Twitter chief executive Elon Musk plans to develop a new generative artificial intelligence platform to challenge Microsoft-backed OpenAI’s ChatGPT and Google’s Bard.

The platform, which the billionaire calls TruthGPT, would become a "third option" to what he calls "the two heavyweights" currently dominating the market that has become the new darling for investors, according to excerpts of Mr Musk's interview with Fox News Channel's Tucker Carlson.

"I'm going to start ... a maximum truth-seeking AI that tries to understand the nature of the universe," Mr Musk told Mr Carlson in the interview that aired on Monday.

"And I think this might be the best path to safety, in the sense that an AI that cares about understanding the universe, it is unlikely to annihilate humans because we are an interesting part of the universe."

He declined to provide specific details on his plans for developing TruthGPT.

Mr Musk's announcement confirms earlier reports by The Information in March and the Financial Times last week on his plans to throw his hat into the generative AI race.

San Francisco-based technology news site The Information said Mr Musk was assembling a team, which includes a former engineer at a unit of Google parent Alphabet, to develop a rival to ChatGPT.

It said he was in discussions with Igor Babuschkin, who recently left Google's DeepMind AI, to lead a group of artificial intelligence researchers in the endeavour. It remains unclear whether any of the other persons who have been approached have signed up so far.

The British daily FT, meanwhile, reported that Mr Musk is building a team of AI researchers and engineers, and also in talks with various investors in his other ventures, such as SpaceX and Tesla, about pumping capital into his new AI start-up.

He has also ordered “thousands of high-powered GPU [graphic processing unit]” chips from technology company Nvidia, the report said. GPUs are sophisticated chips capable of running many tasks simultaneously and are necessary in building generative AI’s large language models.

Last month, he reportedly merged registered a company named X.AI Corp in Nevada, according to a US state filing.

Generative AI can produce various kinds of data, including audio, code, images, text, simulations, 3D objects and videos. While it takes cues from existing data, it is also capable of generating new and unexpected outputs, according to GenerativeAI.net.

The global generative AI market is expected to reach $188.62 billion by 2032, growing at an annual rate of more than 36 per cent from $8.65 billion last year, according to Brainy Insights.

It could also drive a 7 per cent — or almost $7 trillion — increase in the global economy and lift productivity growth by 1.5 percentage points over a 10-year period, Goldman Sachs estimated.

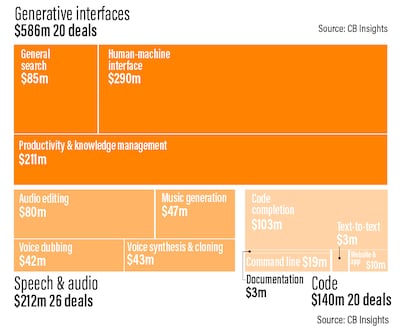

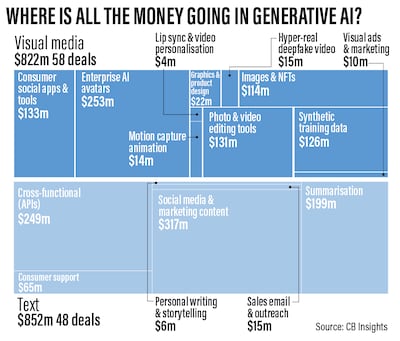

Investors have poured in more than $4.2 billion through 215 deals into generative AI start-ups in 2021 and 2022 after interest spiked in 2019, data from CB Insights showed. Around $586 million in 20 deals during the same period has gone to generative interfaces, it said.

Mr Musk, who co-founded the California-based start-up OpenAI in 2015, left its board in 2018 following disagreements with the company's direction. However, in 2019, he tweeted that the need to focus on Tesla and SpaceX was the reason he left OpenAI.

He has also been critical of the company in recent months, arguing that OpenAI is placing several safety nets to prevent ChatGPT from offering results that might be divisive or offend its users. That implies that his planned TruthGPT chatbot might have less restrictions.

