Pupils across the UAE were celebrating their A-level results on Thursday, as the number of top grades awarded hit their highest level outside of the Covid-19 pandemic.

Graduates told The National that they were now planning to head to elite destinations including University College London, Edinburgh, Toronto and Paris's renowned Gobelins animation school.

Leading school provider Gems Education had a record 1,999 pupils sitting 5,379 A-levels across 22 schools in the UAE and Qatar.

This year, 32 per cent of entries were awarded A* – A, up from 26 per cent last year. The proportion of top A* grades also increased to 11 per cent.

Lisa Crausby, chief education officer for the group, said the results were “just the beginning”.

Standout performances included Gems Wellington Academy – Silicon Oasis, which posted an 18-point rise in A*-A grades, and Gems Founders School – Al Mishear, where A*-B results jumped by 27 points.

More than a quarter (28.3 per cent) of UK pupils were awarded an A or A* grade, up by 0.5 percentage points on last year.

Resilience beyond grades

This time last year, Pranaw Lalwani was ready to throw in the towel.

He told The National that anxiety over grades had affected his performance. “I got to a point at the end-of-year 12, I just wanted to walk out,” he said.

After sitting down with his parents and teachers at Jumeirah College Dubai, he decided to persevere and brought his grades up to gain a place at the University of Madrid.

Beyond the grades, he said he had learnt a critical lesson in resilience.

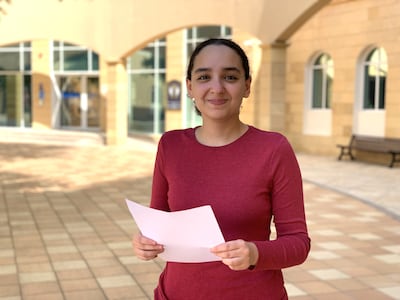

The National joined Pranaw and his classmates at the GEMs school, emotion filled the main reception as students collected white envelopes with their grades ready to be opened at the stroke of 11am.

The parents of Rayyaan Rabbari were elated at his results which have secured him a place studying engineering at University College London.

“I haven't seen him in month,” Rabbi, Rayyaan's mother told The National. Food is delivered to his door as he was so focused on the exams.

Schools across the UAE took to social media to celebrate their results. Cranleigh Abu Dhabi posted that 52 per cent of its students achieved A*-A grades. Repton Abu Dhabi shared that 72 per cent of pupils had obtained A*-B grades.

Exactly half of the A-Level pupils at The British School Al Khubairat in Abu Dhabi achieved A*-A grades. Nord Anglia International School Dubai, Al Barsha, posted on its Instagram account that 100 per cent of pupils had passed their exams, with 38 per cent obtaining A*-A grades.

Brighton College Dubai also celebrated its strongest results yet, with A* grades surging to 28 per cent – almost double last year's 15 per cent. More than half of all grades were at A*-A and 80 per cent at A*-B. Several pupils, including Arvand Zare, Shaurya Kumar and Vibha Kumar achieved the coveted three A* grades.

Vibha told The National that while she was “still in shock”, at the outstanding results, on reflection it was the school environment that made the biggest difference, with the smaller class sizes at Brighton College allowing for more one-on-one time with teaching staff.

“Previously I was in a pretty big school where the year group size was about 300-400 people,” she said. “My classes at Brighton ranged from about five to 13 people.”

Simon Crane, headmaster at Brighton College, hailed the achievement as “among the best in the UAE”, crediting the school's culture of striving for excellence.

Hannah Aly, a pupil at Brighton College Abu Dhabi, received a much-coveted score of four A* grades.

She said the key to success comes from planning to study early, as “that way it’ll be less stressful once exams actually come around”.

Eloi Roberts, an A-level pupil at Brighton College Al Ain, has his heart on a career in architecture. But for now he has a big decision to make, considering a placing in the UK, or at home in the Emirates at UAE University as the built environment industry is moving at a rapid pace.

Elsewhere, at Repton Abu Dhabi, 43 per cent of all A-Level entries were awarded A* to A grades and 72 per cent of all entries at A* to B. At sister school, Repton Dubai 31 per cent of entries received A*to A grades, and 62 per cent of grades awarded A* to B.

Dubai British School Emirates Hills also posted its best A-level results, with the school's principal highlighting the “determination, resilience and commitment” of pupils.

