Two explosive drones were destroyed over a base housing US troops, the Iraqi army said on Sunday.

The attack took place a month after the base was targeted by another armed drone.

The US' counter-rocket, artillery and mortar (C-Ram) defence system was used against the drones above the Ain Al Asad base, located in the Iraqi Western Desert, the Iraqi army said.

The system uses an infrared sensor to detect the drones, before firing a torrent of 4,500 bullets per minute to shoot them down.

Several hours earlier, a rocket was shot down over Baghdad airport, "without causing casualties or damage", said Col Wayne Marotto, a spokesman for the US-led military coalition in Iraq.

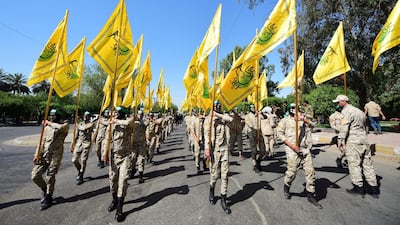

The US blames Iran-linked Iraqi factions for rocket attacks against Iraqi installations housing its personnel.

Since the start of this year, there have been 39 attacks against US interests in Iraq.

The vast majority have been bombs against logistics convoys, while 14 were rocket attacks, some of them claimed by pro-Iran factions, who aim to pressure Washington into withdrawing all their troops.

The use of drones against US interests by these factions is a recent tactic, although the US military has accused pro-Iran Iraqi groups of helping Yemen's Houthi rebels carry out attacks using such devices against Saudi interests.

_________________