Women are more affected by Covid-related job losses than men in 17 of 24 countries in the Organisation for Economic Co-operation and Development that reported an increase in unemployment in 2020, PricewaterhouseCoopers' annual Women in Work Index shows.

Between July and October 2020, 15.3 million people were put on furlough in the UK.

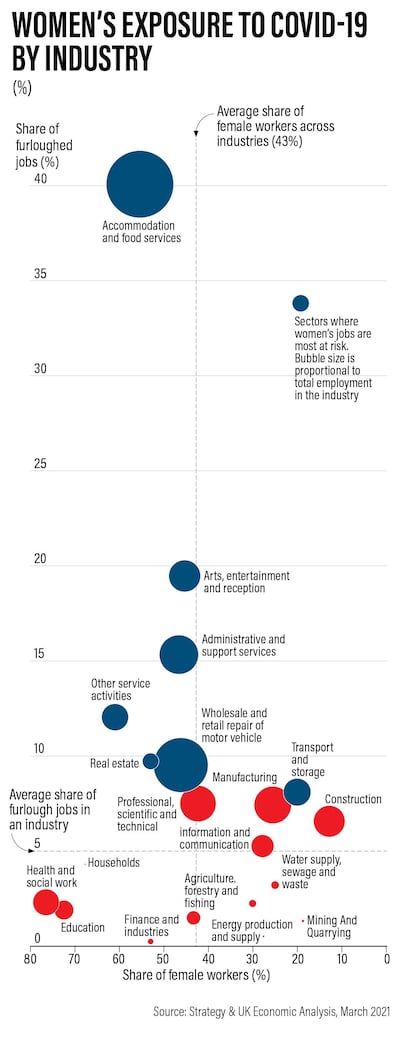

Of the furloughed jobs for which gender breakdowns were available, 52 per cent were women’s jobs, despite women only making up 48 per cent of the workforce.

In the UK, female-dominated industries such as accommodation, food services, arts, entertainment and recreation had the largest share of furloughs in the country.

The study assessed female economic empowerment, in which the UK was 16th of 33 nations in the OECD countries in 2019.

The top three countries were Iceland, Sweden and New Zealand.

But the UK's place in the index is expected to fall in 2021, setting progress for women in work back to 2017 levels.

Progress towards gender equality will have to be double its normal speed to reverse the damage by 2030.

For nine years, all OECD member countries have made consistent gains towards women's economic empowerment.

But because of Covid-19 this trend will be reversed and will not begin to recover until 2022, when it should regain 0.8 points.

The UK's Coronavirus Job Retention Scheme means the full effect of the pandemic on the labour market has not yet been seen.

But if current furlough data indicates future unemployment trends, a larger number of women will be at risk of job losses than men when the initiative ends in April.

Even before the pandemic began, women spent an average of six more hours on unpaid childcare every week than men, according to research by UN Women.

Women have taken on an even greater share during the pandemic and now spend 7.7 more hours a week on unpaid childcare than men.

This "second shift" is almost as long as an extra full-time job.

The longer this burden lasts, the more women are likely to leave or reduce the time they spend working permanently.

“Losing women from the workforce not only reverses progress towards gender equality, it also affects economic growth," said Larice Stielow, senior economist at PwC.

"Although jobs will return when economies bounce back, they will not necessarily be the same jobs.

"If we don't have policies in place to directly address the unequal burden of care, and to enable more women to enter jobs in growing sectors of the economy, women will return to fewer hours, lower-skilled and lower-paid jobs."

For businesses in particular, it's paramount that gender pay-gap reporting is prioritised ... as businesses focus on building back better and fairer

While some women may decide to leave the workforce temporarily because of the effects of the pandemic, research suggests career breaks have long-term effects on their job prospects.

"Based on our findings, there is absolutely no time to lose in addressing the very real impact of the pandemic on women," said Laura Hinton of PwC.

"Governments, policymakers and businesses all have a responsibility to work together to empower women and create opportunities for meaningful participation in the workforce.

"For businesses in particular, it’s paramount that gender pay-gap reporting is prioritised, with targeted action plans put in place as businesses focus on building back better and fairer.

"An important action that should be front and centre of these plans is focusing on developing skills and training initiatives that are tailored to the needs of women, ensuring women can access employment in high-growth sectors such as technology.”

