The British Prime Minister Boris Johnson took a second class degree in Classics at Oxford and will be familiar with the Latin phrase “annus mirabilis”, or “wonderful year”.

In his “annus mirabilis”, 2019, Mr Johnson achieved his heart’s desire – becoming prime minister. In last December’s General Election, he annihilated his opponents and destroyed rebels in his own party by winning an 80 seat majority. He triumphed because he promised to “Get Brexit Done.” He then threatened the EU that he would walk away with “No Deal” unless they offered him “fantastic” terms, which meant the UK could “have our cake and eat it”.

Mr Johnson had enthusiastic support from the US President, which meant he could perhaps secure a rapid US-UK post-Brexit trade deal and reinvigorate the “special relationship”. Donald Trump praised Johnson publicly in terms even more glowing than he had used to describe North Korea’s leader Kim Jong-un.

Mr Trump said: “We have a really good man who’s going to be the prime minister of the UK now. He’s tough and he’s smart. They’re saying, ‘Britain Trump’. They call him ‘Britain Trump’ and people are saying that’s a good thing.”

If 2019 was Mr Johnson's “annus mirabilis” – he even managed to get divorced and father a new child – 2020 is Mr Johnson’s “annus horribilis”, a terrible year in which the wheels have come off the Johnson bandwagon. Brexit isn’t done. Mr Johnson set another self-invented deadline for finalising negotiations by mid-October.

Maybe something extraordinary this week will produce a rapid deal, or maybe not. Then the coronavirus pandemic exposed his personal as well as policy failures. He doesn’t do details, often doesn’t listen to expert advice, and has no clearly defined ideology or plan.

Instead Boris Johnson has a style, bragging like Donald Trump about his “world-beating” successes, which never quite exist in real life. He claimed UK coronavirus testing in 2020 would be “world-beating”. It isn’t. It is expensive and incompetent.

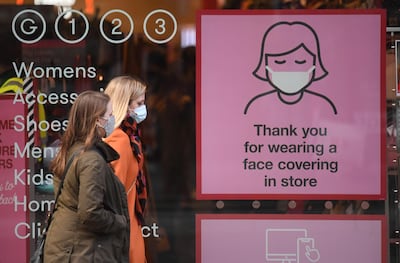

He himself caught the virus. The UK death rate is high. The arrival of a second wave has resulted in open rebellion from mayors in some of England’s great cities who say they are fed up with Mr Johnson’s chaotic “leadership”.

Mr Johnson’s cronies have been appointed to top positions. Companies with no experience in dealing with a viral epidemic have been awarded lucrative government contracts. TV comedians poke fun at him for mixed messages and an antiquated style of speaking.

Opinion polls now show the British Prime Minister is less popular than Labour's leader Kier Starmer. Conservative Members of Parliament are privately very uneasy that Mr Johnson is adrift in his high office.

Boris Johnson triumphed because he promised to 'get Brexit done', then threatened to walk away

It is bad but all the signs are that the “annus horribilis” could get even worse. Mr Johnson has shown no coherent plan for bearing down on coronavirus while the British economy is set to weaken still further.

On top of the pandemic, the self-inflicted wound of Brexit means that after four and a half years of blathering, the UK could face severe trade dislocation, confusion at British ports, a weakening of the currency and inevitably more job losses.

It appears that the Prime Minister has three options. The first is that Britain seeks yet another extension for more talks, but Brexit supporters will be furious at any further delay.

Option two is that to get a last minute deal Mr Johnson will – as he has done before – concede whatever the EU demands yet present it as a "fantastic success". Staunch Brexit campaigners like Nigel Farage will be even more furious and call it a "sell-out".

The third possibility is that there will be no deal, which will do massive self-inflicted damage to the UK economy. While Brexit hardliners may rejoice at No Deal, Mr Johnson will be faced with leading a government through years of economic turmoil, while financing the cost of existing economic damage from coronavirus. That presumably means unpopular tax rises.

