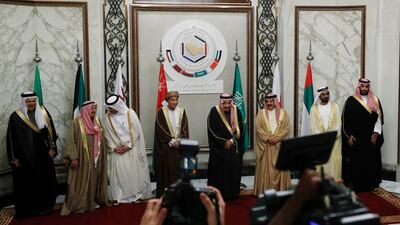

The Gulf states convened in Riyadh this week for their annual Gulf Co-operation Council summit, uniting their voices against Iranian meddling in the region. Abdullatif Al Zayani, the outgoing GCC secretary general, hailed the meeting as a success, as the six nations agreed to work even more closely together in sectors ranging from commerce to defence. After the meeting, member states agreed that the biggest threat to the region was the regime in Tehran.

On September 14, Saudi Arabia’s Aramco facilities were hit in Abqaiq by strikes that took out half of the country’s oil production. The attack was claimed by Houthi rebels in Yemen but Saudi authorities blamed Iran. Since US President Donald Trump pulled out of the flawed nuclear deal last year, tension between Washington and Tehran has escalated, taking a toll on security in the region. In times of adversity, it is important for allied nations to stay united. The call to increase military and security co-operation within the GCC, which the members rallied around, is a welcome development to keep the region safe from Iranian incursions and terrorist attacks.

The GCC's track record in certain areas of co-operation proves that when nations decide to work together, great feats can be accomplished. For instance, trade in the region has multiplied more than 24 times since 2003, rising from $6 billion to $147bn last year. GCC states are also looking to draft legislation for greater economic integration over the next six years, a plan that includes the creation of a monetary union. This is a heartening measure at a time when the future of other political blocs, such as the European Union, are facing cohesiveness from within.

For the GCC to be strong and effective, its members must be on the same page in committing to fight terror groups, an apple of discord that led Saudi Arabia, the UAE and Bahrain to cut links with Qatar two years ago. Since 2017, Doha has been subjected to a boycott by the Arab Quartet, including Egypt, for interfering in their internal affairs, supporting extremist groups and forging closer ties to Iran. In doing so, Doha is playing into Tehran’s strategy of dividing to conquer, which so far has only served to distance the Qataris from their historic allies. Last week, King Salman of Saudi Arabia extended an olive branch to Qatari Emir Sheikh Tamim, inviting him to Tuesday’s summit. Khaled Al Sabah, the Kuwaiti prime minister, said on Sunday that he hoped the meeting will be “an extremely important step forward to Gulf reconciliation”.

Sheikh Tamim did not come to the summit. Qatari prime minister Sheikh Abdullah bin Nasser attended in his place, a miscalculation of the Emir's advisers, according to UAE Minister of State for Foreign Affairs Dr Anwar Gargash. For Doha, this is a lost opportunity to resolve a crisis that has lasted too long. However, despite this painful rift, Gulf states remain hopeful that Doha will return to the fold. At the summit meanwhile, GCC states have shown the capacity to come together to support an alliance that dates back decades.