The multi-billion dirham development of the world's tallest solar power tower in Dubai is continuing to gather pace in spite of the Covid-19 pandemic.

The striking 262-metre-high construction is one of the crown jewels of the Mohammed bin Rashid Al Maktoum Solar Park, which itself is central to the UAE's long-term strategy to shift its focus to renewable energy.

Sheikh Ahmed bin Saeed Al Maktoum, chairman of the Dubai Supreme Council of Energy, and Saeed Mohammed Al Tayer, chief executive of Dubai Electricity and Water Authority (DEWA) were on hand as a Molten Salt Receiver was hoisted above the ground and installed on top of the tower.

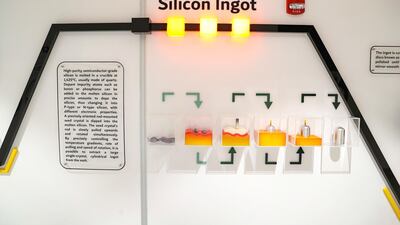

The receiver will play a crucial role in ensuring the tower can store sunlight and convert it into thermal energy.

The project is part of the Dh15.78 billion fourth phase of the vast solar park, called Noor Energy 1, and aims to provide power for 320,000 homes while slashing carbon emissions by 1.6 million tonnes.

The sprawling solar park has a planned capacity of 5,000 megawatts (MW) by 2030 and investments of up to AED 50 billion.

Dubai has set out ambitious plans to derive 75 per cent of its total power output from clean energy by 2050.

Abdul Hamid Al Muhaidib, executive managing director of Noor Energy 1, briefed Sheikh Ahmed on the progress and installation of the MSR.

Noor Energy 1 is owned by DEWA, the Silk Road Fund, which is owned by the Chinese Government and ACWA Power from Saudi Arabia.

“ACWA Power is proud to partner with DEWA and Silk Road Fund and support all efforts to make the Dubai Clean Energy Strategy 2050 a reality," said Mohammad Abunayyan, chairman of ACWA Power.

"Today, we reached another significant milestone in the world’s largest concentrated solar power plant, Noor Energy 1. We have completed the lifting of the Molten Salt Receiver in a record time, keeping the highest standards of safety despite the impact of the COVID-19 pandemic and many other challenges."

The solar park will become operational in stages, starting in the third quarter of 2021.