ENGLAND SQUAD

Goalkeepers: Jack Butland, Jordan Pickford, Nick Pope

Defenders: John Stones, Harry Maguire, Phil Jones, Kyle Walker, Kieran Trippier, Gary Cahill, Ashley Young, Danny Rose, Trent Alexander-Arnold

Midfielders: Eric Dier, Jordan Henderson, Dele Alli, Jesse Lingard, Raheem Sterling, Ruben Loftus-Cheek, Fabian Delph

Forwards: Harry Kane, Jamie Vardy, Marcus Rashford, Danny Welbeck

Mercer, the investment consulting arm of US services company Marsh & McLennan, expects its wealth division to at least double its assets under management (AUM) in the Middle East as wealth in the region continues to grow despite economic headwinds, a company official said.

Mercer Wealth, which globally has $160 billion in AUM, plans to boost its AUM in the region to $2-$3bn in the next 2-3 years from the present $1bn, said Yasir AbuShaban, a Dubai-based principal with Mercer Wealth.

“Within the next two to three years, we are looking at reaching $2 to $3 billion as a conservative estimate and we do see an opportunity to do so,” said Mr AbuShaban.

Mercer does not directly make investments, but allocates clients’ money they have discretion to, to professional asset managers. They also provide advice to clients.

“We have buying power. We can negotiate on their (client’s) behalf with asset managers to provide them lower fees than they otherwise would have to get on their own,” he added.

Mercer Wealth’s clients include sovereign wealth funds, family offices, and insurance companies among others.

From its office in Dubai, Mercer also looks after Africa, India and Turkey, where they also see opportunity for growth.

Wealth creation in Middle East and Africa (MEA) grew 8.5 per cent to $8.1 trillion last year from $7.5tn in 2015, higher than last year’s global average of 6 per cent and the second-highest growth in a region after Asia-Pacific which grew 9.9 per cent, according to consultancy Boston Consulting Group (BCG). In the region, where wealth grew just 1.9 per cent in 2015 compared with 2014, a pickup in oil prices has helped in wealth generation.

BCG is forecasting MEA wealth will rise to $12tn by 2021, growing at an annual average of 8 per cent.

Drivers of wealth generation in the region will be split evenly between new wealth creation and growth of performance of existing assets, according to BCG.

Another general trend in the region is clients’ looking for a comprehensive approach to investing, according to Mr AbuShaban.

“Institutional investors or some of the families are seeing a slowdown in the available capital they have to invest and in that sense they are looking at optimizing the way they manage their portfolios and making sure they are not investing haphazardly and different parts of their investment are working together,” said Mr AbuShaban.

Some clients also have a higher appetite for risk, given the low interest-rate environment that does not provide enough yield for some institutional investors. These clients are keen to invest in illiquid assets, such as private equity and infrastructure.

“What we have seen is a desire for higher returns in what has been a low-return environment specifically in various fixed income or bonds,” he said.

“In this environment, we have seen a de facto increase in the risk that clients are taking in things like illiquid investments, private equity investments, infrastructure and private debt, those kind of investments were higher illiquidity results in incrementally higher returns.”

The Abu Dhabi Investment Authority, one of the largest sovereign wealth funds, said in its 2016 report that has gradually increased its exposure in direct private equity and private credit transactions, mainly in Asian markets and especially in China and India. The authority’s private equity department focused on structured equities owing to “their defensive characteristics.”

Syria squad

Goalkeepers: Ibrahim Alma, Mahmoud Al Youssef, Ahmad Madania.

Defenders: Ahmad Al Salih, Moayad Ajan, Jehad Al Baour, Omar Midani, Amro Jenyat, Hussein Jwayed, Nadim Sabagh, Abdul Malek Anezan.

Midfielders: Mahmoud Al Mawas, Mohammed Osman, Osama Omari, Tamer Haj Mohamad, Ahmad Ashkar, Youssef Kalfa, Zaher Midani, Khaled Al Mobayed, Fahd Youssef.

Forwards: Omar Khribin, Omar Al Somah, Mardik Mardikian.

Saturday's results

Brighton 1-1 Leicester City

Everton 1-0 Cardiff City

Manchester United 0-0 Crystal Palace

Watford 0-3 Liverpool

West Ham United 0-4 Manchester City

Overview

Cricket World Cup League Two: Nepal, Oman, United States tri-series, Tribhuvan University, Kathmandu

Fixtures

Wednesday February 5, Oman v Nepal

Thursday, February 6, Oman v United States

Saturday, February 8, United States v Nepal

Sunday, February 9, Oman v Nepal

Tuesday, February 11, Oman v United States

Wednesday, February 12, United States v Nepal

How to protect yourself when air quality drops

Install an air filter in your home.

