The tiny speck of light currently on display in Louvre Abu Dhabi, part of a recently opened exhibition called 10,000 Years of Luxury, represents the oldest known pearl in the world. This 8,000-year-old pearl was unearthed on Marawah Island about 170 kilometres west of Abu Dhabi and still has its natural lustre.

As small as it is, tells a remarkable story, stretching back to the dawn of civilisation when the Neolithic way of life was taking root in the lands of the Emirates. Together with the sherds of pottery, bones and shells found by archaeologists at sites across the region, it has helped build a picture of what life might have looked like in the Emirates thousands of years ago.

The Neolithic revolution was set in motion by the end of the last Ice Age. It began in the Fertile Crescent – the river-valleys of Iraq and Egypt connected by the Levant – about 14,000 years ago. Primordial hunter-gatherer societies slowly gave way to settled farming or nomadic herding communities. Land ownership guaranteed by new weapon types and religious ideologies forever transformed human societies.

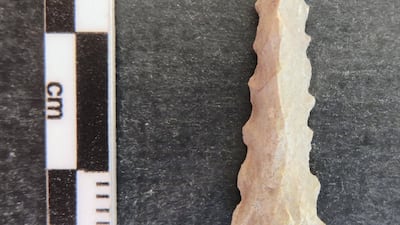

By about 10,000 years ago, the Neolithic revolution was beginning to reach the emirates. Flint arrowheads found at Jebel Faya in Sharjah belong to a Neolithic toolkit imported from the Fertile Crescent. It seems that groups of nomadic pastoralists were moving southwards from Syria-Palestine, possibly driven on by population growth triggered by the Neolithic way of life. This Holocene, or post-Ice Age, repopulation of Arabia likely provided the baseline gene pool of the Emirati people.

A pioneering Neolithic village was established on the island of Marawah in the emirate of Abu Dhabi about 8,000 years ago. Three structures have so far been located. They were built of local limestone and one has an oblong plan. The upper sections of the walls and roofs were probably made of palm fronds. Similar structures have been found at the contemporary site of Al Sabiyah in Kuwait.

These stone-built houses can be contrasted with palm-frond roundhouses at Delma Island in Abu Dhabi and Suwayah in Oman. Analogous palm-frond structures have been found at the settlement at Akab in Umm Al Quwain. Differences in domestic architecture could be indicative of the co-existence of distinct cultural groups in the emirates at the time.

The Marawah pearl dates from 5,800 to 5,600BC. It therefore predates the previous oldest pearl in the world by several centuries, found in Al Sabiyah and dating to 5,300BC. Prior to the discovery of the Marawah pearl, the oldest found in the Emirates was at the settlement of Akab, which flourished between 4,750 and 3,900BC.

Pearls are not infrequently found at Neolithic coastal settlements in the Emirates, which include Yarmouk in Sharjah and the archaeological site of UAQ2 in Umm Al Quwain. The largest number of pearls ever found at a prehistoric site actually come from the interior, from the cemetery of Jebel Al Buhais in Sharjah, where 62 pearls dating from around 5,000 to 4,500BC were discovered.

Many more pre-modern shell middens, or archaeological mounds, dot the coastal landscape of the Gulf. Some of these date to the Neolithic period and are broadly contemporary with the Marawah pearl. One of the largest – a three-metre-high mound densely packed with shell fragments – was found at Dosariyah in Saudi Arabia. The number and size of these middens give some indication of the potential scale of pearl fishing in the Neolithic period.

No evidence has yet been unearthed, however, for Neolithic methods of pearl fishing. It is certainly possible that boats were already being used to transport divers to the pearl beds and that the divers were using weights to sink rapidly to the bottom of the sea, as was the case in later periods. Alternatively, oysters could have been collected by wading from the shore at low tide, a practice which continued into living memory in the Emirates.

Oysters and other shellfish were an important source of food for coastal communities. It is unclear to what extent oysters were fished specifically for their pearls. Certainly some of the pearls from Neolithic sites around the Gulf were pierced and turned into jewellery, as was the case with the Al Sabiyah pearl and those found adorning the dead at Jebel Al Buhais.

It has often been supposed, largely on the basis of analogies with better-known historic periods, that the pearls were traded beyond the Gulf. However, no pearls have yet been found in Mesopotamia – the region of southern Iraq where complex urban civilisation first emerged – prior to the Bronze Age in the third millennium BC.

Pottery provides the best evidence for trade with Mesopotamia. The Neolithic communities of the Emirates had no knowledge of ceramic production and imported fine-bodied decorated pots made in and around the site of Tell Al Ubaid in southern Iraq. One of the most celebrated examples is the Marawah vase, now in Louvre Abu Dhabi.

Sherds of Ubaid pottery are found all along the coast of eastern Arabia. It is possible these were traded directly or, perhaps more likely, via one or more middlemen. By the Bronze Age, Bahrain had emerged as a commercial hub of Gulf trade: the legendary land of Dilmun. This trade constitutes one of the earliest maritime networks in world history.