Director: Laxman Utekar

Cast: Vicky Kaushal, Akshaye Khanna, Diana Penty, Vineet Kumar Singh, Rashmika Mandanna

Rating: 1/5

Company Profile

Name: Thndr

Started: 2019

Co-founders: Ahmad Hammouda and Seif Amr

Sector: FinTech

Headquarters: Egypt

UAE base: Hub71, Abu Dhabi

Current number of staff: More than 150

Funds raised: $22 million

More from Rashmee Roshan Lall

German intelligence warnings

- 2002: "Hezbollah supporters feared becoming a target of security services because of the effects of [9/11] ... discussions on Hezbollah policy moved from mosques into smaller circles in private homes." Supporters in Germany: 800

- 2013: "Financial and logistical support from Germany for Hezbollah in Lebanon supports the armed struggle against Israel ... Hezbollah supporters in Germany hold back from actions that would gain publicity." Supporters in Germany: 950

- 2023: "It must be reckoned with that Hezbollah will continue to plan terrorist actions outside the Middle East against Israel or Israeli interests." Supporters in Germany: 1,250

Source: Federal Office for the Protection of the Constitution

BMW M5 specs

Engine: 4.4-litre twin-turbo V-8 petrol enging with additional electric motor

Power: 727hp

Torque: 1,000Nm

Transmission: 8-speed auto

Fuel consumption: 10.6L/100km

On sale: Now

Price: From Dh650,000

TECH%20SPECS%3A%20APPLE%20IPHONE%2014%20PLUS

%3Cp%3E%3Cstrong%3EDisplay%3A%3C%2Fstrong%3E%206.1%22%20Super%20Retina%20XDR%20OLED%2C%202778%20x%201284%2C%20458ppi%2C%20HDR%2C%20True%20Tone%2C%20P3%2C%201200%20nits%3C%2Fp%3E%0A%3Cp%3E%3Cstrong%3EProcessor%3A%3C%2Fstrong%3E%20A15%20Bionic%2C%206-core%20CPU%2C%205-core%20GPU%2C%2016-core%20Neural%20Engine%C2%A0%3C%2Fp%3E%0A%3Cp%3E%3Cstrong%3EMemory%3A%3C%2Fstrong%3E%206GB%3C%2Fp%3E%0A%3Cp%3E%3Cstrong%3ECapacity%3A%3C%2Fstrong%3E%20128%2F256%2F512GB%3C%2Fp%3E%0A%3Cp%3E%3Cstrong%3EPlatform%3A%3C%2Fstrong%3E%20iOS%2016%3C%2Fp%3E%0A%3Cp%3E%3Cstrong%3EMain%20camera%3A%3C%2Fstrong%3E%20Dual%2012MP%20main%20(f%2F1.5)%20%2B%2012MP%20ultra-wide%20(f%2F2.4)%3B%202x%20optical%2C%205x%20digital%3B%20Photonic%20Engine%2C%20Deep%20Fusion%2C%20Smart%20HDR%204%2C%20Portrait%20Lighting%3C%2Fp%3E%0A%3Cp%3E%3Cstrong%3EMain%20camera%20video%3A%3C%2Fstrong%3E%204K%20%40%2024%2F25%2F3060fps%2C%20full-HD%20%40%2025%2F30%2F60fps%2C%20HD%20%40%2030fps%3B%20HD%20slo-mo%20%40%20120%2F240fps%3B%20night%2C%20time%20lapse%2C%20cinematic%2C%20action%20modes%3B%20Dolby%20Vision%2C%204K%20HDR%3C%2Fp%3E%0A%3Cp%3E%3Cstrong%3EFront%20camera%3A%3C%2Fstrong%3E%2012MP%20TrueDepth%20(f%2F1.9)%2C%20Photonic%20Engine%2C%20Deep%20Fusion%2C%20Smart%20HDR%204%3B%20Animoji%2C%20Memoji%3B%20Portrait%20Lighting%3C%2Fp%3E%0A%3Cp%3E%3Cstrong%3EFront%20camera%20video%3A%3C%2Fstrong%3E%204K%20%40%2024%2F25%2F3060fps%2C%20full-HD%20%40%2025%2F30%2F60fps%2C%20HD%20slo-mo%20%40%20120fps%3B%20night%2C%20time%20lapse%2C%20cinematic%2C%20action%20modes%3B%20Dolby%20Vision%2C%204K%20HDR%3C%2Fp%3E%0A%3Cp%3E%3Cstrong%3EBattery%3A%3C%2Fstrong%3E%204323%20mAh%2C%20up%20to%2026h%20video%2C%2020h%20streaming%20video%2C%20100h%20audio%3B%20fast%20charge%20to%2050%25%20in%2030m%3B%20MagSafe%2C%20Qi%20wireless%20charging%3C%2Fp%3E%0A%3Cp%3E%3Cstrong%3EConnectivity%3A%3C%2Fstrong%3E%20Wi-Fi%2C%20Bluetooth%205.3%2C%20NFC%20(Apple%20Pay)%3C%2Fp%3E%0A%3Cp%3E%3Cstrong%3EBiometrics%3A%3C%2Fstrong%3E%20Face%20ID%3C%2Fp%3E%0A%3Cp%3E%3Cstrong%3EI%2FO%3A%3C%2Fstrong%3E%20Lightning%3C%2Fp%3E%0A%3Cp%3E%3Cstrong%3ECards%3A%3C%2Fstrong%3E%20Dual%20eSIM%20%2F%20eSIM%20%2B%20SIM%20(US%20models%20use%20eSIMs%20only)%3C%2Fp%3E%0A%3Cp%3E%3Cstrong%3EColours%3A%3C%2Fstrong%3E%20Blue%2C%20midnight%2C%20purple%2C%20starlight%2C%20Product%20Red%3C%2Fp%3E%0A%3Cp%3E%3Cstrong%3EIn%20the%20box%3A%3C%2Fstrong%3E%20iPhone%2014%2C%20USB-C-to-Lightning%20cable%2C%20one%20Apple%20sticker%3C%2Fp%3E%0A%3Cp%3E%3Cstrong%3EPrice%3A%3C%2Fstrong%3E%20Dh3%2C799%20%2F%20Dh4%2C199%20%2F%20Dh5%2C049%3C%2Fp%3E%0A

