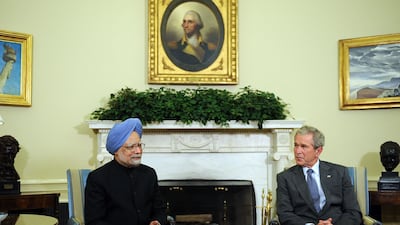

Former Indian prime minister Manmohan Singh, whose policy of liberalisation launched his country on the path to becoming a global economic power, died on Thursday at the age of 92 in a hospital in Delhi

Prime Minister Narendra Modi, who succeeded Mr Singh in 2014, led the tributes for the late leader. "India mourns the loss of one of its most distinguished leaders, Dr Manmohan Singh Ji," Mr Modi wrote on X, using a term of respect.

"Rising from humble origins, he rose to become a respected economist. He served in various government positions as well, including as finance minister, leaving a strong imprint on our economic policy over the years. As our prime minister, he made extensive efforts to improve people’s lives."

The All India Institute of Medical Sciences said Mr Singh was admitted to the hospital on Thursday evening after losing consciousness at his home and died about two hours later, at 9.51pm.

India's finance minister from 1991 to 1996, Mr Singh served two terms as prime minister from 2004 to 2014. He is credited with having overseen an economic boom in Asia's fourth-largest economy in his first term, although slowing growth in later years marred his second stint.

Born in 1932 in the mud-house village of Gah in what is now Pakistan, he studied economics to find a way to eradicate poverty in the vast nation and had never held elected office before he became prime minister.

He won scholarships to attend Cambridge, where he obtained a first in economics, and Oxford, where he completed his PhD.

Mr Singh held a number of senior civil posts, served as a central bank governor and also worked in global agencies such as the UN.

He was appointed in 1991 by then prime minister PV Narasimha Rao of the Congress party to pull India back from the worst financial crisis in its modern history

In his first term, Mr Singh steered the economy through a period of 9 per cent growth, lending the country the international influence it had long sought. His government shared the country's newfound wealth through welfare schemes such as a jobs programme for the rural poor.

He also sealed a landmark nuclear deal with the US that he said would help India meet its growing energy needs.

His efforts to further open up the economy were frequently frustrated by political wrangling in his own party and demands made by coalition partners.

Known for his simple lifestyle and with a reputation for honesty, Mr Singh was not personally regarded as corrupt. But he came under attack for failing to crack down on members of his government as a series of scandals erupted in his second term, leading to mass protests.

He announced his intention to retire after the 2014 general election, with Congress leader Sonia Gandhi's son Rahul set to take his place if the party won.

But Congress crashed to its worst-ever result at that time as Mr Modi's Bharatiya Janata Party won a landslide.

With reporting from agencies.

ARGYLLE

%3Cp%3EDirector%3A%20Matthew%20Vaughn%3C%2Fp%3E%0A%3Cp%3EStarring%3A%20Bryce%20Dallas%20Howard%2C%20Sam%20Rockwell%2C%20John%20Cena%3C%2Fp%3E%0A%3Cp%3ERating%3A%203%2F5%3C%2Fp%3E%0A

ENGLAND SQUAD

Eoin Morgan (captain), Moeen Ali, Jonny Bairstow, Sam Billings, Jos Buttler, Tom Curran, Alex Hales, Liam Plunkett, Adil Rashid, Joe Root, Jason Roy, Ben Stokes, David Willey, Chris Woakes, Mark Wood

'The Batman'

Stars:Robert Pattinson

Director:Matt Reeves

Rating: 5/5

UPI facts

More than 2.2 million Indian tourists arrived in UAE in 2023

More than 3.5 million Indians reside in UAE

Indian tourists can make purchases in UAE using rupee accounts in India through QR-code-based UPI real-time payment systems

Indian residents in UAE can use their non-resident NRO and NRE accounts held in Indian banks linked to a UAE mobile number for UPI transactions

All%20The%20Light%20We%20Cannot%20See%20

%3Cp%3E%3Cstrong%3ECreator%3A%20%3C%2Fstrong%3ESteven%20Knight%3C%2Fp%3E%0A%3Cp%3E%3Cstrong%3EStars%3A%C2%A0%3C%2Fstrong%3EMark%20Ruffalo%2C%20Hugh%20Laurie%2C%20Aria%20Mia%20Loberti%3C%2Fp%3E%0A%3Cp%3E%3Cstrong%3ERating%3A%20%3C%2Fstrong%3E1%2F5%C2%A0%3C%2Fp%3E%0A