Close your windows and turn on the AC.

Shower or bath after being outside.

Wear a face mask.

Stay indoors when conditions are particularly poor.

If driving, turn your engine off when stationary.

Company%C2%A0profile

%3Cp%3E%3Cstrong%3EDate%20started%3A%20%3C%2Fstrong%3EMay%202022%3Cbr%3E%3Cstrong%3EFounder%3A%20%3C%2Fstrong%3EHusam%20Aboul%20Hosn%3Cbr%3E%3Cstrong%3EBased%3A%20%3C%2Fstrong%3EDIFC%3Cbr%3E%3Cstrong%3ESector%3A%20%3C%2Fstrong%3EFinTech%20%E2%80%94%20Innovation%20Hub%3Cbr%3E%3Cstrong%3EEmployees%3A%20%3C%2Fstrong%3Eeight%3Cbr%3E%3Cstrong%3EStage%3A%20%3C%2Fstrong%3Epre-seed%3Cbr%3E%3Cstrong%3EInvestors%3A%20%3C%2Fstrong%3Epre-seed%20funding%20raised%20from%20family%20and%20friends%20earlier%20this%20year%3C%2Fp%3E%0A

First Person

Richard Flanagan

Chatto & Windus

Company profile

Name: Thndr

Started: October 2020

Founders: Ahmad Hammouda and Seif Amr

Based: Cairo, Egypt

Sector: FinTech

Initial investment: pre-seed of $800,000

Funding stage: series A; $20 million

Investors: Tiger Global, Beco Capital, Prosus Ventures, Y Combinator, Global Ventures, Abdul Latif Jameel, Endure Capital, 4DX Ventures, Plus VC, Rabacap and MSA Capital

How Tesla’s price correction has hit fund managers

Investing in disruptive technology can be a bumpy ride, as investors in Tesla were reminded on Friday, when its stock dropped 7.5 per cent in early trading to $575.

It recovered slightly but still ended the week 15 per cent lower and is down a third from its all-time high of $883 on January 26. The electric car maker’s market cap fell from $834 billion to about $567bn in that time, a drop of an astonishing $267bn, and a blow for those who bought Tesla stock late.

The collapse also hit fund managers that have gone big on Tesla, notably the UK-based Scottish Mortgage Investment Trust and Cathie Wood’s ARK Innovation ETF.

Tesla is the top holding in both funds, making up a hefty 10 per cent of total assets under management. Both funds have fallen by a quarter in the past month.

Matt Weller, global head of market research at GAIN Capital, recently warned that Tesla founder Elon Musk had “flown a bit too close to the sun”, after getting carried away by investing $1.5bn of the company’s money in Bitcoin.

He also predicted Tesla’s sales could struggle as traditional auto manufacturers ramp up electric car production, destroying its first mover advantage.

AJ Bell’s Russ Mould warns that many investors buy tech stocks when earnings forecasts are rising, almost regardless of valuation. “When it works, it really works. But when it goes wrong, elevated valuations leave little or no downside protection.”

A Tesla correction was probably baked in after last year’s astonishing share price surge, and many investors will see this as an opportunity to load up at a reduced price.

Dramatic swings are to be expected when investing in disruptive technology, as Ms Wood at ARK makes clear.

Every week, she sends subscribers a commentary listing “stocks in our strategies that have appreciated or dropped more than 15 per cent in a day” during the week.

Her latest commentary, issued on Friday, showed seven stocks displaying extreme volatility, led by ExOne, a leader in binder jetting 3D printing technology. It jumped 24 per cent, boosted by news that fellow 3D printing specialist Stratasys had beaten fourth-quarter revenues and earnings expectations, seen as good news for the sector.

By contrast, computational drug and material discovery company Schrödinger fell 27 per cent after quarterly and full-year results showed its core software sales and drug development pipeline slowing.

Despite that setback, Ms Wood remains positive, arguing that its “medicinal chemistry platform offers a powerful and unique view into chemical space”.

In her weekly video view, she remains bullish, stating that: “We are on the right side of change, and disruptive innovation is going to deliver exponential growth trajectories for many of our companies, in fact, most of them.”

Ms Wood remains committed to Tesla as she expects global electric car sales to compound at an average annual rate of 82 per cent for the next five years.

She said these are so “enormous that some people find them unbelievable”, and argues that this scepticism, especially among institutional investors, “festers” and creates a great opportunity for ARK.

Only you can decide whether you are a believer or a festering sceptic. If it’s the former, then buckle up.