Day 1, Dubai Test: At a glance

Moment of the day Sadeera Samarawickrama set pulses racing with his strokeplay on his introduction to Test cricket. It reached a feverish peak when he stepped down the wicket and launched Yasir Shah, who many regard as the world’s leading spinner, back over his head for six. No matter that he was out soon after: it felt as though the future had arrived.

Stat of the day - 5 The last time Sri Lanka played a Test in Dubai – they won here in 2013 – they had four players in their XI who were known as wicketkeepers. This time they have gone one better. Each of Dinesh Chandimal, Kaushal Silva, Samarawickrama, Kusal Mendis, and Niroshan Dickwella – the nominated gloveman here – can keep wicket.

The verdict Sri Lanka want to make history by becoming the first team to beat Pakistan in a full Test series in the UAE. They could not have made a better start, first by winning the toss, then by scoring freely on an easy-paced pitch. The fact Yasir Shah found some turn on Day 1, too, will have interested their own spin bowlers.

The alternatives

• Founded in 2014, Telr is a payment aggregator and gateway with an office in Silicon Oasis. It’s e-commerce entry plan costs Dh349 monthly (plus VAT). QR codes direct customers to an online payment page and merchants can generate payments through messaging apps.

• Business Bay’s Pallapay claims 40,000-plus active merchants who can invoice customers and receive payment by card. Fees range from 1.99 per cent plus Dh1 per transaction depending on payment method and location, such as online or via UAE mobile.

• Tap started in May 2013 in Kuwait, allowing Middle East businesses to bill, accept, receive and make payments online “easier, faster and smoother” via goSell and goCollect. It supports more than 10,000 merchants. Monthly fees range from US$65-100, plus card charges of 2.75-3.75 per cent and Dh1.2 per sale.

• 2checkout’s “all-in-one payment gateway and merchant account” accepts payments in 200-plus markets for 2.4-3.9 per cent, plus a Dh1.2-Dh1.8 currency conversion charge. The US provider processes online shop and mobile transactions and has 17,000-plus active digital commerce users.

• PayPal is probably the best-known online goods payment method - usually used for eBay purchases - but can be used to receive funds, providing everyone’s signed up. Costs from 2.9 per cent plus Dh1.2 per transaction.

