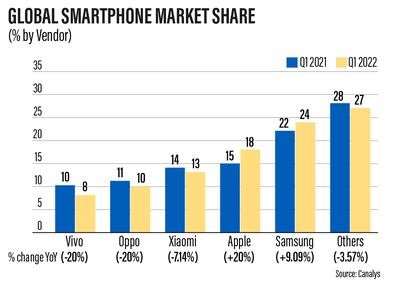

Apple and Samsung, the top two smartphone brands, were able to grow their market share after releasing new models of their flagship products, even as the global smartphone shipments dropped, a report has said.

Apple's market share grew by a fifth to 18 per cent in the first quarter of this year, up from 15 per cent in the same period a year ago, thanks to the continued strength of its iPhone 13 series, a report from research firm Canalys showed.

Meanwhile, Samsung Electronics, the world's largest mobile phone manufacturer, now holds almost a quarter of the market, up from 22 per cent in the same period a year ago, helped by its new Galaxy S22 line-up that was launched in March.

The brands expanded their market share as global smartphone shipments declined 11 per cent in the first quarter, Singapore-based Canalys said in its first smartphone Market Pulse report for 2022.

The overall annual decline reflects the challenges being faced in the market, most notably due to economic uncertainty caused by a resurgence of Covid-19 cases in China, the world's biggest smartphone market, and Russia's military offensive in Ukraine that has hurt consumer confidence.

“The global smartphone market was held back by an unsettled business environment in Q1,” Nicole Peng, vice president for mobility at Canalys, wrote in the report.

“Markets saw a spike in Covid-19 cases due to the Omicron variant," she said, although minimal admissions to hospital and high vaccination rates helped normalise consumer activity quickly.

"Vendors face major uncertainty due to the Russia-Ukraine war, China’s rolling lockdowns and the threat of inflation. All this added to traditionally slow seasonal demand."

Global smartphone shipments, much like other commodities, were affected by the Covid-19 pandemic that started in 2020. The sector, however, grew 6 per cent on an annual basis in 2021 on increased consumer spending as the industry emerged from disruptions caused by the health crisis, said a report released by research firm Gartner in March.

In the same month, Counterpoint Research said that sales of premium smartphones — handsets priced at more than $400 — surged 24 per cent globally on an annual basis in 2021 to reach their highest ever level, outperforming the 7 per cent yearly growth in overall global smartphone sales. Premium devices accounted for nearly 27 per cent of overall shipments, an all-time high.

Apple boosted its portfolio by releasing new devices in March, including an Alpine Green variant of the iPhone 13 series and the third-generation iPhone SE as the Cupertino-based company seeks to capture more of the affordable device segment.

Consumers are also looking forward to the iPhone 14 line-up, which is expected to come with a major redesign and will be released in September.

"Apple is gaining ground in market share despite the company's smartphones mainly being considered expensive compared to competitors. It can be assumed that the devices are gaining more appeal with the company leveraging its loyal consumer base that is attracted by the devices' regular new features and the overall innovative designs," smartphone accessories manufacturer Burga said in a separate report.

South Korea's Samsung, meanwhile, consolidated its portfolio with the Galaxy S22, with the Ultra version coming with a built-in S Pen, a holdover from the now discontinued Note series. The company is expected to launch a new iteration of its foldable devices in August.

"Samsung's strategies amid the economic uncertainty have helped the company to retain its market dominance," Burga said, adding that the company has managed to keep the process of its Galaxy premium phones unchanged despite the pressure for upward pricing, leading to a broader audience.

Chinese smartphone manufacturers continued to maintain their strength in the top tier, albeit posting lower market share than a year ago, said Canalys.

Xiaomi, which remained in third place thanks to the high performance of its Redmi Note series, had its market share drop to 13 per cent from 14 per cent.

Oppo, which is the majority owner of OnePlus, slipped to 10 per cent from 11 per cent, while Vivo slid to 8 per cent from 10 per cent. Both brands are owned by the BBK Electronics conglomerate, which also counts Realme in its portfolio.

“Despite the looming uncertainty in global markets, the leading vendors accelerated their growth by broadening device portfolios for 2022,” Sanyam Chaurasia, an analyst at Canalys, said.