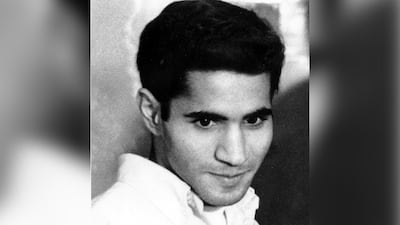

Previously classified documents related to the 1968 murder of presidential hopeful Robert F Kennedy and his Palestinian Christian assassin, Sirhan Sirhan, have been released by the CIA.

One of the files details an emergency meeting of the Palestine Arab Delegation in the Arab League offices of New York's Chrysler building following the killing of Mr Kennedy.

Sirhan, a Palestinian who emigrated from Jordan to the US, shot and killed Mr Kennedy on June 6, 1968, after he won the California Democratic presidential primary.

Several investigations by the Los Angeles police and FBI indicated speeches given by Mr Kennedy on the campaign trail in support of Israel prompted Sirhan's motivation.

“Kennedy must fall … Kennedy must fall” reads one of the diary entries written by Sirhan, released in the latest document dump.

Another document, an intelligence report circulated in the CIA, shows that the Palestinian Arab Delegation was closely monitored by the intelligence agency after Sirhan was taken into custody.

At an emergency meeting of the group held during the assassin's trial, Issa Nakhleh, a former senior adviser to the UN Palestinian Delegation, described Sirhan as an “Arab guerrilla” whose murder of Mr Kennedy was “motivated by political events”.

“Nakhleh informed the group that one of his aims in briefing the group was to enlist their support for a trip to the Middle East which he planned to make in order to collect funds to aid Sirhan's defence,” reads the document.

The source for those particular meeting notes appears to be an informant, described by the CIA as a “Middle East national with a leftist political orientation who has good contacts at the UN”.

It also alleges that Mr Nakhleh had in the past been accused of being a “loose handler” of funds – that he had previously raised money for various causes, but that the funds later “found a way into his pockets”.

Another released document shows that both the CIA and FBI were particularly concerned with how the Soviet Union was portraying Sirhan.

“Soviet media have displayed predictable sensitivity to the fact that the suspect is an Arab immigrant,” reads one of the reports, which also examined how a Soviet journalist's opinion piece critiqued the US reaction to Sirhan.

“Izvestiya Kondrashov accused the US press of 'playing on the Arab origin of the assassin' and on evidence of his 'anti-Israeli attitudes' in order to shift the blame from the American way of life, 'the real guilty party in the tragedy.'”

A report compiled before the assassination, titled “The Arab Nationalists Movement”, was also circulated in the CIA shortly after Mr Kennedy was killed, while investigators were trying to learn about Sirhan's motives.

“In Jordan recently, a new Arab Nationalists Movement commando group has been organised to carry out raids within Israel,” the report reads.

In April of 1969, a jury found Sirhan guilty of assassinating Mr Kennedy.

Despite a preponderance of evidence, conspiracy theories have thrived for decades, with some suggesting Sirhan's innocence.

In a previous interview with The National, author Mel Ayton, widely considered to be one of the foremost experts on Sirhan and the assassination, said that all of those theories fall apart under even the most basic examination.

Any documents that remain classified, he explained, are classified for security reasons.

“It wasn't about covering anything up, it was about protecting sources, police sources and potential informants – that's what it all comes down to,” he said.

Sirhan's many attempts to be paroled have so far been unsuccessful. He was briefly granted parole by the California parole board in 2021, only to have the decision vetoed by California Governor Gavin Newsom, who said the assassination was one of the most notorious crimes in US history.

For the 17th time since being incarcerated in 1969, Sirhan was again denied a parole request in 2023. He will be eligible again in 2027.

The prisoner, 81, has periodically made contradictory comments about his role in the assassination. During some interviews, he claims not to remember the events, while in others, he seems to express remorse.

UAE currency: the story behind the money in your pockets

Mercer, the investment consulting arm of US services company Marsh & McLennan, expects its wealth division to at least double its assets under management (AUM) in the Middle East as wealth in the region continues to grow despite economic headwinds, a company official said.

Mercer Wealth, which globally has $160 billion in AUM, plans to boost its AUM in the region to $2-$3bn in the next 2-3 years from the present $1bn, said Yasir AbuShaban, a Dubai-based principal with Mercer Wealth.

“Within the next two to three years, we are looking at reaching $2 to $3 billion as a conservative estimate and we do see an opportunity to do so,” said Mr AbuShaban.

Mercer does not directly make investments, but allocates clients’ money they have discretion to, to professional asset managers. They also provide advice to clients.

“We have buying power. We can negotiate on their (client’s) behalf with asset managers to provide them lower fees than they otherwise would have to get on their own,” he added.

Mercer Wealth’s clients include sovereign wealth funds, family offices, and insurance companies among others.

From its office in Dubai, Mercer also looks after Africa, India and Turkey, where they also see opportunity for growth.