Dengue%20fever%20symptoms

%3Cul%3E%0A%3Cli%3EHigh%20fever%3C%2Fli%3E%0A%3Cli%3EIntense%20pain%20behind%20your%20eyes%3C%2Fli%3E%0A%3Cli%3ESevere%20headache%3C%2Fli%3E%0A%3Cli%3EMuscle%20and%20joint%20pains%3C%2Fli%3E%0A%3Cli%3ENausea%3C%2Fli%3E%0A%3Cli%3EVomiting%3C%2Fli%3E%0A%3Cli%3ESwollen%20glands%3C%2Fli%3E%0A%3Cli%3ERash%3C%2Fli%3E%0A%3C%2Ful%3E%0A%3Cp%3EIf%20symptoms%20occur%2C%20they%20usually%20last%20for%20two-seven%20days%3C%2Fp%3E%0A

Our family matters legal consultant

Name: Hassan Mohsen Elhais

Position: legal consultant with Al Rowaad Advocates and Legal Consultants.

More from Neighbourhood Watch:

What is a calorie?

A food calorie, or kilocalorie, is a measure of nutritional energy generated from what is consumed.

One calorie, is the amount of heat needed to raise the temperature of 1 kilogram of water by 1°C.

A kilocalorie represents a 1,000 true calories of energy.

Energy density figures are often quoted as calories per serving, with one gram of fat in food containing nine calories, and a gram of protein or carbohydrate providing about four.

Alcohol contains about seven calories a gram.

UPI facts

More than 2.2 million Indian tourists arrived in UAE in 2023

More than 3.5 million Indians reside in UAE

Indian tourists can make purchases in UAE using rupee accounts in India through QR-code-based UPI real-time payment systems

Indian residents in UAE can use their non-resident NRO and NRE accounts held in Indian banks linked to a UAE mobile number for UPI transactions

UAE currency: the story behind the money in your pockets

The biog

Alwyn Stephen says much of his success is a result of taking an educated chance on business decisions.

His advice to anyone starting out in business is to have no fear as life is about taking on challenges.

“If you have the ambition and dream of something, follow that dream, be positive, determined and set goals.

"Nothing and no-one can stop you from succeeding with the right work application, and a little bit of luck along the way.”

Mr Stephen sells his luxury fragrances at selected perfumeries around the UAE, including the House of Niche Boutique in Al Seef.

He relaxes by spending time with his family at home, and enjoying his wife’s India cooking.

Company name: Play:Date

Launched: March 2017 on UAE Mother’s Day

Founder: Shamim Kassibawi

Based: Dubai with operations in the UAE and US

Sector: Tech

Size: 20 employees

Stage of funding: Seed

Investors: Three founders (two silent co-founders) and one venture capital fund

UAE currency: the story behind the money in your pockets

The President's Cake

Director: Hasan Hadi

Starring: Baneen Ahmad Nayyef, Waheed Thabet Khreibat, Sajad Mohamad Qasem

Rating: 4/5

In numbers: China in Dubai

The number of Chinese people living in Dubai: An estimated 200,000

Number of Chinese people in International City: Almost 50,000

Daily visitors to Dragon Mart in 2018/19: 120,000

Daily visitors to Dragon Mart in 2010: 20,000

Percentage increase in visitors in eight years: 500 per cent

MATCH INFO

Uefa Champions League last-16, second leg:

Real Madrid 1 (Asensio 70'), Ajax 4 (Ziyech 7', Neres 18', Tadic 62', Schone 72')

Ajax win 5-3 on aggregate

The%C2%A0specs%20

%3Cp%3E%3Cstrong%3EEngine%3A%3C%2Fstrong%3E%204-cylinder%202.0L%20TSI%0D%3Cbr%3E%3Cstrong%3ETransmission%3A%3C%2Fstrong%3E%20Dual%20clutch%207-speed%0D%3Cbr%3E%3Cstrong%3EPower%3A%3C%2Fstrong%3E%20320HP%20%2F%20235kW%0D%3Cbr%3E%3Cstrong%3ETorque%3A%3C%2Fstrong%3E%20400Nm%0D%3Cbr%3E%3Cstrong%3EPrice%3A%20%3C%2Fstrong%3Efrom%20%2449%2C709%20%0D%3Cbr%3E%3Cstrong%3EOn%20sale%3A%3C%2Fstrong%3E%20now%3C%2Fp%3E%0A

COMPANY PROFILE

Company name: BorrowMe (BorrowMe.com)

Date started: August 2021

Founder: Nour Sabri

Based: Dubai, UAE

Sector: E-commerce / Marketplace

Size: Two employees

Funding stage: Seed investment

Initial investment: $200,000

Investors: Amr Manaa (director, PwC Middle East)

