Nvidia is slated to report its third-quarter earnings on Wednesday. While expectations for another big quarter are not new, the focus may now shift to whether the artificial intelligence chip juggernaut can also maintain its high profits.

Analysts are expecting the California-based company to surpass earnings estimates, with revenue to hit about $33.2 billion, which would be an 84 per cent annual jump, underpinned by a projected doubling of data centre revenue.

Nvidia, the largest stock by market capitalisation in the S&P 500, is also likely to raise its guidance for the fourth quarter. Its stock rallied as much as 5 per cent ahead of Wednesday's earnings report and has nearly tripled so far in 2024.

The company took off amid the generative AI boom started by OpenAI in early 2023, and its ascent rubbed off on other chip shares and the wider stock market.

Whether it will, again, be able to spark another tech rally – which has since cooled down – in the wake of Donald Trump's victory remains to be seen. But the chips seem to be in place.

"Nvidia has consistently delivered positive earnings surprises that have sparked market-wide rallies," Charu Chanana, chief investment strategist of Copenhagen-based Saxo Bank, told The National. "Expectations are understandably high, given its central role in the Al revolution – a structural theme with minimal competition thus far.

"However, for Nvidia to maintain its positive momentum amidst these lofty expectations, continued hyperscaler capex investments and a robust production pipeline for its Blackwell chips will be critical."

Trumping the tech rally cool-down

The increasingly tech-friendly incoming administration of Mr Trump was reflected in technology stocks in the immediate aftermath of his win.

Nvidia's stock gained as much as 6.4 per cent from its November 5 close, though it has since mellowed down and settled to a mere 0.2 per cent gain on Monday – before again jumping about 5 per cent on Tuesday ahead of its earnings report. Google’s parent company Alphabet, Amazon 1.6 and Microsoft 0.8 per cent also logged the same up-and-down trend.

Nvidia's results have historically led to significant share price movement, given its one-day implied volatility of around 9 per cent on the day of its results, and its earnings and outlook would provide important insights into the dynamics of the AI and technology sector, said Vijay Valecha, chief investment officer of Dubai-based Century Financial.

“The company’s results are also expected to influence strategies across the industry, impact market sentiment and guide future tech market trends. Therefore, Nvidia’s earnings play a pivotal role in the resurrection of the broader tech rally that has cooled down since Mr Trump’s win,” Mr Valecha told The National.

It is worth noting, however, that Nvidia is not bulletproof, no matter how hot it is or how slick its presentation is: its stock slumped 2 per cent after its much-hyped Blackwell presentation in March, as investors were somewhat underwhelmed.

That means any disappointing results, no matter how highly unlikely, or a lukewarm reception from investors could further amplify existing market uncertainties, said Bas Kooijman, chief executive of DHF Capital.

“The broader market has experienced declines in major indices, such as the S&P 500 and Nasdaq, driven by inflation concerns and the Federal Reserve’s commentary on interest rates,” he told The National.

“Nvidia’s performance holds significant weight, with a strong earnings report having the potential to reinvigorate investor confidence and provide a catalyst for the tech sector’s recovery.”

Investors are a tough crowd to please: even Nvidia's blowout second-quarter results and solid outlook were not necessarily enough to boost its share price at the time, noted Ipek Ozkardeskaya, a senior analyst at Swissquote Bank.

“Over time, and at the current valuations, investors have become harder to satisfy and increasingly worried about what could go wrong,” she said.

Still, Nvidia would remain the “king of the castle”, so “we simply have to cast our eyes back on the stock and react to what we see from earnings and what Jensen Huang has to say”, Chris Weston, head of research at online broker Pepperstone, told The National.

The prospect of a positive outlook on future sales growth, as the ramp up of Blackwell and other products in the pipeline come to market, suggests the prospects of pleasing the market is elevated, he added.

“Nvidia has the capacity to lift all that swim in its waters,” Mr Weston said.

Blackwell mania

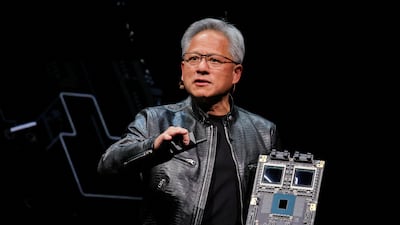

Nvidia introduced its Blackwell chips seeking to solidify its position amid the generative AI boom. Chief executive Jensen Huang at the time touted them as “the most advanced GPU in the world”.

The Blackwell processor is up to five times more powerful than its predecessor, the Hopper, and capable of delivering up to 20 petaflops of performance, compared to Hopper's 4 petaflops. A petaflop is equivalent to one quadrillion operations per second. It can also support trillions of parameters for training large language models, the underlying technology powering generative AI.

Mr Huang also added a foreboding statement, saying the “excitement … is really off the charts” – which came to fruition when, last month, it was reported that Blackwell chips were sold out for the next 12 months. He is also expected to allay concerns over Blackwell production challenges, specifically the overheating issues reported this week.

Still, investors appear to be “very comfortable” with the current dynamic of near-term supply constraints that ease into early 2025 and would evolve into a “sizeable ramp” of Blackwell production from April 2025, Mr Weston said.

“With such significant investment still streaming through from the hyperscalers, the message is clear – AI is the future,” he said.

“While some feel a concern that perhaps these businesses may not achieve the required returns on that investment that justify such huge levels of capex, one has to believe they know what they are doing – and Nvidia will remain the leader of the pack that absorbs this flow of investment for some time to come.”

Caution remains on Blackwell delays, however, which is the “most obvious thing that could go wrong” for the company, Ms Ozkardeskaya said. The company had successfully tamed worries regarding the chips in the last quarter, and may well likely do so again today, she added.

“They will probably play down the delays that could happen for this type of technology releases and focus on the insanity of the demand. If the company could convince investors that they are making progress to meet this insane demand, the reaction will likely be positive,” she said.

In addition, the Blackwell's overheating and design issues are “overblown”, Dylan Patel, chief analyst at semiconductor and AI industry tracker SemiAnalysis, had said on X.