The Opec+ alliance of oil-producing countries is to extend its current output curbs until the end of 2025 amid concerns about growing non-Opec+ supply and the impact of high interest rates on global crude demand.

The group decided to "extend the level of overall crude oil production ... starting January 1, 2025, until December 31, 2025", the alliance said.

The cuts come as Brent, the benchmark for two-thirds of the world’s oil, has lost about 10 per cent of its value after hitting a multi-month high of $91 a barrel in April.

The UAE has been given a higher oil production level for 2025. The country will receive a production quota of an additional 300,000 barrels a day to be phased in gradually over the first nine months of the next year, Opec said after a ministerial monitoring committee meeting on Sunday.

There is clearly an unexplained supply from Opec+ of more than 1 million bpd

Mukesh Sahdev,

head of oil trading, Rystad Energy

The Opec+ ministerial meeting will be held every six months and the next meeting will be held on December 1.

The oil producers' group said it has also extended the assessment period by the three independent sources to the end of November 2025, "to be used as guidance for 2026 reference production levels".

Members of the group remain committed to "achieve and sustain a stable oil market, and to provide long-term guidance and transparency for the market" and in line with its approach of "being precautious, proactive, and pre-emptive", the group said.

The Organisation of the Petroleum Exporting Countries and allies led by Russia, together known as Opec+, has made a series of deep output cuts since late 2022.

Opec+ has total production curbs of 5.86 million barrels per day in place, including a reduction of 2 million bpd agreed on in 2022, and voluntary cuts of 1.66 million bpd, announced in April last year and extended to December 2024.

The Opec+ aggregate cuts of 3.66 million bpd that were valid through to the end of 2024, and 2.2 million bpd of voluntary cuts by some members, expiring this month, amounted to about 5.7 per cent of global demand.

The countries which have made voluntary cuts that are deeper than those agreed with the wider group are Algeria, Iraq, Kazakhstan, Kuwait, Oman, Russia, Saudi Arabia and the UAE.

Officials of these countries met in person in the Saudi capital Riyadh to discuss the the extension of the voluntary cuts, the kingdom's Energy Ministry said in a statement carried by Saudi Press Agency on Sunday.

"These countries will extend their additional voluntary cuts of 2.2 million barrels per day, that were announced in November 2023, until the end of September 2024 and then the 2.2 million barrels per day cut will be gradually phased out on a monthly basis until the end of September 2025 to support market stability," the statement said.

"This monthly increase can be paused or reversed subject to market conditions."

While crude prices briefly soared above $90 a barrel in April as conflict in the Middle East threatened regional exports, they have since declined.

Brent traded 0.29 per cent lower at $81.62 a barrel at the market close on Friday. West Texas Intermediate, the gauge that tracks US crude, was down 1.18 per cent at $76.99 a barrel.

Opec expects strong economic growth from emerging economies, particularly China and India, to drive crude demand this year.

The group has maintained an optimistic growth forecast of 2.25 million bpd in its last 11 oil market updates.

In contrast, the US Energy Information Administration (EIA) and the International Energy Agency (IEA) are forecasting lower growth rates, estimating an increase of close to 1 million bpd.

In its latest oil market report, the IEA lowered its oil demand growth forecast for 2024 by 140,000 barrels per day to 1.1 million bpd, citing weak demand in Europe.

“While there is a positive outlook on a demand increase for the next three to four months, crude and condensate supply is concerning,” said Mukesh Sahdev, senior vice president & head of oil trading at Rystad Energy.

The Norway-based consultancy said its analysis indicates that an increase in refinery crude consumption and exports since the Covid-19 pandemic's low levels is higher than the production that is accounted for.

“There is clearly an unexplained supply from Opec+ of [more than] 1 million bpd. The muted oil price reaction to cuts and erosion of backwardation to near contango reflects some unexplained surplus,” Mr Sahdev said in a research note on Friday.

Non-Opec+ supply

Supply from countries outside the Opec+ alliance is set to grow in the range of 1 million bpd to 1.5 million bpd this year, according to estimates from Opec and the IEA.

The US, the world’s largest oil and gas producer, is heading for another year of record production, although with a significantly smaller increase as companies scale back activity following a wave of acquisitions in the industry, analysts have said.

Production from American oilfields reached a record high of 12.9 million bpd last year as companies utilised new technology to counterbalance lower oil prices and reduced rig counts.

Wood Mackenzie has forecast a 270,000-bpd growth in output this year, which is close to the 260,000-bpd increase projected by the EIA, the statistical arm of the Department of Energy.