The specs

Engine: 2.9-litre twin-turbo V6

Power: 540hp at 6,500rpm

Torque: 600Nm at 2,500rpm

Transmission: Eight-speed auto

Kerb weight: 1580kg

Price: From Dh750k

On sale: via special order

2017%20RESULTS%3A%20FRENCH%20VOTERS%20IN%20UK

%3Cp%3E%3Cstrong%3EFirst%20round%3C%2Fstrong%3E%3Cbr%3EEmmanuel%20Macron%3A%2051.1%25%3Cbr%3EFrancois%20Fillon%3A%2024.2%25%3Cbr%3EJean-Luc%20Melenchon%3A%2011.8%25%3Cbr%3EBenoit%20Hamon%3A%207.0%25%3Cbr%3EMarine%20Le%20Pen%3A%202.9%25%3Cbr%3E%3Cbr%3E%3Cstrong%3ESecond%20round%3C%2Fstrong%3E%3Cbr%3EEmmanuel%20Macron%3A%2095.1%25%3Cbr%3EMarine%20Le%20Pen%3A%204.9%25%26nbsp%3B%3C%2Fp%3E%0A

VEZEETA PROFILE

Date started: 2012

Founder: Amir Barsoum

Based: Dubai, UAE

Sector: HealthTech / MedTech

Size: 300 employees

Funding: $22.6 million (as of September 2018)

Investors: Technology Development Fund, Silicon Badia, Beco Capital, Vostok New Ventures, Endeavour Catalyst, Crescent Enterprises’ CE-Ventures, Saudi Technology Ventures and IFC

Getting%20there%20and%20where%20to%20stay

%3Cp%3EFly%20with%20Etihad%20Airways%20from%20Abu%20Dhabi%20to%20New%20York%E2%80%99s%20JFK.%20There's%2011%20flights%20a%20week%20and%20economy%20fares%20start%20at%20around%20Dh5%2C000.%3Cbr%3EStay%20at%20The%20Mark%20Hotel%20on%20the%20city%E2%80%99s%20Upper%20East%20Side.%20Overnight%20stays%20start%20from%20%241395%20per%20night.%3Cbr%3EVisit%20NYC%20Go%2C%20the%20official%20destination%20resource%20for%20New%20York%20City%20for%20all%20the%20latest%20events%2C%20activites%20and%20openings.%3Cbr%3E%3C%2Fp%3E%0A

India team for Sri Lanka series

Test squad: Rohit Sharma (captain), Priyank Panchal, Mayank Agarwal, Virat Kohli, Shreyas Iyer, Hanuma Vihari, Shubhman Gill, Rishabh Pant (wk), KS Bharath (wk), Ravindra Jadeja, Jayant Yadav, Ravichandran Ashwin, Kuldeep Yadav, Sourabh Kumar, Mohammed Siraj, Umesh Yadav, Mohammed Shami, Jasprit Bumrah.

T20 squad: Rohit Sharma (captain), Ruturaj Gaikwad, Shreyas Iyer, Surya Kumar Yadav, Sanju Samson, Ishan Kishan (wk), Venkatesh Iyer, Deepak Chahar, Deepak Hooda, Ravindra Jadeja, Yuzvendra Chahal, Ravi Bishnoi, Kuldeep Yadav, Mohammed Siraj, Bhuvneshwar Kumar, Harshal Patel, Jasprit Bumrah, Avesh Khan

India Test squad

Kohli (c), Dhawan, Rahul, Vijay, Pujara, Rahane (vc), Karun, Karthik (wk), Rishabh Pant (wk), Ashwin, Jadeja, Kuldeep, Pandya, Ishant, Shami, Umesh, Bumrah, Thakur

LAST 16

SEEDS

Liverpool, Manchester City, Barcelona, Paris St-Germain, Bayern Munich, RB Leipzig, Valencia, Juventus

PLUS

Real Madrid, Tottenham, Atalanta, Atletico Madrid, Napoli, Borussia Dortmund, Lyon, Chelsea

The biog

Favourite food: Fish and seafood

Favourite hobby: Socialising with friends

Favourite quote: You only get out what you put in!

Favourite country to visit: Italy

Favourite film: Lock Stock and Two Smoking Barrels.

Family: We all have one!

Titanium Escrow profile

Started: December 2016

Founder: Ibrahim Kamalmaz

Based: UAE

Sector: Finance / legal

Size: 3 employees, pre-revenue

Stage: Early stage

Investors: Founder's friends and Family