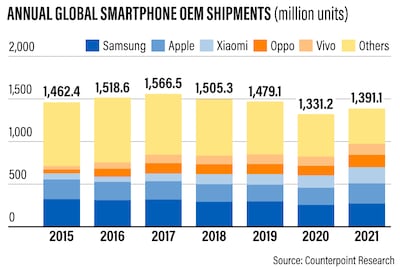

The global smartphone market posted positive growth for the first time in four years, with annual shipments rising 4.5 per cent to 1.39 billion units in 2021 and Apple posting record sales, a study by Counterpoint Research showed.

The Hong Kong-based research firm said that despite the first expansion since 2017, shipments remained below pre-Covid-19 levels, and the recovery could have been better if not for the pandemic's effects and the supply chain crunch that was severely felt in the second half of 2021, most notably in the semiconductor industry.

“The major brands navigated the component shortages comparatively better and hence managed to grow by gaining share from long-tail brands,” said Harmeet Singh Walia, senior researcher at Counterpoint Research.

The global smartphone industry is expected to be hindered in 2022 by supply chain disruptions and component shortages, with new variants of coronavirus further exacerbating the situation. Any improvement would be felt in the second half, the International Data Corporation told The National in December.

Still, Apple shipped a record 237.9 million iPhones in 2021, which was more than 17 per cent of total shipments, Counterpoint said. That was almost 3 per cent better than its previous best of 231.5 million units in 2015 and more than 18 per cent better than the 201.1 million units shipped last year.

Apple on Thursday reported record quarterly sales and net profit in its 2022 fiscal first quarter, and was one of the biggest gainers during the pandemic thanks to its services portfolio.

South Korea's Samsung Electronics, the world's biggest mobile phone maker and perennial market leader, remained on top last year, with 270.7 million shipments – almost a fifth of the total for 2021 but good for only 6 per cent growth from the previous year.

Samsung on Thursday reported a 53 per cent surge in fourth-quarter operating profit, as record sales helped the company rebound despite supply chain disruptions. It is also scheduled to announce its latest Galaxy S22 smartphone range on February 9.

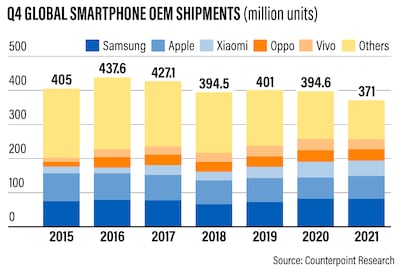

In the fourth quarter of 2021, Apple grew 8 per cent and Samsung was flat compared to the same three-month period in 2020.

The biggest market share growth came from Chinese manufacturers, with Xiaomi improving 31 per cent on 190.4 million units shipped in 2021. Last August, Counterpoint reported that the Beijing-based company overtook Samsung to be the number one smartphone manufacturer globally in June, though Samsung still topped in the second quarter.

Oppo and Vivo, both subsidiaries of Dongguan-based BBK Electronics, shipped 143.2 million and 131.3 million units, respectively, to grow 28 per cent and 21 per cent in 2021.

However, despite the strength of its home-grown companies, the smartphone market in China continued to decline because of supply issues caused by the ongoing component shortages, as well as demand-side issues resulting from lengthening replacement cycles, Counterpoint said.

Sales in the world's biggest smartphone market declined 9 per cent year-on-year for the third consecutive quarter in the three-month period ended December 31, Counterpoint said. For the full year, sales dropped 2 per cent, the fourth straight year of declines.

Counterpoint on January 15 also reported that Apple was the top smartphone brand in China in terms of sales units and revenue for six consecutive weeks to the end of 2021.

research director at Counterpoint

Outside the top five, Lenovo-owned Motorola Mobility was the fastest-growing brand in the top 10 based on annual global shipments, taking advantage of LG’s exit in the US. Realme, another subsidiary of China's BBK, entered the top five Android original equipment manufacturers (OEMs) globally for the first time as its cheaper 5G strategy started to pay off.

Honor, the former budget brand of Huawei, finished its first full year as an independent OEM with a ranking among the top 10 globally, and is already among the top five OEMs in China where it benefited from the reinstatement of its relationship with its suppliers since its separation from Huawei, Counterpoint said. Honor recently announced its first foldable smartphone, the Magic V.

While 2021 was challenging, the world slowly moving on from the pandemic presents an opportunity for further growth in the smartphone market, said Jan Stryjak, research director at Counterpoint.

“Despite the threat of a resurgence towards the end of last year, and with supply issues hopefully coming to an end towards the middle of this year, there is reason to be optimistic for good growth in 2022 as a whole,” he added.