Demand for homes in super tall towers being built in the UAE continues to increase, with developers expecting billions of dirhams in sales from a property boom in the Emirates.

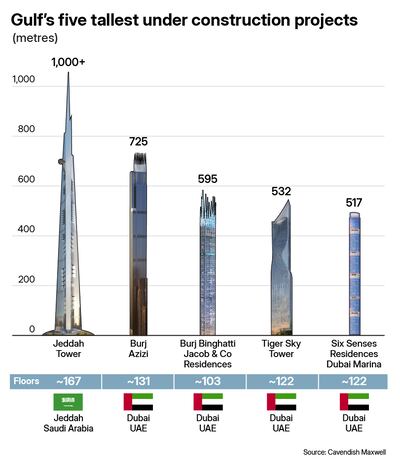

Dubai is already home to the world's tallest tower, the 828-metre Burj Khalifa, and last year, Azizi Developments revealed plans for a Dh6 billion ($1.63 billion) tower called Burj Azizi, designed to stand 725 metres tall to become the world's second-tallest.

Azizi expects Dh20 billion in sales this year for the new project, Mirwais Azizi, founder and chairman of Azizi Developments, told The National.

“Sales have been excellent so far. We have sold close to Dh2 billion [from 200 units], with different nationalities from India, Europe and Arab nations [buying homes],” he said.

Once completed in 2028, the Burj Azizi, with at least 131 levels and 1,000 units will surpass the 679-metre Merdeka 118 in Kuala Lumpur, the company said. The tower will also feature a “seven-star hotel, the highest observation deck on level 130 as well as other amenities”.

Prices for apartments at Burj Azizi start at Dh7.5 million, with a maximum price of Dh1 billion for a penthouse occupying a full floor on the 100th level.

“A lot of people want to have some property here in Dubai, from India, Arab countries … now the Europeans, a lot of them are purchasing here because of the security and good leadership and the [stable] market,” Mr Azizi said.

Dubai’s property market has boomed in recent years on the back of government initiatives such as residency permits for retired and remote workers and the expansion of the 10-year golden visa programme. The overall growth in the UAE’s economy as a result of diversification efforts is also supporting the property market.

The emirate recorded real estate deals worth Dh761 billion last year, up 20 per cent compared to 2023, with the total number of transactions for the year increasing by 36 per cent to 226,000, according to data provided by the Dubai Media Office.

It also achieved a record in the sale of homes valued at more than $10 million last year, Knight Frank said in a report in February. The emirate recorded 435 home sales valued at more than $10 million, up from 434 home sales in 2023 in the same category, with the total value of deals reaching $7 billion.

By the end of the third quarter, Dubai exceeded other hotspots including New York, Hong Kong and Los Angeles for sales of homes valued at more than $10 million.

The prices of homes in Dubai are not high compared to cities like London, New York, Singapore or Hong Kong, making it attractive for buyers, Mr Azizi added.

As of March, the average property price in Dubai is Dh1,682 per square foot, considerably lower than cities like London at Dh4,097 per square foot, New York at Dh1,862, Singapore Dh5,697, and Hong Kong Dh8,047 per square foot, consultancy Betterhomes said, citing Global Property Guide data.

“This affordability, combined with high-quality developments, high rental yields, no capital gains tax, and a business-friendly environment, positions Dubai as an exceptionally attractive market for both investors and end users,” Christopher Cina, director of sales at Betterhomes, said.

Buyers are drawn to tall towers because of the “prestige and lifestyle” they provide, he added.

“As the region attracts more ultra-high-net-worth individuals (UHNWIs), demand is shifting towards limited-edition, highly exclusive assets. These individuals are not just seeking residences – they are investing in status symbols, and unique ownership experiences,” said Siraj Ahmed, partner, strategy and consulting at Cavendish Maxwell.

“With this trend gaining momentum, we anticipate the proliferation of more iconic skyscrapers across the GCC, further reinforcing the region’s position as a global hub for luxury real estate and high-rise innovation.”

The trend of new tall skyscrapers is also benefitting developers to help them establish their brand in the market and help them boost growth, he added.

Scaling heights

UAE developer Select Group, which is building the 122-floor Six Senses Residences Dubai Marina, has also achieved Dh2 billion in sales so far and expects all the units in the project to be sold by the end of 2025.

“We’ve progressed quite well in sales and demand is still very strong. Market is behaving very well, so we don't see any challenges in that respect,” Israr Liaqat, chief executive of Select Group, said.

The 517-metre tall tower, with a total development value of more than $1 billion, has 251 residences ranging from two- to four-bedroom deluxe residences, half-floor penthouses, as well as duplex and triplex sky mansions. It is scheduled for completion by 2028.

Unit prices start from about Dh9 million, with the most expensive unit being a 14,000 square foot sky mansion on the 120th floor, which costs Dh120 million.

“We have more than 36 nationalities [who have] already bought in the project, and the distribution is very healthy. It's ranging between British, French, Russian, American and Indian,” Georges El Hachem, commercial director of Select Group, said.

Chinese, Spanish as well as Romanian buyers have also bought homes in the tower, with investors constituting about 55 per cent of the total buyers and the remaining being end users.

“People are very attracted to the aspect of living in a very dynamic environment with great views of the whole city, the beach, the marina,” Mr El Hachem said.

“The best part of having this elevation is the amount of facilities that can be introduced to such a tower. The wellness building provides 61,000 square foot of facilities that are accessible only to residents … The swimming pool on the 109th floor or the yoga deck that is available on [the same] floor, which is approximately 430 metres above the ground, is definitely an amazing attraction,” he added.

New tallest tower

With demand for tall buildings on the rise not just in the UAE, but across the region, the Burj Khalifa may soon lose its title as the world's tallest.

In January, Saudi Arabia's Kingdom Holding announced that is resuming construction of the Jeddah Tower project, which is expected to be the world's tallest at a height of more than 1,000 metres.

Work on the project was paused in 2018, with 63 floors out of the total 157 completed. The tower, estimated to cost 100 billion Saudi riyals ($26 billion), will feature luxury residences, commercial spaces, a Four Seasons hotel, and an observation deck. Construction is now scheduled to be completed in 2028.

“The project will host up to 100,000 residents and financing of the project is complete,” Prince Al-Waleed bin Talal, chairman of Kingdom Holding, said in a post on X. The project is being financed by banks and money generated through the sale of housing units at the tower.

Meanwhile, in 2023, Kuwait also announced the Burj Mubarak Al Kabir project, proposed to rise 1,001 metres in height, local media reported at the time. However, work is yet to start on the project.