A $500 million fund to help tackle humanitarian crises has been launched by an investment partnership in Dubai.

Dubai-based Legatum on Wednesday announced it is aiming to raise $500 million for its Resilio Fund to develop “hyper-local” responses for those in need.

Legatum said it has already issued grants in Myanmar, Ethiopia, Somalia, Lebanon, India and the Philippines, while it is seeking to use its resources in Gaza and Syria.

It has not yet been announced where the fund will have its headquarters.

The launch comes, however, as global aid is under strain with counties cutting back on budgets.

“These aren't just funding gaps, they are human gaps,” said Badr Jafar, UAE special envoy of the Minister of Foreign Affairs for business and philanthropy, at the formal launch of the fund at Dubai’s Museum of the Future, directly addressing these funding challenges.

“Classrooms not reopened, homes we not rebuilt and livelihoods not restored,” he said. Yet this is not a moment for despair.

“It's a moment for redesign. The question is no longer only how much we give but how we give, to whom and to what.”

He said the new fund represented a proven approach to crisis response and it demonstrated why local ownership is “faster, more dignified and more durable”.

“Now, why Dubai? Because the UAE is rapidly becoming a global nexus for philanthropic investment and collaboration.

“A place where entrepreneurs, philanthropists and humanitarian operators are building unusual alliances that deliver real world outcomes.”

Global aid budgets are under pressure to counter major crises around the world. The plight of refugees poses increasing challenges for host countries including Uganda, which is home to two million refugees.

There is also a need for an international response in Syria, where the civil war has left at least 16 million in need of humanitarian assistance.

The UN Office for the Co-ordination of Humanitarian Affairs said last month that $45.3 billion was needed to fund life-saving initiatives this year, with only 21 per cent funded as of September. The $9.6 billion received marked a drop in funding of more than 40 per cent compared with the same time last year.

“We have been forced into a triage of human survival,” Tom Fletcher, undersecretary general for humanitarian affairs and emergency relief co-ordinator, said in June.

“The maths is cruel and the consequences are heartbreaking. Too many people will not get the support they need but we will save as many lives as we can with the resources we are given.”

The Organisation for Economic Co-operation and Development also projected a 9 to 17 per cent drop in official development assistance in 2025. This comes on top of a nine per cent drop in 2024.

Need for action

The fund operates by dispensing microgrants ranging from $2,000 to $10,000. And these funds go to support first responders from communities that are typically at the front lines before external agencies can get in.

Projects funded during the pilot phase range from rebuilding homes to ensuring access to food banks.

Guy Cave, president of the Legatum Foundation, said the international “top down” humanitarian system has failed to support communities as they tackle disasters. The time has come to back community-led responses to crises and “that’s why we have founded the Resilio Fund”, he added.

The hyper local angle is not a new idea and does not seek to replace conventional aid but it operates independently.

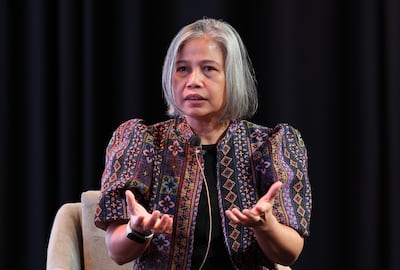

“We have already piloted this intervention … and we found out that it's cheaper, it's faster and it allows us to reach communities that traditional aid can't reach as quickly,” Fanta Toure, chief executive of the fund, told The National.

“The idea of Resilio is to find the communities, find what they're already doing to support themselves and get behind it.”

Born in Ivory Coast, Ms Toure said she was “deeply disturbed” by the response to the genocide in Rwanda in the 1990s and wanted to bring local voices into the conversation.

“I do not believe in charity,” she said. “I believe in aid and I think these two are very different things.

“I think charity comes with a principle that we're going to save people. We're doing them a favour. We know better than we do.”

But she said the approach she preferred was to support people to build their own future.

“We are doing that in a way that they will get the support they need to create a future that is better than the one that they are moving from.”

Malen Serato, Resilio partner in the Philippines, told The National how her country is affected by volcanoes, earthquakes and multiple typhoons a year.

