On average, active Snapchat users in Saudi Arabia open the app approximately 50 times each day, according to Hussein Freijeh, vice president and general manager at Snap Mena.

Mr Freijeh said that's slightly higher than the overall GCC average for Snapchat, which sees active users open the app 45 times each day.

Regardless of how you slice it, Snapchat, the social media platform that made it big on the idea of sharing content that vanishes after a certain period of time, is very popular throughout the Middle East – and in particular, the GCC.

Mr Freijeh said the region “has been going through a massive social and economic transformation”.

“Within that transformation, we're seeing the GCC community is really protective of the sense of community, and their relationships with their friends and family,” he said, during an interview with The National's Business Extra podcast at Snap's Dubai office.

California-based Snapchat was founded in 2011 by three Stanford students. Originally called Picaboo, the idea behind the app was the antithesis of everything social media seemed to stand for at the time, content messaged by those who used the app wouldn't be permanent, but rather, would disappear.

That difference, the emphasis on a social media content shelf-life with an expiration date, proved appealing.

In short, Snapchat skyrocketed to popularity, and today has approximately 375 to 450 million daily active users.

Various estimates indicate that at least 75 million of those users live in the Middle East.

“Snapchat’s community in the MENA region continues to grow and the Middle East remains a major market for the app,” read a 2022 social media report from by the University of Oregon professors Damian Radcliffe and Hadil Abuhmaid.

That report, also reflected on Snapchat's particularly strong user base in Saudi Arabia across several demographics.

“Snapchat has proven popular not only with younger audiences in the Kingdom but also with parents,” the report said. “A 2021 study conducted by Kantar and Snap, discovered that 71 per cent of parents in Saudi Arabia are on the app.”

That appeal, according to Mr Freijeh, can be traced back to the original intention of the Snapchat platform.

“It's about a sense of community,” he said. “Snapchat's core use case is that it was created to enhance the relationships between friends and family through visual communication.”

Snap, however, isn't immune to the occasional turbulence that comes with the territory of being a technology company.

Some of its features, particularly those with an emphasis on temporary content, were widely copied by other platforms.

Instagram's introduction of a stories feature in 2016, which featured content that would vanish after 24 hours, was largely seen as an attempt to replicate Snapchat's success.

In that same vein, TikTok also helped sustain and expand upon its own popularity by implementing various augmented reality filters that Snapchat had implemented several years earlier, called AR Lenses.

Both TikTok and Instagram soared past Snapchat in terms of sheer user numbers.

When asked about both competing platforms and the notion that they replicated Snapchat's success, Mr Freijeh had a stoic response.

“When people copy, that's actually a validation that we are on the right track,” he said. “People told us it was crazy [investing in AR], and then years later, everybody else is doing the same thing.”

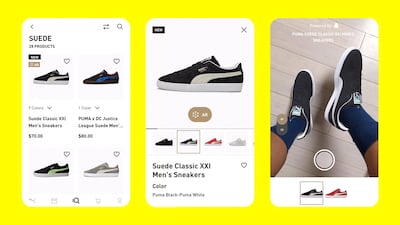

Mr Freijeh said that Snap's early investments in AR have made the company trusted by brands like Versace, Cartier and Tiffany, who use AR on the platform to advertise their products.

“You can try a bracelet on,” he said, describing the AR implementation for the brands. “You just turn the camera on, put it on your wrist and you can see a bracelet from Cartier or Tiffany, and you can see if you like it or want to try something else.”

Those successful implementations of AR with regard to major brands, according to Mr Freijeh, have helped bolster Snapchat's presence in the region.

“Retail, tourism, luxury, auto and entertainment, our direct to consumer approach is massively successful,” he said. “And this, in turn, gets us a lot more interest from brands.”

As artificial intelligence continues to influence just about every technology company, Snap is also making sure it sprinkles in AI to try to keep users engaged.

Using OpenAI's ChatGPT, Snapchat users now have the ability to use something Snap calls the 'My AI' chatbot, to help answer questions while messaging another human.

Snap also recently announced new suite of tools powered by generative AI that allow for developers to create new AR experiences for users at a quicker pace.

The company's efforts have paid off in the most recent quarter with better-than-expected revenues, sales and user growth, but the road hasn't been completely smooth.

Back in February, Snap announced it would be trimming 10 per cent of its workforce, about 500 employees, as it sought to streamline its operations and support growth.

Also in February, the company had to recall its much-hyped camera drone, Pixie, due to a potential fire risk.

Perhaps most pressing, however, is the fact that Snapchat faces a very crowded marketplace of social media platforms and an equally fickle overall social media audience that's been known to come and go to platforms at the drop of a hat.

Mr Freijeh said that the crowded social media marketplace isn't necessarily a concern, however, because Snap doesn't see itself as a social media company.

“That's a misconception,” he said, referring to Snap's relatively new brand campaign, 'Less social media. More Snapchat.'

That brand campaign, Mr Freijeh explained, was now in its second phase, Less likes. More love.

“We innovate and invest in tools and features that bring people together,” he said, expanding upon the campaign.

Soon, he says, Snap will be opening an office in Qatar, in addition to its regional offices in Dubai, Riyadh and Tel Aviv.

The company will also be officially opening a new creative studio in Saudi Arabia later in the year.

“We need to be local and be as close as possible to the local community,” he said.