Evidence for early seafaring has been found at Al Sabiyah. Fragments of bitumen bearing the impression of reeds on one side, with barnacles adhered to the surface of the other, suggest that Neolithic boats were made of reed bundles coated with bitumen. A small clay model of a boat from the site gives an impression of how these vessels might have looked.

Trade was nevertheless only a part of the Neolithic way of life. It is possible that palms were already being grown, as suggested by two carbonised date stones found at Delma Island. Dates may alternatively have been imported from Mesopotamia, as indeed they were until recent times. Farming does not appear to have become significant in the emirates until the Bronze Age Umm Al Nar culture beginning around the mid-third millennium BC.

Over 90 per cent of the bones found at butchery sites at Jebel Al Buhais are from domesticated sheep, goat and cattle, indicating the declining importance of hunting. Most of the sheep and goat were elderly females, suggesting that they had been kept for their milk. The picture emerges of a nomadic herding community moving to Buhais for the lambing season in the spring and spending the summers fishing on coastal and island settlements like Akab and Delma.

It is Jebel Al Buhais too that provides the most complete picture of Neolithic life in the emirates. About 500 individuals were found buried in the cemetery. A study of the human remains revealed that the average life expectancy for women was 33, compared to 40 for the men. More women than men died in their teens and twenties, owing to the dangers of childbearing, while the skeletons of the men displayed a greater occurrence of near or before-death trauma associated with a violent death.

Many of the individuals buried in the Buhais cemetery wore pearls and it is possible that the Marawah pearl was somehow lost before it could be pierced and worn. Alternatively, it was lost before it could be shipped to Mesopotamia in exchange for manufactured goods and agricultural surplus. In either case, the pearl opens a fascinating window on life in the emirates during the Neolithic period.

Timothy Power is an archaeologist, historian and author of A History of the Emirati People, to be published in 2021

Emergency

Director: Kangana Ranaut

Stars: Kangana Ranaut, Anupam Kher, Shreyas Talpade, Milind Soman, Mahima Chaudhry

Rating: 2/5

The 12 breakaway clubs

England

Arsenal, Chelsea, Liverpool, Manchester City, Manchester United, Tottenham Hotspur

Italy

AC Milan, Inter Milan, Juventus

Spain

Atletico Madrid, Barcelona, Real Madrid

MATCH INFO

Scotland 59 (Tries: Hastings (2), G Horne (3), Turner, Seymour, Barclay, Kinghorn, McInally; Cons: Hastings 8)

Russia 0

Killing of Qassem Suleimani

Specs

Engine: 2-litre

Transmission: Eight-speed automatic

Power: 255hp

Torque: 273Nm

Price: Dh240,000

THE BIO

Bio Box

Role Model: Sheikh Zayed, God bless his soul

Favorite book: Zayed Biography of the leader

Favorite quote: To be or not to be, that is the question, from William Shakespeare's Hamlet

Favorite food: seafood

Favorite place to travel: Lebanon

Favorite movie: Braveheart

Upcoming games

SUNDAY

Brighton and Hove Albion v Southampton (5.30pm)

Leicester City v Everton (8pm)

MONDAY

Burnley v Newcastle United (midnight)

UAE currency: the story behind the money in your pockets

COMPANY PROFILE

Founders: Alhaan Ahmed, Alyina Ahmed and Maximo Tettamanzi

Total funding: Self funded

Day 5, Abu Dhabi Test: At a glance

Moment of the day When Dilruwan Perera dismissed Yasir Shah to end Pakistan’s limp resistance, the Sri Lankans charged around the field with the fevered delirium of a side not used to winning. Trouble was, they had not. The delivery was deemed a no ball. Sri Lanka had a nervy wait, but it was merely a stay of execution for the beleaguered hosts.

Stat of the day – 5 Pakistan have lost all 10 wickets on the fifth day of a Test five times since the start of 2016. It is an alarming departure for a side who had apparently erased regular collapses from their resume. “The only thing I can say, it’s not a mitigating excuse at all, but that’s a young batting line up, obviously trying to find their way,” said Mickey Arthur, Pakistan’s coach.

The verdict Test matches in the UAE are known for speeding up on the last two days, but this was extreme. The first two innings of this Test took 11 sessions to complete. The remaining two were done in less than four. The nature of Pakistan’s capitulation at the end showed just how difficult the transition is going to be in the post Misbah-ul-Haq era.

UPI facts

More than 2.2 million Indian tourists arrived in UAE in 2023

More than 3.5 million Indians reside in UAE

Indian tourists can make purchases in UAE using rupee accounts in India through QR-code-based UPI real-time payment systems

Indian residents in UAE can use their non-resident NRO and NRE accounts held in Indian banks linked to a UAE mobile number for UPI transactions

Ten tax points to be aware of in 2026

1. Domestic VAT refund amendments: request your refund within five years

If a business does not apply for the refund on time, they lose their credit.