“With that and the socioeconomic political situation in the Philippines, we are not disaster free. We are disaster guaranteed.”

And it is continuing. On Wednesday, Typhoon Kalmaegi had killed at least 85 people and caused heavy floods in central Philippines – an area still recovering from a major earthquake.

“People are still reeling from the effects of the earthquake and now here comes another strong typhoon and they are displaced once again,” she said.

Ms Serato, who has been working in the aid field for more than a decade, outlined how traditional aid replaces community action, makes people dependent and is often purely “transactional” but she said Resilio looks at it differently.

“We get to these meetings where we talk about how we support these community initiatives or mutual aid without killing it, without strangling it with paperwork, which traditionally aid usually does.”

She also spoke about how resilience, a common term in the aid world, is a “buzzword” but for people in disaster hit areas it is daily life.

“My dream is for the community to stop being resilient,” she said, speaking about the Philippines. “They are resilient people because they are just surviving blow after blow. They should thrive.”

Legatum said the fund had anchor commitments from four philanthropic institutions: the Vitol Foundation, UBS Optimus Foundation, the Irene M Staehelin Foundation, and the Quadrature Climate Foundation, with more to be announced.

Resilio is Legatum’s fourth collaborative philanthropic drive. Its previous initiatives – the END Fund, Freedom Fund and Luminos Fund – raised more than $1 billion and directly helped more than 500 million people worldwide, the group said.

APPLE IPAD MINI (A17 PRO)

Display: 21cm Liquid Retina Display, 2266 x 1488, 326ppi, 500 nits

Chip: Apple A17 Pro, 6-core CPU, 5-core GPU, 16-core Neural Engine

Storage: 128/256/512GB

Main camera: 12MP wide, f/1.8, digital zoom up to 5x, Smart HDR 4

Front camera: 12MP ultra-wide, f/2.4, Smart HDR 4, full-HD @ 25/30/60fps

Biometrics: Touch ID, Face ID

Colours: Blue, purple, space grey, starlight

In the box: iPad mini, USB-C cable, 20W USB-C power adapter

Price: From Dh2,099

Desert Warrior

Starring: Anthony Mackie, Aiysha Hart, Ben Kingsley

Director: Rupert Wyatt

Rating: 3/5

RESULTS

Cagliari 5-2 Fiorentina

Udinese 0-0 SPAL

Sampdoria 0-0 Atalanta

Lazio 4-2 Lecce

Parma 2-0 Roma

Juventus 1-0 AC Milan

UAE currency: the story behind the money in your pockets

Sholto Byrnes on Myanmar politics

Mohammed bin Zayed Majlis

Teenage%20Mutant%20Ninja%20Turtles%3A%20Shredder's%20Revenge

%3Cp%3E%3Cstrong%3EDeveloper%3A%20%3C%2Fstrong%3ETribute%20Games%3Cbr%3E%3Cstrong%3EPublisher%3A%3C%2Fstrong%3E%20Dotemu%3Cbr%3E%3Cstrong%3EConsoles%3A%20%3C%2Fstrong%3ENintendo%20Switch%2C%20PlayStation%204%26amp%3B5%2C%20PC%20and%20Xbox%20One%3Cbr%3E%3Cstrong%3ERating%3A%3C%2Fstrong%3E%204%2F5%3C%2Fp%3E%0A

UAE currency: the story behind the money in your pockets

The years Ramadan fell in May

Zayed Sustainability Prize

BMW%20M4%20Competition

%3Cp%3E%3Cstrong%3EEngine%3A%20%3C%2Fstrong%3E3.0%20twin-turbo%20inline%20six-cylinder%0D%3Cbr%3E%3Cstrong%3ETransmission%3A%3C%2Fstrong%3E%20eight-speed%0D%3Cbr%3E%3Cstrong%3EPower%3A%20%3C%2Fstrong%3E503hp%0D%3Cbr%3E%3Cstrong%3ETorque%3A%3C%2Fstrong%3E%20600Nm%0D%3Cbr%3E%3Cstrong%3EPrice%3A%3C%2Fstrong%3E%20from%20Dh617%2C600%0D%3Cbr%3E%3Cstrong%3EOn%20sale%3A%3C%2Fstrong%3E%20Now%0D%3C%2Fp%3E%0A

