Decentralised and digital identification systems using blockchain technology can be key in the battle against the growing problem of identity theft, with a reliable ecosystem resulting in both personal and economic benefits, the chief technology officer of German cyber security provider DGC.org said.

The Flensburg-based organisation supports the development of regulations supporting these ID systems can increase social and economic contribution, and consequently promote self sovereign identity, which are digital identities managed in a decentralised manner; data monetisation, the process of processing data to obtain economic benefit; and the right to data portability, which allows people to obtain and reuse their personal data for their own purposes across various services.

"Your data is your most valuable thing, but it can also be used against you. Privacy is one of the most important topics we are dealing with. Anywhere where data is being stored, it can be stolen," Eva Gattnar said at the Fantom Developer Conference in Abu Dhabi on Wednesday.

The problem of identity theft has increased with more channels available for cyber criminals to exploit. A wide spectrum of user data is available on the web – from personal information such as birthdays to sensitive ones like bank account numbers – and are ripe for the picking if proper safeguards are not enforced.

Blockchain – the database upon which the world's first cryptocurrency, Bitcoin, was built – was once considered useful only for digital currencies, but its secure nature has allowed it to be used in more industries.

Data from recruitment platform LegalJobs showed that one in 15 people become victims of identity fraud, and a further 30 per cent of ID theft cases involve credit cards. In the US alone, Federal Trade Commission data said reported losses grew 83 per cent from $1.8 billion in 2019 to $3.3bn in 2020.

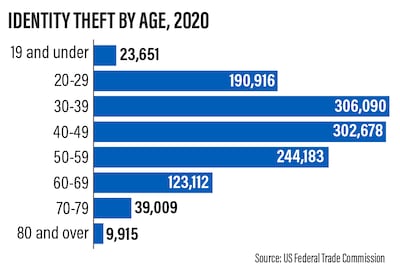

Even more troubling, more than one million children become victims of identity crimes each year. Millennials – those aged 30 and 39 – are most likely to become victims, according to Comparitech data.

chief technology officer of DGC.org

Ms Gattnar said it is important to define and implement cyber identity in a new way, as the new approach of decentralisation – a system that does not have a central authority – is about doing things together.

"We need so many regulations to secure our identity. It also helps if you have a business – how many rules and laws apply to your business, even just for simple things like emails," she added.

"There is the need to develop new mechanisms of trust and direct value. We shouldn't ask how we can improve cybersecurity, but how we can make it obsolete."