A rare total lunar eclipse, also known as a Blood Moon, will be visible across the UAE on Sunday evening, treating skywatchers to one of the year’s most dramatic celestial sights.

The celestial show will appear for about five and a half hours, as the Moon passes through the Earth’s shadow.

It will play out in a sequence of phases, visible across the UAE and around the world.

“This is one of the rare astronomical events happening in the UAE in 2025,” Khadijah Ahmed, operations manager at the Dubai Astronomy Group, told The National. “We will host an event for the eclipse and encourage everyone to witness it. You don’t need any special equipment – just go outside and look up.”

It will be visible to about 87 per cent of the world’s population, including those in the Middle East, Asia, Africa, Europe and Australia.

Timeline of the dramatic phases

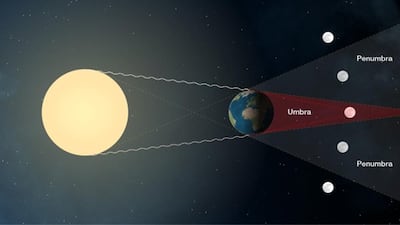

It begins at 7.28pm GST, when the Moon enters the faint outer edge of Earth’s shadow in what is known as the penumbral phase. The change will be faint at first, but by 8.27pm it will look as though a dark bite has been taken out of the Moon.

Totality, when the Moon is covered completely by the Earth’s shadow, will take place at 9.30pm, turning the lunar surface a striking shade of red or copper.

The eclipse reaches its peak at 10.12pm and totality continues until 10.53pm.

From there, the shadow will gradually recede, until the eclipse has ended just before 1am on Monday. The Moon will spend 82 minutes fully eclipsed, making it one of the longest total lunar eclipses in years.

Why it happens

A total lunar eclipse happens when the Sun, Earth and Moon line up perfectly, with the planet casting its shadow across the Moon.

Instead of disappearing, the Moon takes on a dramatic new look because sunlight bends through Earth’s atmosphere, which filters out the blues and lets the red and orange tones shine, giving it the Blood Moon moniker.

Where to watch the eclipse

The eclipse will be visible across all seven emirates, but skywatchers interested in a community experience can observe it with the Dubai Astronomy Group.

It is hosting a public viewing event at the Mohammed bin Rashid Library from 7pm to 11pm, with tickets priced at Dh250 ($68) for adults and Dh200 for children.

There will be telescopes and astronomy-themed activities.

The organisation will also lead a global livestream, in collaboration with observatories and astronomy groups from more than a dozen countries including Spain, Australia, India, Saudi Arabia and Egypt.

The group is also plans to capture an image of the Moon eclipsed over Burj Khalifa.

Long wait for the next one

Those who miss Sunday’s spectacle will have to wait until July 6, 2028, to view another lunar eclipse in the UAE's skies.

That will only be a partial eclipse, with a portion of the Moon darkened by the Earth’s shadow. The next total lunar eclipse in the UAE will be on December 31, 2028 – a New Year’s Eve Blood Moon that will last more than five hours.

Four reasons global stock markets are falling right now

There are many factors worrying investors right now and triggering a rush out of stock markets. Here are four of the biggest:

1. Rising US interest rates

The US Federal Reserve has increased interest rates three times this year in a bid to prevent its buoyant economy from overheating. They now stand at between 2 and 2.25 per cent and markets are pencilling in three more rises next year.

Kim Catechis, manager of the Legg Mason Martin Currie Global Emerging Markets Fund, says US inflation is rising and the Fed will continue to raise rates in 2019. “With inflationary pressures growing, an increasing number of corporates are guiding profitability expectations downwards for 2018 and 2019, citing the negative impact of rising costs.”

At the same time as rates are rising, central bankers in the US and Europe have been ending quantitative easing, bringing the era of cheap money to an end.

2. Stronger dollar

High US rates have driven up the value of the dollar and bond yields, and this is putting pressure on emerging market countries that took advantage of low interest rates to run up trillions in dollar-denominated debt. They have also suffered capital outflows as international investors have switched to the US, driving markets lower. Omar Negyal, portfolio manager of the JP Morgan Global Emerging Markets Income Trust, says this looks like a buying opportunity. “Despite short-term volatility we remain positive about long-term prospects and profitability for emerging markets.”