The specs

- Engine: 3.9-litre twin-turbo V8

- Power: 640hp

- Torque: 760nm

- On sale: 2026

- Price: Not announced yet

Springsteen: Deliver Me from Nowhere

Director: Scott Cooper

Starring: Jeremy Allen White, Odessa Young, Jeremy Strong

Rating: 4/5

EMERGENCY PHONE NUMBERS

Estijaba – 8001717 – number to call to request coronavirus testing

Ministry of Health and Prevention – 80011111

Dubai Health Authority – 800342 – The number to book a free video or voice consultation with a doctor or connect to a local health centre

Emirates airline – 600555555

Etihad Airways – 600555666

Ambulance – 998

Knowledge and Human Development Authority – 8005432 ext. 4 for Covid-19 queries

UAE%20v%20West%20Indies

%3Cp%3EFirst%20ODI%20-%20Sunday%2C%20June%204%20%0D%3Cbr%3ESecond%20ODI%20-%20Tuesday%2C%20June%206%20%0D%3Cbr%3EThird%20ODI%20-%20Friday%2C%20June%209%26nbsp%3B%3C%2Fp%3E%0A%3Cp%3EMatches%20at%20Sharjah%20Cricket%20Stadium.%20All%20games%20start%20at%204.30pm%0D%3Cbr%3E%0D%3Cbr%3E%3Cstrong%3EUAE%20squad%3C%2Fstrong%3E%0D%3Cbr%3EMuhammad%20Waseem%20(captain)%2C%20Aayan%20Khan%2C%20Adithya%20Shetty%2C%20Ali%20Naseer%2C%20Ansh%20Tandon%2C%20Aryansh%20Sharma%2C%20Asif%20Khan%2C%20Basil%20Hameed%2C%20Ethan%20D%E2%80%99Souza%2C%20Fahad%20Nawaz%2C%20Jonathan%20Figy%2C%20Junaid%20Siddique%2C%20Karthik%20Meiyappan%2C%20Lovepreet%20Singh%2C%20Matiullah%2C%20Mohammed%20Faraazuddin%2C%20Muhammad%20Jawadullah%2C%20Rameez%20Shahzad%2C%20Rohan%20Mustafa%2C%20Sanchit%20Sharma%2C%20Vriitya%20Aravind%2C%20Zahoor%20Khan%0D%3C%2Fp%3E%0A

Company%20profile

%3Cp%3E%3Cstrong%3EName%3A%3C%2Fstrong%3E%20JustClean%3Cbr%3E%3Cbr%3E%3Cstrong%3EBased%3A%20%3C%2Fstrong%3EDubai%20with%20offices%20in%20other%20GCC%20countries%3Cbr%3E%3Cbr%3E%3Cstrong%3ELaunch%20year%3A%3C%2Fstrong%3E%202016%3Cbr%3E%3Cbr%3E%3Cstrong%3ENumber%20of%20employees%3A%3C%2Fstrong%3E%20160%2B%20with%2021%20nationalities%20in%20eight%20cities%3Cbr%3E%3Cstrong%3E%3Cbr%3ESector%3A%3C%2Fstrong%3E%20online%20laundry%20and%20cleaning%20services%3Cbr%3E%3Cbr%3E%3Cstrong%3EFunding%3A%20%3C%2Fstrong%3E%2430m%20from%20Kuwait-based%20Faith%20Capital%20Holding%20and%20Gulf%20Investment%20Corporation%3C%2Fp%3E%0A

Turkish Ladies

Various artists, Sony Music Turkey

Tell-tale signs of burnout

- loss of confidence and appetite

- irritability and emotional outbursts

- sadness

- persistent physical ailments such as headaches, frequent infections and fatigue

- substance abuse, such as smoking or drinking more

- impaired judgement

- excessive and continuous worrying

- irregular sleep patterns

Tips to help overcome burnout

Acknowledge how you are feeling by listening to your warning signs. Set boundaries and learn to say ‘no’

Do activities that you want to do as well as things you have to do

Undertake at least 30 minutes of exercise per day. It releases an abundance of feel-good hormones

Find your form of relaxation and make time for it each day e.g. soothing music, reading or mindful meditation

Sleep and wake at the same time every day, even if your sleep pattern was disrupted. Without enough sleep condition such as stress, anxiety and depression can thrive.

Full Party in the Park line-up

2pm – Andreah

3pm – Supernovas

4.30pm – The Boxtones

5.30pm – Lighthouse Family

7pm – Step On DJs

8pm – Richard Ashcroft

9.30pm – Chris Wright

10pm – Fatboy Slim

11pm – Hollaphonic

Desert Warrior

Starring: Anthony Mackie, Aiysha Hart, Ben Kingsley

Director: Rupert Wyatt

Rating: 3/5

How to watch Ireland v Pakistan in UAE

When: The one-off Test starts on Friday, May 11

What time: Each day’s play is scheduled to start at 2pm UAE time.

TV: The match will be broadcast on OSN Sports Cricket HD. Subscribers to the channel can also stream the action live on OSN Play.