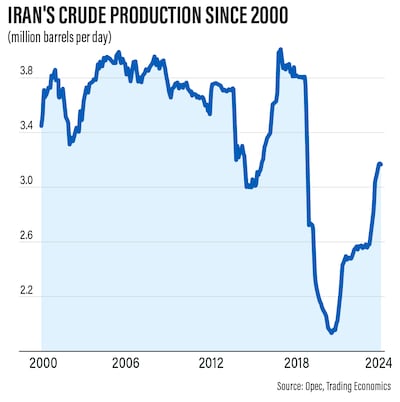

Meanwhile, Iran, which was the second-largest source of crude supply growth last year after the US, plans to raise its production to 4 million bpd, Iranian media reported this week, without specifying a timeframe.

Last year, the country's production reached 3.4 million bpd, with exports at about 1.5 million bpd.

Interest rate concerns

At the start of 2024, some economists predicted the US Federal Reserve would cut interest rates, driven by concerns about slowing economic growth and potentially rising unemployment.

However, the Fed has maintained a cautious stance due to persistent inflation. While inflation has shown signs of decline from its peak in mid-2022, it has remained above the central bank’s 2 per cent inflation target.

High interest rates can weigh on economic growth, lowering crude demand.

“Inflation readings recorded levels worse than market expectations earlier this year, this has accordingly diminished investors’ hopes for a rate cut this summer, so most market expectations shifted to the possibility of starting to reduce interest rates in late 2024,” said Mohamed Hashad, chief market strategist at Noor Capital.

“Investors and market participants are awaiting a slew of readings of personal consumption expenditures, personal income, and consumer spending in the US."

Fed officials have kept interest rates in the range of 5.25 per cent to 5.5 per cent, a two-decade high, since last July.

Tentative schedule of 2017/18 Ashes series

1st Test November 23-27, The Gabba, Brisbane

2nd Test December 2-6, Adelaide Oval, Adelaide

3rd Test Dcember 14-18, Waca, Perth

4th Test December 26-30, Melbourne Cricket Ground, Melbourne

5th Test January 4-8, Sydney Cricket Ground, Sydney

Tearful appearance

Chancellor Rachel Reeves set markets on edge as she appeared visibly distraught in parliament on Wednesday.

Legislative setbacks for the government have blown a new hole in the budgetary calculations at a time when the deficit is stubbornly large and the economy is struggling to grow.

She appeared with Keir Starmer on Thursday and the pair embraced, but he had failed to give her his backing as she cried a day earlier.

A spokesman said her upset demeanour was due to a personal matter.

Company%20profile

%3Cp%3E%3Cstrong%3EName%3A%20%3C%2Fstrong%3EMaly%20Tech%3Cbr%3E%3Cstrong%3EStarted%3A%3C%2Fstrong%3E%202023%3Cbr%3E%3Cstrong%3EFounder%3A%3C%2Fstrong%3E%20Mo%20Ibrahim%3Cbr%3E%3Cstrong%3EBased%3A%3C%2Fstrong%3E%20Dubai%20International%20Financial%20Centre%3Cbr%3E%3Cstrong%3ESector%3A%3C%2Fstrong%3E%20FinTech%3Cbr%3E%3Cstrong%3EFunds%20raised%3A%3C%2Fstrong%3E%20%241.6%20million%3Cbr%3E%3Cstrong%3ECurrent%20number%20of%20staff%3A%3C%2Fstrong%3E%2015%3Cbr%3E%3Cstrong%3EInvestment%20stage%3A%20%3C%2Fstrong%3EPre-seed%2C%20planning%20first%20seed%20round%3Cbr%3E%3Cstrong%3EInvestors%3A%3C%2Fstrong%3E%20GCC-based%20angel%20investors%3C%2Fp%3E%0A

Tips on buying property during a pandemic

Islay Robinson, group chief executive of mortgage broker Enness Global, offers his advice on buying property in today's market.

While many have been quick to call a market collapse, this simply isn’t what we’re seeing on the ground. Many pockets of the global property market, including London and the UAE, continue to be compelling locations to invest in real estate.

While an air of uncertainty remains, the outlook is far better than anyone could have predicted. However, it is still important to consider the wider threat posed by Covid-19 when buying bricks and mortar.

Anything with outside space, gardens and private entrances is a must and these property features will see your investment keep its value should the pandemic drag on. In contrast, flats and particularly high-rise developments are falling in popularity and investors should avoid them at all costs.

