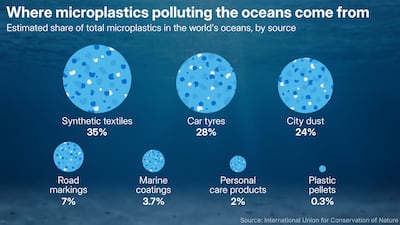

Microplastics are one of the biggest threats to global water health, with research piling up to show they are everywhere, from oceans and rivers to the air we breathe. The biggest culprits are synthetic textiles and car tyres.

A single washing machine load of acrylic clothes − made from a synthetic material often used as a wool substitute − can release an estimated 730,000 fibres into wastewater, according to Plymouth University.

The International Union for Conservation of Nature (IUCN) estimates that man-made fabrics account for thirty-five per cent of all primary microplastics in the ocean.

Car tyres, the second-largest source at 28 per cent, shed micro and nano-particles as they erode during driving, contaminating the air, soil and waterways.

But the problem is bigger than just fast fashion and transport. Microplastics come from other everyday items, such as cleaning products and road markings, making them nearly impossible to avoid.

World Ocean Day

June 8 marked World Oceans Day, spotlighting the urgent need to protect our seas. In the UAE, Dr Amna Al Dahak, Minister of Climate Change and Environment, warned that the health of the world’s oceans is at serious risk: “Covering more than 70 per cent of the Earth’s surface, our oceans are undeniably essential to human lives and livelihoods,” she said.

Abu Dhabi has led the region’s fight against plastic pollution, introducing a single-use plastic ban on June 1, 2022. By the end of 2024, the campaign had removed 360 million plastic bags from circulation.

Globally, the numbers are staggering. According to the UN Environment Programme, humans have produced 9.2 billion tonnes of plastic since the 1950s — 7 billion tonnes of which is now waste. By 2060, plastic waste could nearly triple to one billion tonnes annually if current trends continue.

“Plastic pollution is one of the gravest environmental threats facing Earth,” said Elisa Tonda at the UNEP. “But it’s a problem we can solve.”

The Human Impact

Emerging research in animal and human cells suggests microplastics may be linked to cancer, heart disease, and reproductive problems.

In the UAE, the urgency hits close to home. “We eat seafood. That plastic enters our food chain, and it stays in our bodies. It’s toxic. This isn’t just about the environment — it’s about public health,” said Ms Al Mazrouei.