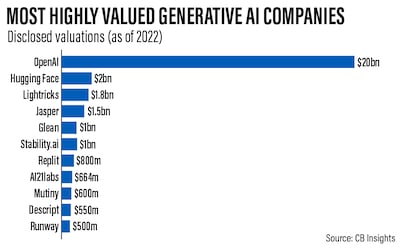

ChatGPT was launched in November by OpenAI — the world's most valuable generative AI start-up — and quickly gained popularity as it can generate written content with a simple request within seconds.

AI is more dangerous than, say, mismanaged aircraft design or production maintenance or bad car production

Elon Musk,

chief executive of Twitter and Tesla

In January, technology company Microsoft announced the third phase of its long-term partnership with OpenAI through a new multiyear, multibillion-dollar investment, worth a reported $10 billion.

Earlier this month, Google, meanwhile, unveiled its own conversational AI service, Bard. However, days later, Bard made an error in a promotional video during a company event in Paris, causing $100 billion to be wiped off Google's market value.

Mr Musk had criticisms for both companies during the interview with Mr Carlson, saying that OpenAI is "training the AI to lie" and that it has become a "closed source", "for-profit" platform "closely allied with Microsoft".

He also accused Google co-founder Larry Page of not taking AI safety seriously and that their disagreements were the reason OpenAI now exists.

"The reason OpenAI exists at all is that Larry Page and I used to be close friends and I would stay at his house in Palo Alto, and I would talk to him late into the night about AI safety," Mr Musk said.

"And at least my perception was that Larry was not taking AI safety seriously enough."

It is unclear how much Mr Musk, the world's second-wealthiest person, is willing to invest in his chatbot venture. He paid $44 billion to acquire Twitter last year.

"Conservational AI is currently in its early stages of monetisation and costs remain high as it is expensive to run," Swiss bank UBS said in a research note.

Mr Musk also remained cautious about the risks of AI in his interview with Mr Carlson, comparing it to other industries that now widely utilise the technology.

"AI is more dangerous than, say, mismanaged aircraft design or production maintenance or bad car production," he said.

Mercer, the investment consulting arm of US services company Marsh & McLennan, expects its wealth division to at least double its assets under management (AUM) in the Middle East as wealth in the region continues to grow despite economic headwinds, a company official said.

Mercer Wealth, which globally has $160 billion in AUM, plans to boost its AUM in the region to $2-$3bn in the next 2-3 years from the present $1bn, said Yasir AbuShaban, a Dubai-based principal with Mercer Wealth.

“Within the next two to three years, we are looking at reaching $2 to $3 billion as a conservative estimate and we do see an opportunity to do so,” said Mr AbuShaban.

Mercer does not directly make investments, but allocates clients’ money they have discretion to, to professional asset managers. They also provide advice to clients.

“We have buying power. We can negotiate on their (client’s) behalf with asset managers to provide them lower fees than they otherwise would have to get on their own,” he added.

Mercer Wealth’s clients include sovereign wealth funds, family offices, and insurance companies among others.

From its office in Dubai, Mercer also looks after Africa, India and Turkey, where they also see opportunity for growth.

Wealth creation in Middle East and Africa (MEA) grew 8.5 per cent to $8.1 trillion last year from $7.5tn in 2015, higher than last year’s global average of 6 per cent and the second-highest growth in a region after Asia-Pacific which grew 9.9 per cent, according to consultancy Boston Consulting Group (BCG). In the region, where wealth grew just 1.9 per cent in 2015 compared with 2014, a pickup in oil prices has helped in wealth generation.

BCG is forecasting MEA wealth will rise to $12tn by 2021, growing at an annual average of 8 per cent.

Drivers of wealth generation in the region will be split evenly between new wealth creation and growth of performance of existing assets, according to BCG.

Another general trend in the region is clients’ looking for a comprehensive approach to investing, according to Mr AbuShaban.

“Institutional investors or some of the families are seeing a slowdown in the available capital they have to invest and in that sense they are looking at optimizing the way they manage their portfolios and making sure they are not investing haphazardly and different parts of their investment are working together,” said Mr AbuShaban.

Some clients also have a higher appetite for risk, given the low interest-rate environment that does not provide enough yield for some institutional investors. These clients are keen to invest in illiquid assets, such as private equity and infrastructure.

“What we have seen is a desire for higher returns in what has been a low-return environment specifically in various fixed income or bonds,” he said.

