Nvidia reinforced its dizzying rise to industry and market superstardom with better-than-expected financials in the second quarter, and this bodes well for the broader artificial intelligence industry and stock market.

The artificial intelligence chip leader's stock has nearly doubled year-to-date. Its shares closed 0.46 per cent down at $949.50 on Wednesday, giving the company a market value of $2.34 trillion, placing it right behind Apple and Microsoft.

The California-based company achieved another milestone when its stock hit $1,000 for the first time, as it rose as much as 7 per cent in pre-market trading on Thursday.

This is like “party that is just getting started”, said Gene Munster, a noted tech analyst and managing partner at Deepwater Asset Management.

“The stock will continue to gain momentum in the days and weeks to come,” he said.

tech analyst and managing partner, Deepwater Asset Management

“If we continue to see the type of demand through the buildout of this AI industry … [Nvidia will continue to post] faster than expected growth for longer.”

Nvidia's rise has prompted several of the technology industry's biggest names to make moves to boost their investments in generative artificial intelligence, indicating that the frenzy for the much-hyped sector isn not slowing down any time soon.

Nvidia's latest chip, the Blackwell series, is all but confirmed to be released in the autumn of 2024. It is expected to continue the strength of its predecessor, the Hopper line, further underpinning the company's growth.

The company's reputation has been so high that it was even able to defy the Osborne effect, a phenomenon in which orders for older products are cancelled in favour of announced but yet-to-be-released successors, said Mr Munster, noting the continued strength of Hopper chips.

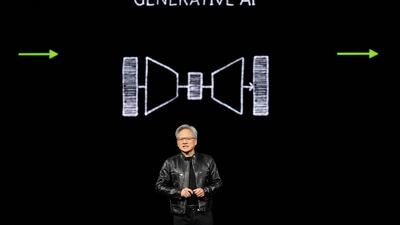

“We will see a lot of Blackwell revenue this year,” Nvidia chief executive Jensen Huang said in a conference call after Wednesday's results.

Customer service

Mr Huang founded Nvidia in 1993 and was focused on gaming, a relatively small industry at the time.

Today, it is leading the AI hardware revolution, and its customers include trillion-dollar behemoths – Amazon, Facebook owner Meta Platforms, Google parent Alphabet and the world's most valuable company, Microsoft.

These companies are also seeking to find their footing in a highly competitive AI market, and Nvidia's help is a much welcome addition to its arsenal, even though they are competitors.

“With estimates suggesting Nvidia holds over 90 per cent of the data centre GPU market, the company's end-to-end AI solutions – encompassing hardware, software, and developer tools – solidify its stronghold,” Vijay Valecha, chief investment officer at Century Financial, told The National.

“Companies buy not just chips, but entire Nvidia-optimised systems.”

To the rescue

Before Nvidia reported earnings, Wall Street settled lower on Wednesday, retreating from record levels this week.

Many investors "[sat] on their hands as the market anxiously anticipate[d] Nvidia’s earnings report”, said Mohamed Hashad, chief market strategist at Dubai-based Noor Capital, noting that the company's results will “have an impact on the mood of the market”. And so they did.

“This is perhaps why we see US futures back in the green this morning,” said Ipek Ozkardeskaya, a senior analyst at Swissquote Bank.

Early on Thursday, well after Nvidia – the last significant company to report earnings this season – had unveiled its results, futures in both the US and Europe were up, with the S&P 500 looking to a 5 per cent rise at the opening bell.

Tech stocks have been very influential on the market. For instance, Apple, after announcing its $110 billion share buyback programme earlier this month, helped Wall Street rally after an uneven trading week.

Nvidia's rise is so meteoric that its stock is now rated as a “strong buy”, according to 39 analysts polled by Nasdaq Analyst Research.

Investors are watchful of high-profile stocks, keeping an eye on their performance and forecast, which can be a factor on how the market would play out.

“The market is still bullish overall, but investors are nevertheless apprehensive as they consider several different aspects of the present economic environment,” Mr Hashad said.