigation into Petrofac’s use of agents, corruption, and potential bribery to secure contracts

September 2021

Petrofac pleads guilty to seven counts of failing to prevent bribery under the UK Bribery Act

October 2021

Court fines Petrofac £77 million for bribery. Former executive receives a two-year suspended sentence

December 2024

Petrofac enters into comprehensive restructuring to strengthen the financial position of the group

May 2025

The High Court of England and Wales approves the company’s restructuring plan

July 2025

The Court of Appeal issues a judgment challenging parts of the restructuring plan

August 2025

Petrofac issues a business update to execute the restructuring and confirms it will appeal the Court of Appeal decision

October 2025

Petrofac loses a major TenneT offshore wind contract worth €13 billion. Holding company files for administration in the UK. Petrofac delisted from the London Stock Exchange

November 2025

180 Petrofac employees laid off in the UAE

Padmaavat

Director: Sanjay Leela Bhansali

Starring: Ranveer Singh, Deepika Padukone, Shahid Kapoor, Jim Sarbh

3.5/5

COMPANY%20PROFILE

%3Cp%3E%3Cstrong%3EName%3A%20%3C%2Fstrong%3EShaffra%3Cbr%3E%3Cstrong%3EStarted%3A%20%3C%2Fstrong%3E2023%3Cbr%3E%3Cstrong%3EBased%3A%20%3C%2Fstrong%3EDIFC%20Innovation%20Hub%3Cbr%3E%3Cstrong%3ESector%3A%20%3C%2Fstrong%3Emetaverse-as-a-Service%20(MaaS)%3Cbr%3E%3Cstrong%3EInvestment%3A%20%3C%2Fstrong%3Ecurrently%20closing%20%241.5%20million%20seed%20round%3Cbr%3E%3Cstrong%3EInvestment%20stage%3A%20%3C%2Fstrong%3Epre-seed%3Cbr%3E%3Cstrong%3EInvestors%3A%20%3C%2Fstrong%3EFlat6Labs%20Abu%20Dhabi%20and%20different%20PCs%20and%20angel%20investors%20from%20Saudi%20Arabia%3Cbr%3E%3Cstrong%3ENumber%20of%20staff%3A%20%3C%2Fstrong%3Enine%3C%2Fp%3E%0A

Mercer, the investment consulting arm of US services company Marsh & McLennan, expects its wealth division to at least double its assets under management (AUM) in the Middle East as wealth in the region continues to grow despite economic headwinds, a company official said.

Mercer Wealth, which globally has $160 billion in AUM, plans to boost its AUM in the region to $2-$3bn in the next 2-3 years from the present $1bn, said Yasir AbuShaban, a Dubai-based principal with Mercer Wealth.

“Within the next two to three years, we are looking at reaching $2 to $3 billion as a conservative estimate and we do see an opportunity to do so,” said Mr AbuShaban.

Mercer does not directly make investments, but allocates clients’ money they have discretion to, to professional asset managers. They also provide advice to clients.

“We have buying power. We can negotiate on their (client’s) behalf with asset managers to provide them lower fees than they otherwise would have to get on their own,” he added.

Mercer Wealth’s clients include sovereign wealth funds, family offices, and insurance companies among others.

From its office in Dubai, Mercer also looks after Africa, India and Turkey, where they also see opportunity for growth.

Wealth creation in Middle East and Africa (MEA) grew 8.5 per cent to $8.1 trillion last year from $7.5tn in 2015, higher than last year’s global average of 6 per cent and the second-highest growth in a region after Asia-Pacific which grew 9.9 per cent, according to consultancy Boston Consulting Group (BCG). In the region, where wealth grew just 1.9 per cent in 2015 compared with 2014, a pickup in oil prices has helped in wealth generation.

BCG is forecasting MEA wealth will rise to $12tn by 2021, growing at an annual average of 8 per cent.

Drivers of wealth generation in the region will be split evenly between new wealth creation and growth of performance of existing assets, according to BCG.

Another general trend in the region is clients’ looking for a comprehensive approach to investing, according to Mr AbuShaban.

“Institutional investors or some of the families are seeing a slowdown in the available capital they have to invest and in that sense they are looking at optimizing the way they manage their portfolios and making sure they are not investing haphazardly and different parts of their investment are working together,” said Mr AbuShaban.

Some clients also have a higher appetite for risk, given the low interest-rate environment that does not provide enough yield for some institutional investors. These clients are keen to invest in illiquid assets, such as private equity and infrastructure.

“What we have seen is a desire for higher returns in what has been a low-return environment specifically in various fixed income or bonds,” he said.

“In this environment, we have seen a de facto increase in the risk that clients are taking in things like illiquid investments, private equity investments, infrastructure and private debt, those kind of investments were higher illiquidity results in incrementally higher returns.”

The Abu Dhabi Investment Authority, one of the largest sovereign wealth funds, said in its 2016 report that has gradually increased its exposure in direct private equity and private credit transactions, mainly in Asian markets and especially in China and India. The authority’s private equity department focused on structured equities owing to “their defensive characteristics.”

Name: Colm McLoughlin

Country: Galway, Ireland

Job: Executive vice chairman and chief executive of Dubai Duty Free

Favourite golf course: Dubai Creek Golf and Yacht Club

Favourite part of Dubai: Palm Jumeirah

Company%20profile

%3Cp%3EName%3A%20Tabby%3Cbr%3EFounded%3A%20August%202019%3B%20platform%20went%20live%20in%20February%202020%3Cbr%3EFounder%2FCEO%3A%20Hosam%20Arab%2C%20co-founder%3A%20Daniil%20Barkalov%3Cbr%3EBased%3A%20Dubai%2C%20UAE%3Cbr%3ESector%3A%20Payments%3Cbr%3ESize%3A%2040-50%20employees%3Cbr%3EStage%3A%20Series%20A%3Cbr%3EInvestors%3A%20Arbor%20Ventures%2C%20Mubadala%20Capital%2C%20Wamda%20Capital%2C%20STV%2C%20Raed%20Ventures%2C%20Global%20Founders%20Capital%2C%20JIMCO%2C%20Global%20Ventures%2C%20Venture%20Souq%2C%20Outliers%20VC%2C%20MSA%20Capital%2C%20HOF%20and%20AB%20Accelerator.%3Cbr%3E%3C%2Fp%3E%0A