Attractive investment property can be hard to find amid strong demand and heightened buyer activity. When you do find one, be prepared to move hard and fast to secure it. If you have your finances in order, this shouldn’t be an issue.

Lenders continue to lend and rates remain at an all-time low, so utilise this. There is no point in tying up cash when you can keep this liquidity to maximise other opportunities.

Keep your head and, as always when investing, take the long-term view. External factors such as coronavirus or Brexit will present challenges in the short-term, but the long-term outlook remains strong.

Finally, keep an eye on your currency. Whenever currency fluctuations favour foreign buyers, you can bet that demand will increase, as they act to secure what is essentially a discounted property.

The Dark Blue Winter Overcoat & Other Stories From the North

Edited and Introduced by Sjón and Ted Hodgkinson

Pushkin Press

Under 19 World Cup

Group A: India, Japan, New Zealand, Sri Lanka

Group B: Australia, England, Nigeria, West Indies

Group C: Bangladesh, Pakistan, Scotland, Zimbabwe

Group D: Afghanistan, Canada, South Africa, UAE

UAE fixtures

Saturday, January 18, v Canada

Wednesday, January 22, v Afghanistan

Saturday, January 25, v South Africa

Racecard:

6.30pm: Mazrat Al Ruwayah (PA) | Group 2 | US$55,000 (Dirt) | 1,600 metres

7.05pm: Meydan Sprint (TB) | Group 2 | $250,000 (Turf) | 1,000m

7.40pm: Firebreak Stakes | Group 3 | $200,000 (D) | 1,600m

8.15pm: Meydan Trophy | Conditions (TB) | $100,000 (T) | 1,900m

8.50pm: Balanchine | Group 2 (TB) | $250,000 (T) | 1,800m

9.25pm: Handicap (TB) | $135,000 (D) | 1,200m

10pm: Handicap (TB) | $175,000 (T) | 2,410m.

Desert Warrior

Starring: Anthony Mackie, Aiysha Hart, Ben Kingsley

Director: Rupert Wyatt

Rating: 3/5

THE BIO: Martin Van Almsick

Hometown: Cologne, Germany

Family: Wife Hanan Ahmed and their three children, Marrah (23), Tibijan (19), Amon (13)

Favourite dessert: Umm Ali with dark camel milk chocolate flakes

Favourite hobby: Football

Breakfast routine: a tall glass of camel milk

Moving%20Out%202

%3Cp%3E%3Cstrong%3EDeveloper%3A%3C%2Fstrong%3E%20SMG%20Studio%3Cbr%3E%3Cstrong%3EPublisher%3A%3C%2Fstrong%3E%20Team17%3Cbr%3E%3Cstrong%3EConsoles%3A%3C%2Fstrong%3E%20Nintendo%20Switch%2C%20PlayStation%204%26amp%3B5%2C%20PC%20and%20Xbox%20One%3Cbr%3E%3Cstrong%3ERating%3A%3C%2Fstrong%3E%204%2F5%3C%2Fp%3E%0A

match info

Manchester United 3 (Martial 7', 44', 74')

Sheffield United 0

Mercer, the investment consulting arm of US services company Marsh & McLennan, expects its wealth division to at least double its assets under management (AUM) in the Middle East as wealth in the region continues to grow despite economic headwinds, a company official said.

Mercer Wealth, which globally has $160 billion in AUM, plans to boost its AUM in the region to $2-$3bn in the next 2-3 years from the present $1bn, said Yasir AbuShaban, a Dubai-based principal with Mercer Wealth.

“Within the next two to three years, we are looking at reaching $2 to $3 billion as a conservative estimate and we do see an opportunity to do so,” said Mr AbuShaban.

Mercer does not directly make investments, but allocates clients’ money they have discretion to, to professional asset managers. They also provide advice to clients.

“We have buying power. We can negotiate on their (client’s) behalf with asset managers to provide them lower fees than they otherwise would have to get on their own,” he added.

Mercer Wealth’s clients include sovereign wealth funds, family offices, and insurance companies among others.

From its office in Dubai, Mercer also looks after Africa, India and Turkey, where they also see opportunity for growth.

Wealth creation in Middle East and Africa (MEA) grew 8.5 per cent to $8.1 trillion last year from $7.5tn in 2015, higher than last year’s global average of 6 per cent and the second-highest growth in a region after Asia-Pacific which grew 9.9 per cent, according to consultancy Boston Consulting Group (BCG). In the region, where wealth grew just 1.9 per cent in 2015 compared with 2014, a pickup in oil prices has helped in wealth generation.

