One does not need to be a computer expert to understand how much of modern life revolves around advanced technology. From autonomous cars and navigation systems to AI-enabled household gadgets and Chat GPT, millions of people are influenced by the digital revolution on a daily basis.

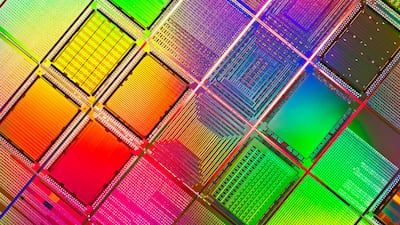

Key to these transformative technologies is what powers them. So important have some small components become that they are subject to export controls and high-level trade negotiations. In the case of today’s powerful microchips, such as those made by US tech manufacturer Nvidia, they sit on government lists alongside other sensitive technologies such as military hardware and advanced lasers.

The indispensability of such crucial technology was once again highlighted on Monday when US tech giant Microsoft announced that amid its plans to invest $15.2 billion in the UAE by 2030, it would be able to obtain licences from the US government to supply the Emirates with thousands of Nvidia graphics processing units.

“Washington doesn't hand out these licences lightly,” Mohammed Soliman, technology analyst and senior fellow at the Middle East Institute, told The National. “It means they're confident in the safeguards, the operator and the bilateral relationship."

Microsoft also feels the UAE is the right place to do business. "This is not money raised in the UAE. It’s money we’re spending in the UAE," said Brad Smith, the company's vice chairman and president. "We’re focused not just on growing our business, but also on contributing to the local economy. This involves bringing together three critical factors – technology, talent and trust."

Such confidence in the Emirates is well placed. This is not just because of the country’s robust relationship with the US but because the UAE is in a special position to harness the power of this technology and push AI innovation to the next stage. There are also wider ramifications to this development that reach beyond what it means for the UAE economy.

The Emirates is an energy and capital-rich country, an early adopter of AI, a major international convener and is well-located at the juncture of several major markets. It has also worked hard to develop a cosmopolitan collection of political and business partnerships with countries, many of them ambitious emerging economies. For example, in July it was reported that Abu Dhabi AI and cloud computing company G42 planned a $2 billion hyperscale data centre in Vietnam’s capital, Ho Chi Minh City. With access to the latest chip technology, the UAE can expand and intensify such collaborations.

Although having access to high-powered components like Nvidia chips carries with it a lot of potential, running powerful AI and computing services comes with its own demands, and the vast amounts of energy consumed by such technology is a key concern.

Speaking on the same day as the Microsoft announcement, Dr Sultan Al Jaber, Adnoc's managing director and group chief executive, told the Adipec energy conference in Abu Dhabi about the need for infrastructure to support AI and data centre development. “You simply can’t run tomorrow’s economy on yesterday’s grid,” he said, adding that demand for energy, including new grids and data centres, will require up to $4 trillion in investment annually.

This is no small order, but with the UAE’s increasing access to advanced technology, it is arguable that the country will be in a stronger position to further develop and invest in renewable and sustainable energy.

Most consumers may not be overly concerned with what goes on under the bonnet of their AI-enabled devices and services. Nevertheless, the UAE has reached a landmark moment in which is it acquiring the technological tools to shape the future, not only for itself but for partners and allies across the world.