Ferrari 12Cilindri specs

Engine: naturally aspirated 6.5-liter V12

Power: 819hp

Torque: 678Nm at 7,250rpm

Price: From Dh1,700,000

Available: Now

Turning%20waste%20into%20fuel

%3Cp%3EAverage%20amount%20of%20biofuel%20produced%20at%20DIC%20factory%20every%20month%3A%20%3Cstrong%3EApproximately%20106%2C000%20litres%3C%2Fstrong%3E%3C%2Fp%3E%0A%3Cp%3EAmount%20of%20biofuel%20produced%20from%201%20litre%20of%20used%20cooking%20oil%3A%20%3Cstrong%3E920ml%20(92%25)%3C%2Fstrong%3E%3C%2Fp%3E%0A%3Cp%3ETime%20required%20for%20one%20full%20cycle%20of%20production%20from%20used%20cooking%20oil%20to%20biofuel%3A%20%3Cstrong%3EOne%20day%3C%2Fstrong%3E%3C%2Fp%3E%0A%3Cp%3EEnergy%20requirements%20for%20one%20cycle%20of%20production%20from%201%2C000%20litres%20of%20used%20cooking%20oil%3A%3Cbr%3E%3Cstrong%3E%E2%96%AA%20Electricity%20-%201.1904%20units%3Cbr%3E%E2%96%AA%20Water-%2031%20litres%3Cbr%3E%E2%96%AA%20Diesel%20%E2%80%93%2026.275%20litres%3C%2Fstrong%3E%3C%2Fp%3E%0A

SPECS

%3Cp%3E%3Cstrong%3EEngine%3A%3C%2Fstrong%3E%201.5-litre%204-cylinder%3Cbr%3E%3Cstrong%3EPower%3A%3C%2Fstrong%3E%20101hp%3Cbr%3E%3Cstrong%3ETorque%3A%3C%2Fstrong%3E%20135Nm%3Cbr%3E%3Cstrong%3ETransmission%3C%2Fstrong%3E%3A%20Six-speed%20auto%3Cbr%3E%3Cstrong%3EPrice%3A%3C%2Fstrong%3E%20From%20Dh79%2C900%3Cbr%3E%3Cstrong%3EOn%20sale%3A%3C%2Fstrong%3E%20Now%3C%2Fp%3E%0A

Company%20profile

%3Cp%3EName%3A%20Tabby%3Cbr%3EFounded%3A%20August%202019%3B%20platform%20went%20live%20in%20February%202020%3Cbr%3EFounder%2FCEO%3A%20Hosam%20Arab%2C%20co-founder%3A%20Daniil%20Barkalov%3Cbr%3EBased%3A%20Dubai%2C%20UAE%3Cbr%3ESector%3A%20Payments%3Cbr%3ESize%3A%2040-50%20employees%3Cbr%3EStage%3A%20Series%20A%3Cbr%3EInvestors%3A%20Arbor%20Ventures%2C%20Mubadala%20Capital%2C%20Wamda%20Capital%2C%20STV%2C%20Raed%20Ventures%2C%20Global%20Founders%20Capital%2C%20JIMCO%2C%20Global%20Ventures%2C%20Venture%20Souq%2C%20Outliers%20VC%2C%20MSA%20Capital%2C%20HOF%20and%20AB%20Accelerator.%3Cbr%3E%3C%2Fp%3E%0A

Killing of Qassem Suleimani

Dhadak 2

Director: Shazia Iqbal

Starring: Siddhant Chaturvedi, Triptii Dimri

Rating: 1/5

The specs

- Engine: 3.9-litre twin-turbo V8

- Power: 640hp

- Torque: 760nm

- On sale: 2026

- Price: Not announced yet

More from Neighbourhood Watch:

Israel Palestine on Swedish TV 1958-1989

Director: Goran Hugo Olsson

Rating: 5/5

Killing of Qassem Suleimani

Pharaoh's curse

British aristocrat Lord Carnarvon, who funded the expedition to find the Tutankhamun tomb, died in a Cairo hotel four months after the crypt was opened.