BCG is forecasting MEA wealth will rise to $12tn by 2021, growing at an annual average of 8 per cent.

Drivers of wealth generation in the region will be split evenly between new wealth creation and growth of performance of existing assets, according to BCG.

Another general trend in the region is clients’ looking for a comprehensive approach to investing, according to Mr AbuShaban.

“Institutional investors or some of the families are seeing a slowdown in the available capital they have to invest and in that sense they are looking at optimizing the way they manage their portfolios and making sure they are not investing haphazardly and different parts of their investment are working together,” said Mr AbuShaban.

Some clients also have a higher appetite for risk, given the low interest-rate environment that does not provide enough yield for some institutional investors. These clients are keen to invest in illiquid assets, such as private equity and infrastructure.

“What we have seen is a desire for higher returns in what has been a low-return environment specifically in various fixed income or bonds,” he said.

“In this environment, we have seen a de facto increase in the risk that clients are taking in things like illiquid investments, private equity investments, infrastructure and private debt, those kind of investments were higher illiquidity results in incrementally higher returns.”

The Abu Dhabi Investment Authority, one of the largest sovereign wealth funds, said in its 2016 report that has gradually increased its exposure in direct private equity and private credit transactions, mainly in Asian markets and especially in China and India. The authority’s private equity department focused on structured equities owing to “their defensive characteristics.”

The specs: Lamborghini Aventador SVJ

Price, base: Dh1,731,672

Engine: 6.5-litre V12

Gearbox: Seven-speed automatic

Power: 770hp @ 8,500rpm

Torque: 720Nm @ 6,750rpm

Fuel economy: 19.6L / 100km

Napoleon

%3Cp%3E%3Cstrong%3EDirector%3C%2Fstrong%3E%3A%20Ridley%20Scott%3Cbr%3E%3Cstrong%3EStars%3C%2Fstrong%3E%3A%20Joaquin%20Phoenix%2C%20Vanessa%20Kirby%2C%20Tahar%20Rahim%3Cbr%3E%3Cstrong%3ERating%3C%2Fstrong%3E%3A%202%2F5%3Cbr%3E%3Cbr%3E%3C%2Fp%3E%0A

Zayed Sustainability Prize

Greatest Royal Rumble results

John Cena pinned Triple H in a singles match

Cedric Alexander retained the WWE Cruiserweight title against Kalisto

Matt Hardy and Bray Wyatt win the Raw Tag Team titles against Cesaro and Sheamus

Jeff Hardy retained the United States title against Jinder Mahal

Bludgeon Brothers retain the SmackDown Tag Team titles against the Usos

Seth Rollins retains the Intercontinental title against The Miz, Finn Balor and Samoa Joe

AJ Styles remains WWE World Heavyweight champion after he and Shinsuke Nakamura are both counted out

The Undertaker beats Rusev in a casket match

Brock Lesnar retains the WWE Universal title against Roman Reigns in a steel cage match

Braun Strowman won the 50-man Royal Rumble by eliminating Big Cass last

Infiniti QX80 specs

Engine: twin-turbocharged 3.5-liter V6

Power: 450hp

Torque: 700Nm

Price: From Dh450,000, Autograph model from Dh510,000

Available: Now

How Beautiful this world is!

Inside%20Out%202

%3Cp%3E%3Cstrong%3EDirector%3A%C2%A0%3C%2Fstrong%3EKelsey%20Mann%3C%2Fp%3E%0A%3Cp%3E%3Cstrong%3EStarring%3A%3C%2Fstrong%3E%C2%A0Amy%20Poehler%2C%20Maya%20Hawke%2C%20Ayo%20Edebiri%3C%2Fp%3E%0A%3Cp%3E%3Cstrong%3ERating%3A%20%3C%2Fstrong%3E4.5%2F5%3C%2Fp%3E%0A

Profile of Tarabut Gateway

Founder: Abdulla Almoayed

Based: UAE

Founded: 2017

Number of employees: 35

Sector: FinTech

Raised: $13 million

Backers: Berlin-based venture capital company Target Global, Kingsway, CE Ventures, Entrée Capital, Zamil Investment Group, Global Ventures, Almoayed Technologies and Mad’a Investment.

Men's football draw

Group A: UAE, Spain, South Africa, Jamaica

Group B: Bangladesh, Serbia, Korea

Group C: Bharat, Denmark, Kenya, USA

Group D: Oman, Austria, Rwanda