Godzilla%20x%20Kong%3A%20The%20New%20Empire

%3Cp%3E%3Cstrong%3EDirector%3A%20%3C%2Fstrong%3EAdam%20Wingard%3C%2Fp%3E%0A%3Cp%3E%3Cstrong%3EStarring%3A%20%3C%2Fstrong%3EBrian%20Tyree%20Henry%2C%20Rebecca%20Hall%2C%20Dan%20Stevens%3C%2Fp%3E%0A%3Cp%3E%3Cstrong%3ERating%3A%3C%2Fstrong%3E%204%2F5%3C%2Fp%3E%0A

UAE currency: the story behind the money in your pockets

The Buckingham Murders

Starring: Kareena Kapoor Khan, Ash Tandon, Prabhleen Sandhu

Director: Hansal Mehta

Rating: 4 / 5

Friday's schedule at the Etihad Airways Abu Dhabi Grand Prix

GP3 qualifying, 10:15am

Formula 2, practice 11:30am

Formula 1, first practice, 1pm

GP3 qualifying session, 3.10pm

Formula 1 second practice, 5pm

Formula 2 qualifying, 7pm

AIDA%20RETURNS

%3Cp%3E%3Cstrong%3EDirector%3A%20%3C%2Fstrong%3ECarol%20Mansour%3C%2Fp%3E%0A%3Cp%3E%3Cstrong%3EStarring%3A%20%3C%2Fstrong%3EAida%20Abboud%2C%20Carol%20Mansour%3C%2Fp%3E%0A%3Cp%3E%3Cstrong%3ERating%3A%3C%2Fstrong%3E%203.5.%2F5%3C%2Fp%3E%0A

Trolls World Tour

Directed by: Walt Dohrn, David Smith

Starring: Anna Kendrick, Justin Timberlake

Rating: 4 stars

What can you do?

Document everything immediately; including dates, times, locations and witnesses

Seek professional advice from a legal expert

You can report an incident to HR or an immediate supervisor

You can use the Ministry of Human Resources and Emiratisation’s dedicated hotline

In criminal cases, you can contact the police for additional support

What vitamins do we know are beneficial for living in the UAE

Vitamin D: Highly relevant in the UAE due to limited sun exposure; supports bone health, immunity and mood.

Vitamin B12: Important for nerve health and energy production, especially for vegetarians, vegans and individuals with absorption issues.

Iron: Useful only when deficiency or anaemia is confirmed; helps reduce fatigue and support immunity.

Omega-3 (EPA/DHA): Supports heart health and reduces inflammation, especially for those who consume little fish.

UK’s AI plan

- AI ambassadors such as MIT economist Simon Johnson, Monzo cofounder Tom Blomfield and Google DeepMind’s Raia Hadsell

- £10bn AI growth zone in South Wales to create 5,000 jobs

- £100m of government support for startups building AI hardware products

- £250m to train new AI models

SPECS

%3Cp%3E%3Cstrong%3EEngine%3A%20%3C%2Fstrong%3E2-litre%204-cylinder%20petrol%20(V%20Class)%3B%20electric%20motor%20with%2060kW%20or%2090kW%20powerpack%20(EQV)%0D%3Cbr%3E%3Cstrong%3EPower%3A%3C%2Fstrong%3E%20233hp%20(V%20Class%2C%20best%20option)%3B%20204hp%20(EQV%2C%20best%20option)%0D%3Cbr%3E%3Cstrong%3ETorque%3A%3C%2Fstrong%3E%20350Nm%20(V%20Class%2C%20best%20option)%3B%20TBA%20(EQV)%0D%3Cbr%3E%3Cstrong%3EOn%20sale%3A%20%3C%2Fstrong%3EMid-2024%0D%3Cbr%3E%3Cstrong%3EPrice%3A%20%3C%2Fstrong%3ETBA%0D%3C%2Fp%3E%0A

BRAZIL SQUAD

Alisson (Liverpool), Daniel Fuzato (Roma), Ederson (Man City); Alex Sandro (Juventus), Danilo (Juventus), Eder Militao (Real Madrid), Emerson (Real Betis), Felipe (Atletico Madrid), Marquinhos (PSG), Renan Lodi (Atletico Madrid), Thiago Silva (PSG); Arthur (Barcelona), Casemiro (Real Madrid), Douglas Luiz (Aston Villa), Fabinho (Liverpool), Lucas Paqueta (AC Milan), Philippe Coutinho (Bayern Munich); David Neres (Ajax), Gabriel Jesus (Man City), Richarlison (Everton), Roberto Firmino (Liverpool), Rodrygo (Real Madrid), Willian (Chelsea).