“In this environment, we have seen a de facto increase in the risk that clients are taking in things like illiquid investments, private equity investments, infrastructure and private debt, those kind of investments were higher illiquidity results in incrementally higher returns.”

The Abu Dhabi Investment Authority, one of the largest sovereign wealth funds, said in its 2016 report that has gradually increased its exposure in direct private equity and private credit transactions, mainly in Asian markets and especially in China and India. The authority’s private equity department focused on structured equities owing to “their defensive characteristics.”

What went into the film

25 visual effects (VFX) studios

2,150 VFX shots in a film with 2,500 shots

1,000 VFX artists

3,000 technicians

10 Concept artists, 25 3D designers

New sound technology, named 4D SRL

Company profile

Company name: Dharma

Date started: 2018

Founders: Charaf El Mansouri, Nisma Benani, Leah Howe

Based: Abu Dhabi

Sector: TravelTech

Funding stage: Pre-series A

Investors: Convivialite Ventures, BY Partners, Shorooq Partners, L& Ventures, Flat6Labs

Trump v Khan

2016: Feud begins after Khan criticised Trump’s proposed Muslim travel ban to US

2017: Trump criticises Khan’s ‘no reason to be alarmed’ response to London Bridge terror attacks

2019: Trump calls Khan a “stone cold loser” before first state visit

2019: Trump tweets about “Khan’s Londonistan”, calling him “a national disgrace”

2022: Khan’s office attributes rise in Islamophobic abuse against the major to hostility stoked during Trump’s presidency

July 2025 During a golfing trip to Scotland, Trump calls Khan “a nasty person”

Sept 2025 Trump blames Khan for London’s “stabbings and the dirt and the filth”.

Dec 2025 Trump suggests migrants got Khan elected, calls him a “horrible, vicious, disgusting mayor”

Tank warfare

Lt Gen Erik Petersen, deputy chief of programs, US Army, has argued it took a “three decade holiday” on modernising tanks.

“There clearly remains a significant armoured heavy ground manoeuvre threat in this world and maintaining a world class armoured force is absolutely vital,” the general said in London last week.

“We are developing next generation capabilities to compete with and deter adversaries to prevent opportunism or miscalculation, and, if necessary, defeat any foe decisively.”

The Voice of Hind Rajab

Starring: Saja Kilani, Clara Khoury, Motaz Malhees

Director: Kaouther Ben Hania

Rating: 4/5

Jetour T1 specs

Engine: 2-litre turbocharged

Power: 254hp

Torque: 390Nm

Price: From Dh126,000

Available: Now

The specs

- Engine: 3.9-litre twin-turbo V8

- Power: 640hp

- Torque: 760nm

- On sale: 2026

- Price: Not announced yet

Types of policy

Term life insurance: this is the cheapest and most-popular form of life cover. You pay a regular monthly premium for a pre-agreed period, typically anything between five and 25 years, or possibly longer. If you die within that time, the policy will pay a cash lump sum, which is typically tax-free even outside the UAE. If you die after the policy ends, you do not get anything in return. There is no cash-in value at any time. Once you stop paying premiums, cover stops.

Whole-of-life insurance: as its name suggests, this type of life cover is designed to run for the rest of your life. You pay regular monthly premiums and in return, get a guaranteed cash lump sum whenever you die. As a result, premiums are typically much higher than one term life insurance, although they do not usually increase with age. In some cases, you have to keep up premiums for as long as you live, although there may be a cut-off period, say, at age 80 but it can go as high as 95. There are penalties if you don’t last the course and you may get a lot less than you paid in.

Critical illness cover: this pays a cash lump sum if you suffer from a serious illness such as cancer, heart disease or stroke. Some policies cover as many as 50 different illnesses, although cancer triggers by far the most claims. The payout is designed to cover major financial responsibilities such as a mortgage or children’s education fees if you fall ill and are unable to work. It is cost effective to combine it with life insurance, with the policy paying out once if you either die or suffer a serious illness.

Income protection: this pays a replacement income if you fall ill and are unable to continue working. On the best policies, this will continue either until you recover, or reach retirement age. Unlike critical illness cover, policies will typically pay out for stress and musculoskeletal problems such as back trouble.