Combatting terrorism and drugs trafficking are the main challenges Iraq and Syria face and the two neighbours need to enhance co-operation on this front, the countries' leaders said on Sunday.

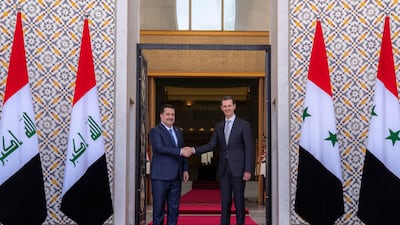

Iraq's Prime Minister Mohammed Shia Al Sudani began an official visit to Damascus to boost relations in the first visit by an Iraqi prime minister since the outbreak of Syria's 12-year conflict.

"Drugs are the most dangerous epidemic we are currently facing, and they are no different from terrorism," Syrian President Bashar Al Assad told a joint press conference.

"They have the ability to destroy a society in the same way terrorism does," Mr Al Assad added.

Mr Al Sudani echoed the Syrian president's statements.

He described drug trafficking and consumption as a "dangerous phenomenon that threatens our communities and infiltrates our youth in a destructive and dangerous manner".

During the discussions, both leaders agreed on "establishing mechanisms for co-ordination, tracking and monitoring as the optimal approach to tackle this dangerous phenomenon," he added.

The didn't elaborate on the discussed mechanisms.

The countries share a 600km desert border that continues to see militant activity years after the defeat of ISIS in late 2017.

In recent years, drug trafficking has also increased, with the trade of the amphetamine-like drug Captagon rising in the region, much of it across the Syria-Iraq border.

The US and the EU claim that Syrian government officials are directly involved in the Captagon trade, and the European bloc has sanctioned several in connection with drug smuggling. The Syrian government has dismissed the allegations as "lies."

Iraq was considered a vital corridor for the smuggling of drugs to neighbouring countries before the 2003 US-led invasion that toppled Saddam Hussein’s regime. Since then, drug use in the country has greatly increased.

A succession of weak governments, widespread corruption among security forces and a lack of co-operation between government agencies are the main reasons behind drugs proliferation.

Captagon has become the second most widely used drug in the country, according to the Health Ministry, overtaking tramadol, heroin and hashish in popularity and lagging behind only crystal methamphetamine, the use of which has skyrocketed in southern Iraq.

Iran is said to be the main source of crystal methamphetamine found in Iraq, while Syria is the source of most of the Captagon, Iraqi officials have said. Lebanon is also a source.

'Important visit'

Since the onset of the turmoil, Iraq has positioned itself as a firm supporter of Mr Al Assad’s regime, unlike other Arab countries that cut ties with Syria.

Iran-backed Shiite militias, ostensibly under Iraqi government control, have also been fighting alongside Syrian regime forces, and maintain a presence in much of the country.

Iraq abstained from the 2011 vote that resulted in Damascus's suspension from the Arab League. For years, Iraqi officials have been lobbying to reinstate Syria.

Mr Al Assad described the visit as "important and its significance stems from the depth of the relationship between the Syrian and Iraqi peoples".

"During the war, Iraq offered the most valuable contribution that a person could offer: blood," he said, adding discussions covered fighting terrorism.

"This visit will not only represent a qualitative leap bit also a practical and genuine step towards strengthening brotherly relations," he said.

"There are direct challenges that we face with the foremost being the challenge of terrorism which we consistently witness and remains active and resilient, seemingly never dying," he added.

Trade relations

The visit follows an invitation from the Syrian president more than a month ago, the Iraqi government spokesman Basim Al Awadi told The National.

The leaders were also set to discuss ways to grow trade relations and the possibility of Syria joining the ambitious $17 billion Development Road initiative, Mr Al Awadi said.

The infrastructure project will connect southern Iraq to the border with Turkey, where it will connect European road and rail networks.

Also on the agenda is the possibility of reopening a Mediterranean oil export pipeline, which could help Iraq diversify its export routes, he added.

Both leaders also discussed ways to combat drought conditions in both countries caused by a reduction in rainfall, climate change and upstream dams built by Turkey on the Tigris and Euphrates.

"We need to co-operate to get our fair share of water," Mr Al Sudani said.

In early June, Syrian Foreign Minister Faisal Mekdad visited Baghdad and appealed for humanitarian support in the wake of a simmering, decade-long conflict and a devastating earthquake in February.

The visit comes more than two months after the Arab League agreed to end Syria's suspension from the 22-member bloc.

The suspension was a response to Syrian President Bashar Al Assad’s repression of pro-democracy protests in 2011, which sparked further conflict.