What went into the film

25 visual effects (VFX) studios

2,150 VFX shots in a film with 2,500 shots

1,000 VFX artists

3,000 technicians

10 Concept artists, 25 3D designers

New sound technology, named 4D SRL

Cricket World Cup League Two

Teams

Oman, UAE, Namibia

Al Amerat, Muscat

Results

Oman beat UAE by five wickets

UAE beat Namibia by eight runs

Namibia beat Oman by 52 runs

UAE beat Namibia by eight wickets

Fixtures

Saturday January 11 - UAE v Oman

Sunday January 12 – Oman v Namibia

Recent winners

2002 Giselle Khoury (Colombia)

2004 Nathalie Nasralla (France)

2005 Catherine Abboud (Oceania)

2007 Grace Bijjani (Mexico)

2008 Carina El-Keddissi (Brazil)

2009 Sara Mansour (Brazil)

2010 Daniella Rahme (Australia)

2011 Maria Farah (Canada)

2012 Cynthia Moukarzel (Kuwait)

2013 Layla Yarak (Australia)

2014 Lia Saad (UAE)

2015 Cynthia Farah (Australia)

2016 Yosmely Massaad (Venezuela)

2017 Dima Safi (Ivory Coast)

2018 Rachel Younan (Australia)

Classification from Tour de France after Stage 17

1. Chris Froome (Britain / Team Sky) 73:27:26"

2. Rigoberto Uran (Colombia / Cannondale-Drapac) 27"

3. Romain Bardet (France / AG2R La Mondiale)

4. Fabio Aru (Italy / Astana Pro Team) 53"

5. Mikel Landa (Spain / Team Sky) 1:24"

A timeline of the Historical Dictionary of the Arabic Language

- 2018: Formal work begins

- November 2021: First 17 volumes launched

- November 2022: Additional 19 volumes released

- October 2023: Another 31 volumes released

- November 2024: All 127 volumes completed

World record transfers

1. Kylian Mbappe - to Real Madrid in 2017/18 - €180 million (Dh770.4m - if a deal goes through)

2. Paul Pogba - to Manchester United in 2016/17 - €105m

3. Gareth Bale - to Real Madrid in 2013/14 - €101m

4. Cristiano Ronaldo - to Real Madrid in 2009/10 - €94m

5. Gonzalo Higuain - to Juventus in 2016/17 - €90m

6. Neymar - to Barcelona in 2013/14 - €88.2m

7. Romelu Lukaku - to Manchester United in 2017/18 - €84.7m

8. Luis Suarez - to Barcelona in 2014/15 - €81.72m

9. Angel di Maria - to Manchester United in 2014/15 - €75m

10. James Rodriguez - to Real Madrid in 2014/15 - €75m

The specs: 2018 Volkswagen Teramont

Price, base / as tested Dh137,000 / Dh189,950

Engine 3.6-litre V6

Gearbox Eight-speed automatic

Power 280hp @ 6,200rpm

Torque 360Nm @ 2,750rpm

Fuel economy, combined 11.7L / 100km

Name: Peter Dicce

Title: Assistant dean of students and director of athletics

Favourite sport: soccer

Favourite team: Bayern Munich

Favourite player: Franz Beckenbauer

Favourite activity in Abu Dhabi: scuba diving in the Northern Emirates

Skoda Superb Specs

Engine: 2-litre TSI petrol

Power: 190hp

Torque: 320Nm

Price: From Dh147,000

Available: Now

More from Aya Iskandarani

Results:

6.30pm: Handicap | US$135,000 (Dirt) | 1,400 metres

Winner: Rodaini, Connor Beasley (jockey), Ahmad bin Harmash (trainer)

7.05pm: Handicap | $135,000 (Turf) | 1,200m

Winner: Ekhtiyaar, Jim Crowley, Doug Watson

7.40pm: Dubai Millennium Stakes | Group 3 | $200,000 (T) | 2,000m

Winner: Spotify, James Doyle, Charlie Appleby

8.15pm: UAE Oakes | Group 3 | $250,000 (D) | 1,900m

Winner: Divine Image, William Buick, Charlie Appleby

8.50pm: Zabeel Mile | Group 2 | $250,000 (T) | 1,600m

Winner: Mythical Image, William Buick, Charlie Appleby

9.20pm: Handicap | $135,000 (T) | 1,600m

Winner: Major Partnership, Kevin Stott, Saeed bin Suroor

GRAN%20TURISMO

%3Cp%3E%3Cstrong%3EDirector%3A%3C%2Fstrong%3E%20Neill%20Blomkamp%3C%2Fp%3E%0A%3Cp%3E%3Cstrong%3EStars%3A%3C%2Fstrong%3E%20David%20Harbour%2C%20Orlando%20Bloom%2C%20Archie%20Madekwe%2C%20Darren%20Barnet%3C%2Fp%3E%0A%3Cp%3E%3Cstrong%3ERating%3A%3C%2Fstrong%3E%203%2F5%3C%2Fp%3E%0A