He had been in poor health for many years after a car crash, and a mosquito bite made worse by a shaving cut led to blood poisoning and pneumonia.

Reports at the time said Lord Carnarvon suffered from “pain as the inflammation affected the nasal passages and eyes”.

Decades later, scientists contended he had died of aspergillosis after inhaling spores of the fungus aspergillus in the tomb, which can lie dormant for months. The fact several others who entered were also found dead withiin a short time led to the myth of the curse.

Mercer, the investment consulting arm of US services company Marsh & McLennan, expects its wealth division to at least double its assets under management (AUM) in the Middle East as wealth in the region continues to grow despite economic headwinds, a company official said.

Mercer Wealth, which globally has $160 billion in AUM, plans to boost its AUM in the region to $2-$3bn in the next 2-3 years from the present $1bn, said Yasir AbuShaban, a Dubai-based principal with Mercer Wealth.

“Within the next two to three years, we are looking at reaching $2 to $3 billion as a conservative estimate and we do see an opportunity to do so,” said Mr AbuShaban.

Mercer does not directly make investments, but allocates clients’ money they have discretion to, to professional asset managers. They also provide advice to clients.

“We have buying power. We can negotiate on their (client’s) behalf with asset managers to provide them lower fees than they otherwise would have to get on their own,” he added.

Mercer Wealth’s clients include sovereign wealth funds, family offices, and insurance companies among others.

From its office in Dubai, Mercer also looks after Africa, India and Turkey, where they also see opportunity for growth.

Wealth creation in Middle East and Africa (MEA) grew 8.5 per cent to $8.1 trillion last year from $7.5tn in 2015, higher than last year’s global average of 6 per cent and the second-highest growth in a region after Asia-Pacific which grew 9.9 per cent, according to consultancy Boston Consulting Group (BCG). In the region, where wealth grew just 1.9 per cent in 2015 compared with 2014, a pickup in oil prices has helped in wealth generation.

BCG is forecasting MEA wealth will rise to $12tn by 2021, growing at an annual average of 8 per cent.

Drivers of wealth generation in the region will be split evenly between new wealth creation and growth of performance of existing assets, according to BCG.

Another general trend in the region is clients’ looking for a comprehensive approach to investing, according to Mr AbuShaban.

“Institutional investors or some of the families are seeing a slowdown in the available capital they have to invest and in that sense they are looking at optimizing the way they manage their portfolios and making sure they are not investing haphazardly and different parts of their investment are working together,” said Mr AbuShaban.

Some clients also have a higher appetite for risk, given the low interest-rate environment that does not provide enough yield for some institutional investors. These clients are keen to invest in illiquid assets, such as private equity and infrastructure.

“What we have seen is a desire for higher returns in what has been a low-return environment specifically in various fixed income or bonds,” he said.

“In this environment, we have seen a de facto increase in the risk that clients are taking in things like illiquid investments, private equity investments, infrastructure and private debt, those kind of investments were higher illiquidity results in incrementally higher returns.”

The Abu Dhabi Investment Authority, one of the largest sovereign wealth funds, said in its 2016 report that has gradually increased its exposure in direct private equity and private credit transactions, mainly in Asian markets and especially in China and India. The authority’s private equity department focused on structured equities owing to “their defensive characteristics.”

A%20MAN%20FROM%20MOTIHARI

%3Cp%3E%3Cstrong%3EAuthor%3A%20%3C%2Fstrong%3EAbdullah%20Khan%0D%3Cbr%3E%3Cstrong%3EPublisher%3A%20%3C%2Fstrong%3EPenguin%20Random%20House%3Cbr%3E%3Cstrong%3EPages%3A%20%3C%2Fstrong%3E304%0D%3Cbr%3E%3Cstrong%3EAvailable%3A%20%3C%2Fstrong%3ENow%0D%3Cbr%3E%3C%2Fp%3E%0A

In The Heights

Directed by: Jon M. Chu

Stars: Anthony Ramos, Lin-Manual Miranda

Rating: ****