Terror attacks in Paris, November 13, 2015

- At 9.16pm, three suicide attackers killed one person outside the Atade de France during a foootball match between France and Germany

- At 9.25pm, three attackers opened fire on restaurants and cafes over 20 minutes, killing 39 people

- Shortly after 9.40pm, three other attackers launched a three-hour raid on the Bataclan, in which 1,500 people had gathered to watch a rock concert. In total, 90 people were killed

- Salah Abdeslam, the only survivor of the terrorists, did not directly participate in the attacks, thought to be due to a technical glitch in his suicide vest

- He fled to Belgium and was involved in attacks on Brussels in March 2016. He is serving a life sentence in France

Red flags

- Promises of high, fixed or 'guaranteed' returns.

- Unregulated structured products or complex investments often used to bypass traditional safeguards.

- Lack of clear information, vague language, no access to audited financials.

- Overseas companies targeting investors in other jurisdictions - this can make legal recovery difficult.

- Hard-selling tactics - creating urgency, offering 'exclusive' deals.

Courtesy: Carol Glynn, founder of Conscious Finance Coaching

Company%20Profile

%3Cp%3E%3Cstrong%3EName%3A%3C%2Fstrong%3E%20Ovasave%3Cbr%3E%3Cstrong%3EStarted%3A%3C%2Fstrong%3E%20November%202022%3Cbr%3E%3Cstrong%3EFounders%3A%3C%2Fstrong%3E%20Majd%20Abu%20Zant%20and%20Torkia%20Mahloul%3Cbr%3E%3Cstrong%3EBased%3A%3C%2Fstrong%3E%20Abu%20Dhabi%3Cbr%3E%3Cstrong%3ESector%3A%3C%2Fstrong%3E%20Healthtech%3Cbr%3E%3Cstrong%3ENumber%20of%20staff%3A%3C%2Fstrong%3E%20Three%20employees%3Cbr%3E%3Cstrong%3EInvestment%20stage%3A%3C%2Fstrong%3E%20Pre-seed%3Cbr%3E%3Cstrong%3EInvestment%3A%3C%2Fstrong%3E%20%24400%2C000%3C%2Fp%3E%0A

The%20Emperor%20and%20the%20Elephant

%3Cp%3E%3Cstrong%3EAuthor%3A%20%3C%2Fstrong%3ESam%20Ottewill-Soulsby%3C%2Fp%3E%0A%3Cp%3E%3Cstrong%3EPublisher%3A%20%3C%2Fstrong%3EPrinceton%20University%20Press%3C%2Fp%3E%0A%3Cp%3E%3Cstrong%3EPages%3A%20%3C%2Fstrong%3E392%3C%2Fp%3E%0A%3Cp%3E%3Cstrong%3EAvailable%3A%20%3C%2Fstrong%3EJuly%2011%3C%2Fp%3E%0A

UAE tour of Zimbabwe

All matches in Bulawayo

Friday, Sept 26 – UAE won by 36 runs

Sunday, Sept 28 – Second ODI

Tuesday, Sept 30 – Third ODI

Thursday, Oct 2 – Fourth ODI

Sunday, Oct 5 – First T20I

Monday, Oct 6 – Second T20I

2024%20Dubai%20Marathon%20Results

%3Cp%3E%3Cstrong%3EWomen%E2%80%99s%20race%3A%3C%2Fstrong%3E%0D%3Cbr%3E1.%20Tigist%20Ketema%20(ETH)%202hrs%2016min%207sec%0D%3Cbr%3E2.%20Ruti%20Aga%20(ETH)%202%3A18%3A09%0D%3Cbr%3E3.%20Dera%20Dida%20(ETH)%202%3A19%3A29%0D%3Cbr%3EMen's%20race%3A%0D%3Cbr%3E1.%20Addisu%20Gobena%20(ETH)%202%3A05%3A01%0D%3Cbr%3E2.%20Lemi%20Dumicha%20(ETH)%202%3A05%3A20%0D%3Cbr%3E3.%20DejeneMegersa%20(ETH)%202%3A05%3A42%3C%2Fp%3E%0A

LOVE%20AGAIN

%3Cp%3EDirector%3A%20Jim%20Strouse%3C%2Fp%3E%0A%3Cp%3EStars%3A%20Priyanka%20Chopra%20Jonas%2C%20Sam%20Heughan%2C%20Celine%20Dion%3C%2Fp%3E%0A%3Cp%3ERating%3A%202%2F5%3C%2Fp%3E%0A