As the former prime minister Tony Blair once put it to me, Mr Johnson ultimately must choose between “a pointless Brexit or a painful Brexit”, a deal which does profound damage to the British economy, or one which aligns Britain with Europe, does less damage but does indeed seem pointless.

If 2020 was bad, next year could be even worse. Polls suggest that in January 2021, it will be Joe Biden who is inaugurated President of the US. “Britain Trump” is already desperately trying to cosy up to “America Biden”, but given the way Mr Johnson derided the Obama presidency when Joe Biden was vice president, a warm Johnson-Biden relationship seems unlikely.

And so, out of the EU, probably out of favour with the White House, Mr Johnson might find British voters, after a terrible year, come to learn another Latin phrase in 2021 – “annus exitiabilis” or a “catastrophic year”.

Gavin Esler is a UK columnist for The National

More on Quran memorisation:

COMPANY%20PROFILE

%3Cp%3E%3Cstrong%3EName%3A%20%3C%2Fstrong%3ESmartCrowd%0D%3Cbr%3E%3Cstrong%3EStarted%3A%20%3C%2Fstrong%3E2018%0D%3Cbr%3E%3Cstrong%3EFounder%3A%20%3C%2Fstrong%3ESiddiq%20Farid%20and%20Musfique%20Ahmed%0D%3Cbr%3E%3Cstrong%3EBased%3A%20%3C%2Fstrong%3EDubai%0D%3Cbr%3E%3Cstrong%3ESector%3A%20%3C%2Fstrong%3EFinTech%20%2F%20PropTech%0D%3Cbr%3E%3Cstrong%3EInitial%20investment%3A%20%3C%2Fstrong%3E%24650%2C000%0D%3Cbr%3E%3Cstrong%3ECurrent%20number%20of%20staff%3A%3C%2Fstrong%3E%2035%0D%3Cbr%3E%3Cstrong%3EInvestment%20stage%3A%20%3C%2Fstrong%3ESeries%20A%0D%3Cbr%3E%3Cstrong%3EInvestors%3A%20%3C%2Fstrong%3EVarious%20institutional%20investors%20and%20notable%20angel%20investors%20(500%20MENA%2C%20Shurooq%2C%20Mada%2C%20Seedstar%2C%20Tricap)%3C%2Fp%3E%0A

Avatar: Fire and Ash

Director: James Cameron

Starring: Sam Worthington, Sigourney Weaver, Zoe Saldana

Rating: 4.5/5

The rules on fostering in the UAE

A foster couple or family must:

- be Muslim, Emirati and be residing in the UAE

- not be younger than 25 years old

- not have been convicted of offences or crimes involving moral turpitude

- be free of infectious diseases or psychological and mental disorders

- have the ability to support its members and the foster child financially

- undertake to treat and raise the child in a proper manner and take care of his or her health and well-being

- A single, divorced or widowed Muslim Emirati female, residing in the UAE may apply to foster a child if she is at least 30 years old and able to support the child financially

Company%20profile

%3Cp%3E%3Cstrong%3ECompany%20name%3A%20%3C%2Fstrong%3EHakbah%0D%3Cbr%3E%3Cstrong%3EStarted%3A%20%3C%2Fstrong%3E2018%0D%3Cbr%3E%3Cstrong%3EFounder%3A%20%3C%2Fstrong%3ENaif%20AbuSaida%0D%3Cbr%3E%3Cstrong%3EBased%3A%20%3C%2Fstrong%3ESaudi%20Arabia%0D%3Cbr%3E%3Cstrong%3ESector%3A%20%3C%2Fstrong%3EFinTech%0D%3Cbr%3E%3Cstrong%3ECurrent%20number%20of%20staff%3A%20%3C%2Fstrong%3E22%20%0D%3Cbr%3E%3Cstrong%3EInitial%20investment%3A%20%3C%2Fstrong%3E%24200%2C000%0D%3Cbr%3E%3Cstrong%3EInvestment%20stage%3A%20%3C%2Fstrong%3Epre-Series%20A%0D%3Cbr%3E%3Cstrong%3EInvestors%3A%20%3C%2Fstrong%3EGlobal%20Ventures%20and%20Aditum%20Investment%20Management%0D%3Cbr%3E%3Cbr%3E%3C%2Fp%3E%0A

Ten tax points to be aware of in 2026

1. Domestic VAT refund amendments: request your refund within five years

If a business does not apply for the refund on time, they lose their credit.

