Email providers are notoriously cagey about releasing user figures, but by some measures Gmail surpassed Hotmail as the world’s most-popular email server in 2012, and with good reason. Great search capability and huge amounts of storage quickly made anyone with a Hotmail email address suddenly look terribly 1990s.

While Google is currently rolling out an email organiser add-on called Inbox by Gmail, you have to wait for an invitation to try it out. In the meantime, add-ons such as Boomerang and Streak are helping to turn the old-fashioned email inbox into a workflow system for your entire business, and as Streak currently offers a more comprehensive service free of charge, it’s the one that’s winning my affection right now.

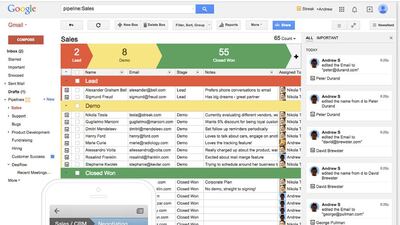

Streak bills itself as a customer relationship management system, but it’s customisable enough to be useful to just about everyone who wants to get on top of their emails. While you can start from scratch when designing a workflow system that works for you, there are more than a dozen pre-set options to choose, including everything from wedding or holiday planning to sales, product development and fundraising.

Once the extension is installed, your Gmail homepage will look the same, except for a few extra buttons. The sidebar where your inboxes and outboxes are listed now has an extra item, Pipelines. Let’s say I pitch a feature to my editor: I can add that email to my “journalism” pipeline, creating a new “box” for that particular story.

If other emails relating to this story build up, I can add them to the box, and the same goes for images and files. As the story moves through the process of commissioning, editing, publication and invoicing, I physically move it along the different headings of the pipeline. This way, I can see at a glance what stories I have at which stage of development. A similar process, of course, applies to anything from event planning to building a new start-up.

There are lots of tools to make life easier along the way, such as a service that lets me know when my emails have been read by the recipient, and a “snooze” function which reminds you to chase up emails that haven’t received a reply.

Q&A

Jessica Holland reveals the advantages of signing up for Streak:

Wait, it tells you when someone’s read my email? That means other people know if I’ve read their email and am ignoring them? I’m quitting the internet.

Whoa there. Services like BlackBerry Messenger have had this function for years. I’m afraid it’s true, but on the up side, it’s incredibly useful for figuring out when to follow up on important emails.

I already have a CRM that integrates with my work email, and I don’t want to faff around with pipelines. Why should I install Streak on my personal account?

It has a few tools that are widely useful, like a function that allows you to write emails and then schedule them to leave your outbox at a later time. “Snippets” allows you to quickly and easily create canned responses to replace phrases you have to type over and over. Mail merge allows you to send a whole bunch of personalised messages at once and reminders can make sure you never let an unanswered email drop off your radar.

Can I share my pipelines with colleagues?

Yes, you can choose whether to keep your pipelines private or allow other people to share and edit them.

And all this is free?

As always, you can pay for an upgrade for services like email filtering and reports, which give you statistics about your pipelines. Currently, though, all the features mentioned above come as part of the free package.

Who should I thank?

The same small, San Francisco-based start-up behind the encryption add-on Secure Mail for Gmail.

business@thenational.ae

Follow The National's Business section on Twitter

Mercer, the investment consulting arm of US services company Marsh & McLennan, expects its wealth division to at least double its assets under management (AUM) in the Middle East as wealth in the region continues to grow despite economic headwinds, a company official said.

Mercer Wealth, which globally has $160 billion in AUM, plans to boost its AUM in the region to $2-$3bn in the next 2-3 years from the present $1bn, said Yasir AbuShaban, a Dubai-based principal with Mercer Wealth.

“Within the next two to three years, we are looking at reaching $2 to $3 billion as a conservative estimate and we do see an opportunity to do so,” said Mr AbuShaban.

Mercer does not directly make investments, but allocates clients’ money they have discretion to, to professional asset managers. They also provide advice to clients.

“We have buying power. We can negotiate on their (client’s) behalf with asset managers to provide them lower fees than they otherwise would have to get on their own,” he added.

Mercer Wealth’s clients include sovereign wealth funds, family offices, and insurance companies among others.

From its office in Dubai, Mercer also looks after Africa, India and Turkey, where they also see opportunity for growth.

Wealth creation in Middle East and Africa (MEA) grew 8.5 per cent to $8.1 trillion last year from $7.5tn in 2015, higher than last year’s global average of 6 per cent and the second-highest growth in a region after Asia-Pacific which grew 9.9 per cent, according to consultancy Boston Consulting Group (BCG). In the region, where wealth grew just 1.9 per cent in 2015 compared with 2014, a pickup in oil prices has helped in wealth generation.