3. Global trade war

Ritu Vohora, investment director at fund manager M&G, says markets fear that US President Donald Trump’s spat with China will escalate into a full-blown global trade war, with both sides suffering. “The US economy is robust enough to absorb higher input costs now, but this may not be the case as tariffs escalate. However, with a host of factors hitting investor sentiment, this is becoming a stock picker’s market.”

4. Eurozone uncertainty

Europe faces two challenges right now in the shape of Brexit and the new populist government in eurozone member Italy.

Chris Beauchamp, chief market analyst at IG, which has offices in Dubai, says the stand-off between between Rome and Brussels threatens to become much more serious. "As with Brexit, neither side appears willing to step back from the edge, threatening more trouble down the line.”

The European economy may also be slowing, Mr Beauchamp warns. “A four-year low in eurozone manufacturing confidence highlights the fact that producers see a bumpy road ahead, with US-EU trade talks remaining a major question-mark for exporters.”

The%20specs

%3Cp%3E%3Cstrong%3EEngine%3A%3C%2Fstrong%3E%201.8-litre%204-cyl%20turbo%0D%3Cbr%3E%3Cstrong%3EPower%3A%20%3C%2Fstrong%3E190hp%20at%205%2C200rpm%0D%3Cbr%3E%3Cstrong%3ETorque%3A%3C%2Fstrong%3E%20320Nm%20from%201%2C800-5%2C000rpm%0D%3Cbr%3E%3Cstrong%3ETransmission%3A%20%3C%2Fstrong%3ESeven-speed%20dual-clutch%20auto%0D%3Cbr%3E%3Cstrong%3EFuel%20consumption%3A%3C%2Fstrong%3E%206.7L%2F100km%0D%3Cbr%3E%3Cstrong%3EPrice%3A%3C%2Fstrong%3E%20From%20Dh111%2C195%0D%3Cbr%3E%3Cstrong%3EOn%20sale%3A%20%3C%2Fstrong%3ENow%3C%2Fp%3E%0A

How to apply for a drone permit

- Individuals must register on UAE Drone app or website using their UAE Pass

- Add all their personal details, including name, nationality, passport number, Emiratis ID, email and phone number

- Upload the training certificate from a centre accredited by the GCAA

- Submit their request

What are the regulations?

- Fly it within visual line of sight

- Never over populated areas

- Ensure maximum flying height of 400 feet (122 metres) above ground level is not crossed

- Users must avoid flying over restricted areas listed on the UAE Drone app

- Only fly the drone during the day, and never at night

- Should have a live feed of the drone flight

- Drones must weigh 5 kg or less

Thor%3A%20Love%20and%20Thunder%20

%3Cp%3E%3Cstrong%3EDirector%3A%3C%2Fstrong%3E%20Taika%20Waititi%C2%A0%3C%2Fp%3E%0A%3Cp%3E%3Cstrong%3EStars%3A%3C%2Fstrong%3E%20Chris%20Hemsworth%2C%20Natalie%20Portman%2C%20Christian%20Bale%2C%20Russell%20Crowe%2C%20Tessa%20Thompson%2C%20Taika%20Waititi%3C%2Fp%3E%0A%3Cp%3E%3Cstrong%3ERating%3A%3C%2Fstrong%3E%204%2F5%3C%2Fp%3E%0A

UAE currency: the story behind the money in your pockets

Various Artists

Habibi Funk: An Eclectic Selection Of Music From The Arab World (Habibi Funk)

More on Quran memorisation:

More coverage from the Future Forum

Medicus AI

Started: 2016

Founder(s): Dr Baher Al Hakim, Dr Nadine Nehme and Makram Saleh

Based: Vienna, Austria; started in Dubai

Sector: Health Tech

Staff: 119

Funding: €7.7 million (Dh31m)

Our family matters legal consultant

Name: Hassan Mohsen Elhais

Position: legal consultant with Al Rowaad Advocates and Legal Consultants.

