Earth will dodge another interstellar bullet in October, according to the European Space Agency, when an asteroid the size of a house will pass the planet at the relatively near distance of just 44,000km away.

The lump of space rock, which is roughly 25m long and travelling at 14km per second (50,400kph), will pass between Earth and the moon, but will still be 8,000km away from the orbit of geostationary satellites, which circle the globe at a distance of 36,000km.

“We know for sure that there is no possibility for this object to hit the Earth,” Detlef Koschny of ESA’s Near Earth Objects research team told reporters. “There is no danger whatsoever.”

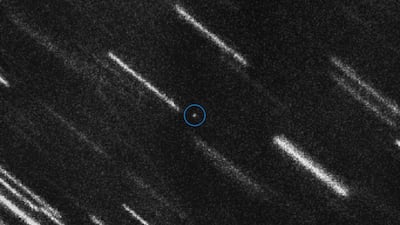

Dubbed 2012 TC4, the asteroid first passed the Earth in 2012, when it was almost twice as far away as it will be this year before disappearing off on its galactic path. It is expected to return at its closest on October 12, having been tracked by the Very Large Telescope of the European Southern Observatory in Chile from a distance of 56 million kilometres away.

“It’s damn close,” said Rolf Densing, who heads up the European Space Operations Centre in Darmstadt, Germany. If it continues to narrow the distance between its orbit and the Earth then the next time it appears in five or so years time, it could strike the planet.

Researchers for the various space programmes across the globe currently have no planetary defence systems in place – they are focused on early warning – and at present ideas of protecting the Earth from an asteroid heading towards it remain in the realm of science fiction.

The ESA said in a statement that observing TC4's movements “is an excellent opportunity to test the international ability to detect and track near-Earth objects and assess our ability to respond together to a real asteroid threat.”

A 40m-long space rock caused the largest Earth impact in recent history when it exploded over Tunguska, Siberia, in 1908, flattening 2,000 km2 of forest.

Four years ago, a meteoroid of about 20 metres exploded in the atmosphere over the city of Chelyabinsk in central Russia with the kinetic energy of about 30 Hiroshima atom bombs.

The resulting shockwave blew out the windows of nearly 5,000 buildings and injured more than 1,200 people. It caught everyone unawares.

If an object the size of TC4 were to enter Earth’s atmosphere, “it would have a similar effect to the Chelyabinsk event,” said the ESA.

The Kites

Romain Gary

Penguin Modern Classics

Company%20Profile

%3Cp%3E%3Cstrong%3ECompany%20name%3A%3C%2Fstrong%3E%20myZoi%3Cbr%3E%3Cstrong%3EStarted%3A%3C%2Fstrong%3E%202021%3Cbr%3E%3Cstrong%3EFounders%3A%3C%2Fstrong%3E%20Syed%20Ali%2C%20Christian%20Buchholz%2C%20Shanawaz%20Rouf%2C%20Arsalan%20Siddiqui%2C%20Nabid%20Hassan%3Cbr%3E%3Cstrong%3EBased%3A%3C%2Fstrong%3E%20UAE%3Cbr%3E%3Cstrong%3ENumber%20of%20staff%3A%3C%2Fstrong%3E%2037%3Cbr%3E%3Cstrong%3EInvestment%3A%3C%2Fstrong%3E%20Initial%20undisclosed%20funding%20from%20SC%20Ventures%3B%20second%20round%20of%20funding%20totalling%20%2414%20million%20from%20a%20consortium%20of%20SBI%2C%20a%20Japanese%20VC%20firm%2C%20and%20SC%20Venture%3C%2Fp%3E%0A

Ten tax points to be aware of in 2026

1. Domestic VAT refund amendments: request your refund within five years

If a business does not apply for the refund on time, they lose their credit.

2. E-invoicing in the UAE

Businesses should continue preparing for the implementation of e-invoicing in the UAE, with 2026 a preparation and transition period ahead of phased mandatory adoption.

3. More tax audits

Tax authorities are increasingly using data already available across multiple filings to identify audit risks.

4. More beneficial VAT and excise tax penalty regime

Tax disputes are expected to become more frequent and more structured, with clearer administrative objection and appeal processes. The UAE has adopted a new penalty regime for VAT and excise disputes, which now mirrors the penalty regime for corporate tax.

5. Greater emphasis on statutory audit

There is a greater need for the accuracy of financial statements. The International Financial Reporting Standards standards need to be strictly adhered to and, as a result, the quality of the audits will need to increase.

6. Further transfer pricing enforcement

Transfer pricing enforcement, which refers to the practice of establishing prices for internal transactions between related entities, is expected to broaden in scope. The UAE will shortly open the possibility to negotiate advance pricing agreements, or essentially rulings for transfer pricing purposes.

7. Limited time periods for audits

Recent amendments also introduce a default five-year limitation period for tax audits and assessments, subject to specific statutory exceptions. While the standard audit and assessment period is five years, this may be extended to up to 15 years in cases involving fraud or tax evasion.

8. Pillar 2 implementation

Many multinational groups will begin to feel the practical effect of the Domestic Minimum Top-Up Tax (DMTT), the UAE's implementation of the OECD’s global minimum tax under Pillar 2. While the rules apply for financial years starting on or after January 1, 2025, it is 2026 that marks the transition to an operational phase.

9. Reduced compliance obligations for imported goods and services

Businesses that apply the reverse-charge mechanism for VAT purposes in the UAE may benefit from reduced compliance obligations.

10. Substance and CbC reporting focus

Tax authorities are expected to continue strengthening the enforcement of economic substance and Country-by-Country (CbC) reporting frameworks. In the UAE, these regimes are increasingly being used as risk-assessment tools, providing tax authorities with a comprehensive view of multinational groups’ global footprints and enabling them to assess whether profits are aligned with real economic activity.

Contributed by Thomas Vanhee and Hend Rashwan, Aurifer