2. E-invoicing in the UAE

Businesses should continue preparing for the implementation of e-invoicing in the UAE, with 2026 a preparation and transition period ahead of phased mandatory adoption.

3. More tax audits

Tax authorities are increasingly using data already available across multiple filings to identify audit risks.

4. More beneficial VAT and excise tax penalty regime

Tax disputes are expected to become more frequent and more structured, with clearer administrative objection and appeal processes. The UAE has adopted a new penalty regime for VAT and excise disputes, which now mirrors the penalty regime for corporate tax.

5. Greater emphasis on statutory audit

There is a greater need for the accuracy of financial statements. The International Financial Reporting Standards standards need to be strictly adhered to and, as a result, the quality of the audits will need to increase.

6. Further transfer pricing enforcement

Transfer pricing enforcement, which refers to the practice of establishing prices for internal transactions between related entities, is expected to broaden in scope. The UAE will shortly open the possibility to negotiate advance pricing agreements, or essentially rulings for transfer pricing purposes.

7. Limited time periods for audits

Recent amendments also introduce a default five-year limitation period for tax audits and assessments, subject to specific statutory exceptions. While the standard audit and assessment period is five years, this may be extended to up to 15 years in cases involving fraud or tax evasion.

8. Pillar 2 implementation

Many multinational groups will begin to feel the practical effect of the Domestic Minimum Top-Up Tax (DMTT), the UAE's implementation of the OECD’s global minimum tax under Pillar 2. While the rules apply for financial years starting on or after January 1, 2025, it is 2026 that marks the transition to an operational phase.

9. Reduced compliance obligations for imported goods and services

Businesses that apply the reverse-charge mechanism for VAT purposes in the UAE may benefit from reduced compliance obligations.

10. Substance and CbC reporting focus

Tax authorities are expected to continue strengthening the enforcement of economic substance and Country-by-Country (CbC) reporting frameworks. In the UAE, these regimes are increasingly being used as risk-assessment tools, providing tax authorities with a comprehensive view of multinational groups’ global footprints and enabling them to assess whether profits are aligned with real economic activity.

Contributed by Thomas Vanhee and Hend Rashwan, Aurifer

Match info:

Manchester City 2

Sterling (8'), Walker (52')

Newcastle United 1

Yedlin (30')

PREMIER LEAGUE FIXTURES

Saturday (UAE kick-off times)

Watford v Leicester City (3.30pm)

Brighton v Arsenal (6pm)

West Ham v Wolves (8.30pm)

Bournemouth v Crystal Palace (10.45pm)

Sunday

Newcastle United v Sheffield United (5pm)

Aston Villa v Chelsea (7.15pm)

Everton v Liverpool (10pm)

Monday

Manchester City v Burnley (11pm)

Nepotism is the name of the game

Salman Khan’s father, Salim Khan, is one of Bollywood’s most legendary screenwriters. Through his partnership with co-writer Javed Akhtar, Salim is credited with having paved the path for the Indian film industry’s blockbuster format in the 1970s. Something his son now rules the roost of. More importantly, the Salim-Javed duo also created the persona of the “angry young man” for Bollywood megastar Amitabh Bachchan in the 1970s, reflecting the angst of the average Indian. In choosing to be the ordinary man’s “hero” as opposed to a thespian in new Bollywood, Salman Khan remains tightly linked to his father’s oeuvre. Thanks dad.