COMPANY%20PROFILE

%3Cp%3E%3Cstrong%3ECompany%20name%3A%3C%2Fstrong%3E%20Alaan%3Cbr%3E%3Cstrong%3EStarted%3A%3C%2Fstrong%3E%202021%3Cbr%3E%3Cstrong%3EBased%3A%3C%2Fstrong%3E%20Dubai%3Cbr%3E%3Cstrong%3EFounders%3A%3C%2Fstrong%3E%20Parthi%20Duraisamy%20and%20Karun%20Kurien%3Cbr%3E%3Cstrong%3ESector%3A%3C%2Fstrong%3E%20FinTech%3Cbr%3E%3Cstrong%3EInvestment%20stage%3A%3C%2Fstrong%3E%20%247%20million%20raised%20in%20total%20%E2%80%94%20%242.5%20million%20in%20a%20seed%20round%20and%20%244.5%20million%20in%20a%20pre-series%20A%20round%3Cbr%3E%3Cbr%3E%3C%2Fp%3E%0A

FIXTURES (all times UAE)

Sunday

Brescia v Lazio (3.30pm)

SPAL v Verona (6pm)

Genoa v Sassuolo (9pm)

AS Roma v Torino (11.45pm)

Monday

Bologna v Fiorentina (3.30pm)

AC Milan v Sampdoria (6pm)

Juventus v Cagliari (6pm)

Atalanta v Parma (6pm)

Lecce v Udinese (9pm)

Napoli v Inter Milan (11.45pm)

'Saand Ki Aankh'

Produced by: Reliance Entertainment with Chalk and Cheese Films

Director: Tushar Hiranandani

Cast: Taapsee Pannu, Bhumi Pednekar, Prakash Jha, Vineet Singh

Rating: 3.5/5 stars

Mercer, the investment consulting arm of US services company Marsh & McLennan, expects its wealth division to at least double its assets under management (AUM) in the Middle East as wealth in the region continues to grow despite economic headwinds, a company official said.

Mercer Wealth, which globally has $160 billion in AUM, plans to boost its AUM in the region to $2-$3bn in the next 2-3 years from the present $1bn, said Yasir AbuShaban, a Dubai-based principal with Mercer Wealth.

“Within the next two to three years, we are looking at reaching $2 to $3 billion as a conservative estimate and we do see an opportunity to do so,” said Mr AbuShaban.

Mercer does not directly make investments, but allocates clients’ money they have discretion to, to professional asset managers. They also provide advice to clients.

“We have buying power. We can negotiate on their (client’s) behalf with asset managers to provide them lower fees than they otherwise would have to get on their own,” he added.

Mercer Wealth’s clients include sovereign wealth funds, family offices, and insurance companies among others.

From its office in Dubai, Mercer also looks after Africa, India and Turkey, where they also see opportunity for growth.

Wealth creation in Middle East and Africa (MEA) grew 8.5 per cent to $8.1 trillion last year from $7.5tn in 2015, higher than last year’s global average of 6 per cent and the second-highest growth in a region after Asia-Pacific which grew 9.9 per cent, according to consultancy Boston Consulting Group (BCG). In the region, where wealth grew just 1.9 per cent in 2015 compared with 2014, a pickup in oil prices has helped in wealth generation.

BCG is forecasting MEA wealth will rise to $12tn by 2021, growing at an annual average of 8 per cent.

Drivers of wealth generation in the region will be split evenly between new wealth creation and growth of performance of existing assets, according to BCG.

Another general trend in the region is clients’ looking for a comprehensive approach to investing, according to Mr AbuShaban.

“Institutional investors or some of the families are seeing a slowdown in the available capital they have to invest and in that sense they are looking at optimizing the way they manage their portfolios and making sure they are not investing haphazardly and different parts of their investment are working together,” said Mr AbuShaban.

Some clients also have a higher appetite for risk, given the low interest-rate environment that does not provide enough yield for some institutional investors. These clients are keen to invest in illiquid assets, such as private equity and infrastructure.

“What we have seen is a desire for higher returns in what has been a low-return environment specifically in various fixed income or bonds,” he said.

“In this environment, we have seen a de facto increase in the risk that clients are taking in things like illiquid investments, private equity investments, infrastructure and private debt, those kind of investments were higher illiquidity results in incrementally higher returns.”

The Abu Dhabi Investment Authority, one of the largest sovereign wealth funds, said in its 2016 report that has gradually increased its exposure in direct private equity and private credit transactions, mainly in Asian markets and especially in China and India. The authority’s private equity department focused on structured equities owing to “their defensive characteristics.”

Classification of skills

A worker is categorised as skilled by the MOHRE based on nine levels given in the International Standard Classification of Occupations (ISCO) issued by the International Labour Organisation.

A skilled worker would be someone at a professional level (levels 1 – 5) which includes managers, professionals, technicians and associate professionals, clerical support workers, and service and sales workers.

The worker must also have an attested educational certificate higher than secondary or an equivalent certification, and earn a monthly salary of at least Dh4,000.

What the law says

Micro-retirement is not a recognised concept or employment status under Federal Decree Law No. 33 of 2021 on the Regulation of Labour Relations (as amended) (UAE Labour Law). As such, it reflects a voluntary work-life balance practice, rather than a recognised legal employment category, according to Dilini Loku, senior associate for law firm Gateley Middle East.

“Some companies may offer formal sabbatical policies or career break programmes; however, beyond such arrangements, there is no automatic right or statutory entitlement to extended breaks,” she explains.

“Any leave taken beyond statutory entitlements, such as annual leave, is typically regarded as unpaid leave in accordance with Article 33 of the UAE Labour Law. While employees may legally take unpaid leave, such requests are subject to the employer’s discretion and require approval.”

If an employee resigns to pursue micro-retirement, the employment contract is terminated, and the employer is under no legal obligation to rehire the employee in the future unless specific contractual agreements are in place (such as return-to-work arrangements), which are generally uncommon, Ms Loku adds.

Sholto Byrnes on Myanmar politics

Desert Warrior

Starring: Anthony Mackie, Aiysha Hart, Ben Kingsley

Director: Rupert Wyatt

Rating: 3/5