Visit Abu Dhabi culinary team's top Emirati restaurants in Abu Dhabi

Yadoo’s House Restaurant & Cafe

For the karak and Yoodo's house platter with includes eggs, balaleet, khamir and chebab bread.

Golden Dallah

For the cappuccino, luqaimat and aseeda.

Al Mrzab Restaurant

For the shrimp murabian and Kuwaiti options including Kuwaiti machboos with kebab and spicy sauce.

Al Derwaza

For the fish hubul, regag bread, biryani and special seafood soup.

Scores

Oman 109-3 in 18.4 overs (Aqib Ilyas 45 not out, Aamir Kaleem 27) beat UAE 108-9 in 20 overs (Usman 27, Mustafa 24, Fayyaz 3-16, Bilal 3-23)

The specs

Engine: 6.2-litre supercharged V8

Power: 712hp at 6,100rpm

Torque: 881Nm at 4,800rpm

Transmission: 8-speed auto

Fuel consumption: 19.6 l/100km

Price: Dh380,000

On sale: now

MATCH INFO

Rugby World Cup (all times UAE)

Third-place play-off: New Zealand v Wales, Friday, 1pm

Final: England v South Africa, Saturday, 1pm

match details

Wales v Hungary

Cardiff City Stadium, kick-off 11.45pm

The biog

Name: Atheja Ali Busaibah

Date of birth: 15 November, 1951

Favourite books: Ihsan Abdel Quddous books, such as “The Sun will Never Set”

Hobbies: Reading and writing poetry

Our legal columnist

Name: Yousef Al Bahar

Advocate at Al Bahar & Associate Advocates and Legal Consultants, established in 1994

Education: Mr Al Bahar was born in 1979 and graduated in 2008 from the Judicial Institute. He took after his father, who was one of the first Emirati lawyers

All or Nothing

Amazon Prime

Four stars

Company%C2%A0profile

%3Cp%3E%3Cstrong%3EDate%20started%3A%20%3C%2Fstrong%3EMay%202022%3Cbr%3E%3Cstrong%3EFounder%3A%20%3C%2Fstrong%3EHusam%20Aboul%20Hosn%3Cbr%3E%3Cstrong%3EBased%3A%20%3C%2Fstrong%3EDIFC%3Cbr%3E%3Cstrong%3ESector%3A%20%3C%2Fstrong%3EFinTech%20%E2%80%94%20Innovation%20Hub%3Cbr%3E%3Cstrong%3EEmployees%3A%20%3C%2Fstrong%3Eeight%3Cbr%3E%3Cstrong%3EStage%3A%20%3C%2Fstrong%3Epre-seed%3Cbr%3E%3Cstrong%3EInvestors%3A%20%3C%2Fstrong%3Epre-seed%20funding%20raised%20from%20family%20and%20friends%20earlier%20this%20year%3C%2Fp%3E%0A

Racecard

6.30pm: Mazrat Al Ruwayah Group Two (PA) US$55,000 (Dirt) 1,600m

7.05pm: Meydan Trophy (TB) $100,000 (Turf) 1,900m

7.40pm: Handicap (TB) $135,000 (D) 1,200m

8.15pm: Balanchine Group Two (TB) $250,000 (T) 1,800m

8.50pm: Handicap (TB) $135,000 (T) 1,000m

9.25pm: Firebreak Stakes Group Three (TB) $200,000 (D) 1,600m

10pm: Handicap (TB) $175,000 (T) 2,410m

The National selections: 6.30pm: RM Lam Tara, 7.05pm: Al Mukhtar Star, 7.40pm: Bochart, 8.15pm: Magic Lily, 8.50pm: Roulston Scar, 9.25pm: Quip, 10pm: Jalmoud

MATCH INFO

Uefa Champions League semi-final, first leg

Bayern Munich v Real Madrid

When: April 25, 10.45pm kick-off (UAE)

Where: Allianz Arena, Munich

Live: BeIN Sports HD

Second leg: May 1, Santiago Bernabeu, Madrid