2. E-invoicing in the UAE

Businesses should continue preparing for the implementation of e-invoicing in the UAE, with 2026 a preparation and transition period ahead of phased mandatory adoption.

3. More tax audits

Tax authorities are increasingly using data already available across multiple filings to identify audit risks.

4. More beneficial VAT and excise tax penalty regime

Tax disputes are expected to become more frequent and more structured, with clearer administrative objection and appeal processes. The UAE has adopted a new penalty regime for VAT and excise disputes, which now mirrors the penalty regime for corporate tax.

5. Greater emphasis on statutory audit

There is a greater need for the accuracy of financial statements. The International Financial Reporting Standards standards need to be strictly adhered to and, as a result, the quality of the audits will need to increase.

6. Further transfer pricing enforcement

Transfer pricing enforcement, which refers to the practice of establishing prices for internal transactions between related entities, is expected to broaden in scope. The UAE will shortly open the possibility to negotiate advance pricing agreements, or essentially rulings for transfer pricing purposes.

7. Limited time periods for audits

Recent amendments also introduce a default five-year limitation period for tax audits and assessments, subject to specific statutory exceptions. While the standard audit and assessment period is five years, this may be extended to up to 15 years in cases involving fraud or tax evasion.

8. Pillar 2 implementation

Many multinational groups will begin to feel the practical effect of the Domestic Minimum Top-Up Tax (DMTT), the UAE's implementation of the OECD’s global minimum tax under Pillar 2. While the rules apply for financial years starting on or after January 1, 2025, it is 2026 that marks the transition to an operational phase.

9. Reduced compliance obligations for imported goods and services

Businesses that apply the reverse-charge mechanism for VAT purposes in the UAE may benefit from reduced compliance obligations.

10. Substance and CbC reporting focus

Tax authorities are expected to continue strengthening the enforcement of economic substance and Country-by-Country (CbC) reporting frameworks. In the UAE, these regimes are increasingly being used as risk-assessment tools, providing tax authorities with a comprehensive view of multinational groups’ global footprints and enabling them to assess whether profits are aligned with real economic activity.

Contributed by Thomas Vanhee and Hend Rashwan, Aurifer

Mercer, the investment consulting arm of US services company Marsh & McLennan, expects its wealth division to at least double its assets under management (AUM) in the Middle East as wealth in the region continues to grow despite economic headwinds, a company official said.

Mercer Wealth, which globally has $160 billion in AUM, plans to boost its AUM in the region to $2-$3bn in the next 2-3 years from the present $1bn, said Yasir AbuShaban, a Dubai-based principal with Mercer Wealth.

“Within the next two to three years, we are looking at reaching $2 to $3 billion as a conservative estimate and we do see an opportunity to do so,” said Mr AbuShaban.

Mercer does not directly make investments, but allocates clients’ money they have discretion to, to professional asset managers. They also provide advice to clients.

“We have buying power. We can negotiate on their (client’s) behalf with asset managers to provide them lower fees than they otherwise would have to get on their own,” he added.

Mercer Wealth’s clients include sovereign wealth funds, family offices, and insurance companies among others.

From its office in Dubai, Mercer also looks after Africa, India and Turkey, where they also see opportunity for growth.

Wealth creation in Middle East and Africa (MEA) grew 8.5 per cent to $8.1 trillion last year from $7.5tn in 2015, higher than last year’s global average of 6 per cent and the second-highest growth in a region after Asia-Pacific which grew 9.9 per cent, according to consultancy Boston Consulting Group (BCG). In the region, where wealth grew just 1.9 per cent in 2015 compared with 2014, a pickup in oil prices has helped in wealth generation.

BCG is forecasting MEA wealth will rise to $12tn by 2021, growing at an annual average of 8 per cent.

Drivers of wealth generation in the region will be split evenly between new wealth creation and growth of performance of existing assets, according to BCG.

Another general trend in the region is clients’ looking for a comprehensive approach to investing, according to Mr AbuShaban.

“Institutional investors or some of the families are seeing a slowdown in the available capital they have to invest and in that sense they are looking at optimizing the way they manage their portfolios and making sure they are not investing haphazardly and different parts of their investment are working together,” said Mr AbuShaban.

Some clients also have a higher appetite for risk, given the low interest-rate environment that does not provide enough yield for some institutional investors. These clients are keen to invest in illiquid assets, such as private equity and infrastructure.

“What we have seen is a desire for higher returns in what has been a low-return environment specifically in various fixed income or bonds,” he said.

“In this environment, we have seen a de facto increase in the risk that clients are taking in things like illiquid investments, private equity investments, infrastructure and private debt, those kind of investments were higher illiquidity results in incrementally higher returns.”

The Abu Dhabi Investment Authority, one of the largest sovereign wealth funds, said in its 2016 report that has gradually increased its exposure in direct private equity and private credit transactions, mainly in Asian markets and especially in China and India. The authority’s private equity department focused on structured equities owing to “their defensive characteristics.”

Killing of Qassem Suleimani