BCG is forecasting MEA wealth will rise to $12tn by 2021, growing at an annual average of 8 per cent.

Drivers of wealth generation in the region will be split evenly between new wealth creation and growth of performance of existing assets, according to BCG.

Another general trend in the region is clients’ looking for a comprehensive approach to investing, according to Mr AbuShaban.

“Institutional investors or some of the families are seeing a slowdown in the available capital they have to invest and in that sense they are looking at optimizing the way they manage their portfolios and making sure they are not investing haphazardly and different parts of their investment are working together,” said Mr AbuShaban.

Some clients also have a higher appetite for risk, given the low interest-rate environment that does not provide enough yield for some institutional investors. These clients are keen to invest in illiquid assets, such as private equity and infrastructure.

“What we have seen is a desire for higher returns in what has been a low-return environment specifically in various fixed income or bonds,” he said.

“In this environment, we have seen a de facto increase in the risk that clients are taking in things like illiquid investments, private equity investments, infrastructure and private debt, those kind of investments were higher illiquidity results in incrementally higher returns.”

The Abu Dhabi Investment Authority, one of the largest sovereign wealth funds, said in its 2016 report that has gradually increased its exposure in direct private equity and private credit transactions, mainly in Asian markets and especially in China and India. The authority’s private equity department focused on structured equities owing to “their defensive characteristics.”

ETFs explained

Exhchange traded funds are bought and sold like shares, but operate as index-tracking funds, passively following their chosen indices, such as the S&P 500, FTSE 100 and the FTSE All World, plus a vast range of smaller exchanges and commodities, such as gold, silver, copper sugar, coffee and oil.

ETFs have zero upfront fees and annual charges as low as 0.07 per cent a year, which means you get to keep more of your returns, as actively managed funds can charge as much as 1.5 per cent a year.

There are thousands to choose from, with the five biggest providers BlackRock’s iShares range, Vanguard, State Street Global Advisors SPDR ETFs, Deutsche Bank AWM X-trackers and Invesco PowerShares.

Ten tax points to be aware of in 2026

1. Domestic VAT refund amendments: request your refund within five years

If a business does not apply for the refund on time, they lose their credit.

2. E-invoicing in the UAE

Businesses should continue preparing for the implementation of e-invoicing in the UAE, with 2026 a preparation and transition period ahead of phased mandatory adoption.

3. More tax audits

Tax authorities are increasingly using data already available across multiple filings to identify audit risks.

4. More beneficial VAT and excise tax penalty regime

Tax disputes are expected to become more frequent and more structured, with clearer administrative objection and appeal processes. The UAE has adopted a new penalty regime for VAT and excise disputes, which now mirrors the penalty regime for corporate tax.

5. Greater emphasis on statutory audit

There is a greater need for the accuracy of financial statements. The International Financial Reporting Standards standards need to be strictly adhered to and, as a result, the quality of the audits will need to increase.

6. Further transfer pricing enforcement

Transfer pricing enforcement, which refers to the practice of establishing prices for internal transactions between related entities, is expected to broaden in scope. The UAE will shortly open the possibility to negotiate advance pricing agreements, or essentially rulings for transfer pricing purposes.

7. Limited time periods for audits

Recent amendments also introduce a default five-year limitation period for tax audits and assessments, subject to specific statutory exceptions. While the standard audit and assessment period is five years, this may be extended to up to 15 years in cases involving fraud or tax evasion.

8. Pillar 2 implementation

Many multinational groups will begin to feel the practical effect of the Domestic Minimum Top-Up Tax (DMTT), the UAE's implementation of the OECD’s global minimum tax under Pillar 2. While the rules apply for financial years starting on or after January 1, 2025, it is 2026 that marks the transition to an operational phase.

9. Reduced compliance obligations for imported goods and services

Businesses that apply the reverse-charge mechanism for VAT purposes in the UAE may benefit from reduced compliance obligations.

10. Substance and CbC reporting focus

Tax authorities are expected to continue strengthening the enforcement of economic substance and Country-by-Country (CbC) reporting frameworks. In the UAE, these regimes are increasingly being used as risk-assessment tools, providing tax authorities with a comprehensive view of multinational groups’ global footprints and enabling them to assess whether profits are aligned with real economic activity.

Contributed by Thomas Vanhee and Hend Rashwan, Aurifer