Wealth creation in Middle East and Africa (MEA) grew 8.5 per cent to $8.1 trillion last year from $7.5tn in 2015, higher than last year’s global average of 6 per cent and the second-highest growth in a region after Asia-Pacific which grew 9.9 per cent, according to consultancy Boston Consulting Group (BCG). In the region, where wealth grew just 1.9 per cent in 2015 compared with 2014, a pickup in oil prices has helped in wealth generation.

BCG is forecasting MEA wealth will rise to $12tn by 2021, growing at an annual average of 8 per cent.

Drivers of wealth generation in the region will be split evenly between new wealth creation and growth of performance of existing assets, according to BCG.

Another general trend in the region is clients’ looking for a comprehensive approach to investing, according to Mr AbuShaban.

“Institutional investors or some of the families are seeing a slowdown in the available capital they have to invest and in that sense they are looking at optimizing the way they manage their portfolios and making sure they are not investing haphazardly and different parts of their investment are working together,” said Mr AbuShaban.

Some clients also have a higher appetite for risk, given the low interest-rate environment that does not provide enough yield for some institutional investors. These clients are keen to invest in illiquid assets, such as private equity and infrastructure.

“What we have seen is a desire for higher returns in what has been a low-return environment specifically in various fixed income or bonds,” he said.

“In this environment, we have seen a de facto increase in the risk that clients are taking in things like illiquid investments, private equity investments, infrastructure and private debt, those kind of investments were higher illiquidity results in incrementally higher returns.”

The Abu Dhabi Investment Authority, one of the largest sovereign wealth funds, said in its 2016 report that has gradually increased its exposure in direct private equity and private credit transactions, mainly in Asian markets and especially in China and India. The authority’s private equity department focused on structured equities owing to “their defensive characteristics.”

What is blockchain?

Blockchain is a form of distributed ledger technology, a digital system in which data is recorded across multiple places at the same time. Unlike traditional databases, DLTs have no central administrator or centralised data storage. They are transparent because the data is visible and, because they are automatically replicated and impossible to be tampered with, they are secure.

The main difference between blockchain and other forms of DLT is the way data is stored as ‘blocks’ – new transactions are added to the existing ‘chain’ of past transactions, hence the name ‘blockchain’. It is impossible to delete or modify information on the chain due to the replication of blocks across various locations.

Blockchain is mostly associated with cryptocurrency Bitcoin. Due to the inability to tamper with transactions, advocates say this makes the currency more secure and safer than traditional systems. It is maintained by a network of people referred to as ‘miners’, who receive rewards for solving complex mathematical equations that enable transactions to go through.

However, one of the major problems that has come to light has been the presence of illicit material buried in the Bitcoin blockchain, linking it to the dark web.

Other blockchain platforms can offer things like smart contracts, which are automatically implemented when specific conditions from all interested parties are reached, cutting the time involved and the risk of mistakes. Another use could be storing medical records, as patients can be confident their information cannot be changed. The technology can also be used in supply chains, voting and has the potential to used for storing property records.

The specs

Engine: 3-litre twin-turbo V6

Power: 400hp

Torque: 475Nm

Transmission: 9-speed automatic

Price: From Dh215,900

On sale: Now

How much do leading UAE’s UK curriculum schools charge for Year 6?

- Nord Anglia International School (Dubai) – Dh85,032

- Kings School Al Barsha (Dubai) – Dh71,905

- Brighton College Abu Dhabi - Dh68,560

- Jumeirah English Speaking School (Dubai) – Dh59,728

- Gems Wellington International School – Dubai Branch – Dh58,488

- The British School Al Khubairat (Abu Dhabi) - Dh54,170

- Dubai English Speaking School – Dh51,269

*Annual tuition fees covering the 2024/2025 academic year

About Housecall

Date started: July 2020

Founders: Omar and Humaid Alzaabi

Based: Abu Dhabi

Sector: HealthTech

# of staff: 10

Funding to date: Self-funded

If%20you%20go

%3Cp%3E%0DThere%20are%20regular%20flights%20from%20Dubai%20to%20Addis%20Ababa%20with%20Ethiopian%20Airlines%20with%20return%20fares%20from%20Dh1%2C700.%20Nashulai%20Journeys%20offers%20tailormade%20and%20ready%20made%20trips%20in%20Africa%20while%20Tesfa%20Tours%20has%20a%20number%20of%20different%20community%20trekking%20tours%20throughout%20northern%20Ethiopia.%20%20The%20Ben%20Abeba%20Lodge%20has%20rooms%20from%20Dh228%2C%20and%20champions%20a%20programme%20of%20re-forestation%20in%20the%20surrounding%20area.%26nbsp%3B%3C%2Fp%3E%0A%3Cp%3E%3Cbr%3E%3Cbr%3E%3C%2Fp%3E%0A

MATCH INFO

Uefa Champions League semi-finals, first leg

Liverpool v Roma

When: April 24, 10.45pm kick-off (UAE)

Where: Anfield, Liverpool

Live: BeIN Sports HD

Second leg: May 2, Stadio Olimpico, Rome