Israel must provide Moscow with more information about the downing of a Russian military aircraft near the Syrian coast earlier this week, Russia's Foreign Ministry said in a statement on Thursday, the Interfax news agency reported.

Fifteen Russian crew were killed when the IL-20 surveillance plane crashed near Latakia in northern Syria on Monday. Russia has said Syria shot the plane down shortly after Israeli jets hit the area, and accused Israel of creating the dangerous conditions by failing to give sufficient advance notice.

Russia's Defence Ministry initially blamed the plane's loss on Israel, saying its fighter jets pushed the Russian plane into the line of fire, but Russian President Vladimir Putin sought to defuse tensions, pointing at “a chain of tragic accidental circumstances”.

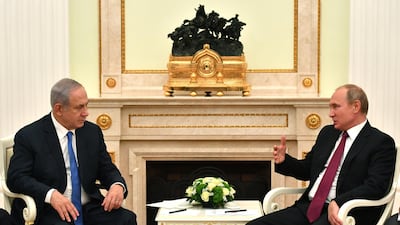

Israeli Prime Minister Benjamin Netanyahu has offered to share data with Russia on what was happening in the sky over Syria that day and dispatched his air force chief to Moscow. The official is due to arrive in Moscow on Thursday.

The Russia-bound delegation, led by Major General Amikam Norkin, will "present the situation report... regarding all aspects" of the incident, the Israeli army said in a statement on Wednesday.

It will also provide information on "Iranian attempts to transfer strategic weapons to the Hezbollah terror organisation and to establish an Iranian military presence in Syria", the statement said.

The Israeli military said its fighter jets were targeting a Syrian military facility involved in providing weapons for Iran's proxy Hezbollah militia and insisted it warned Russia of the coming raid in accordance with deconfliction agreements. It said the Syrian army fired the missiles that hit the Russian plane when the Israeli jets had already returned to Israeli airspace.

Russian Foreign Ministry spokeswoman Maria Zakharova on Thursday accused Israeli pilots of “unprofessionalism” and said that Russia still needs to hear more “explanations from Israel”.

__________

Read more:

Hezbollah leader says group will stay in Syria until further notice

Hezbollah is flaunting its support for Yemen’s Houthis

__________

Israel said on Thursday it would not halt strikes on Syria but would do more to "deconflict" them with Russian forces.

Israel has struck Syria scores of times during its seven-year civil war to prevent what it says are transfers of weapons to Hezbollah fighters and other Iranian allies. Russia has largely overlooked the sorties, which the Israelis say pose no direct threat to Moscow's ally, President Bashar Al Assad.

Speaking to Army Radio, Defence Minister Avigdor Lieberman made clear that Israel would not halt attacks in Syria.

“We will do whatever is necessary to safeguard the security of Israel's citizens...and we will not hold these discussions over the airwaves,” he said.

But when pressed during the interview, Mr Lieberman avoided asserting Israeli “freedom of action” over Syria, a term he has used in the past.

Naftali Bennett, another far-right member of Mr Netanyahu's security cabinet, said “deconfliction mechanisms” would be improved, referring to a Russian-Israeli hotline designed to avoid inadvertent clashes with forces Moscow sent to Syria as part of a military intervention mounted in 2015.

"We will of course strengthen these mechanisms. We will do everything so as not to harm anyone we do not intend to, God forbid," Mr Bennett told Army Radio in a separate interview.

Israel has admitted to striking Syria to prevent what it says are deliveries of advanced weaponry to Lebanon's Hezbollah, an armed movement backed by Iran and which fights alongside Syrian troops.

On Wednesday, Hezbollah's leader Hassan Nasrallah said the Shiite movement would stay in Syria "until further notice".

"We will remain there even after the Idlib accord," Nasrallah said, referring to a Russia-Turkey deal to prevent a Syrian regime offensive on the country's last rebel-held stronghold.

KINGDOM%20OF%20THE%20PLANET%20OF%20THE%20APES

%3Cp%3E%3Cstrong%3EDirector%3A%3C%2Fstrong%3E%20Wes%20Ball%3C%2Fp%3E%0A%3Cp%3E%3Cstrong%3EStarring%3A%3C%2Fstrong%3E%20Owen%20Teague%2C%20Freya%20Allen%2C%20Kevin%20Durand%3C%2Fp%3E%0A%3Cp%3E%3Cstrong%3ERating%3A%20%3C%2Fstrong%3E3.5%2F5%3C%2Fp%3E%0A

Profile of Tamatem

Date started: March 2013

Founder: Hussam Hammo

Based: Amman, Jordan

Employees: 55

Funding: $6m

Funders: Wamda Capital, Modern Electronics (part of Al Falaisah Group) and North Base Media

The Florida Project

Director: Sean Baker

Starring: Bria Vinaite, Brooklynn Prince, Willem Dafoe

Four stars

Zayed Sustainability Prize

The biog

Favourite food: Tabbouleh, greek salad and sushi

Favourite TV show: That 70s Show

Favourite animal: Ferrets, they are smart, sensitive, playful and loving

Favourite holiday destination: Seychelles, my resolution for 2020 is to visit as many spiritual retreats and animal shelters across the world as I can

Name of first pet: Eddy, a Persian cat that showed up at our home

Favourite dog breed: I love them all - if I had to pick Yorkshire terrier for small dogs and St Bernard's for big

Ten tax points to be aware of in 2026

1. Domestic VAT refund amendments: request your refund within five years

If a business does not apply for the refund on time, they lose their credit.

2. E-invoicing in the UAE

Businesses should continue preparing for the implementation of e-invoicing in the UAE, with 2026 a preparation and transition period ahead of phased mandatory adoption.

3. More tax audits

Tax authorities are increasingly using data already available across multiple filings to identify audit risks.

4. More beneficial VAT and excise tax penalty regime

Tax disputes are expected to become more frequent and more structured, with clearer administrative objection and appeal processes. The UAE has adopted a new penalty regime for VAT and excise disputes, which now mirrors the penalty regime for corporate tax.

5. Greater emphasis on statutory audit

There is a greater need for the accuracy of financial statements. The International Financial Reporting Standards standards need to be strictly adhered to and, as a result, the quality of the audits will need to increase.

6. Further transfer pricing enforcement

Transfer pricing enforcement, which refers to the practice of establishing prices for internal transactions between related entities, is expected to broaden in scope. The UAE will shortly open the possibility to negotiate advance pricing agreements, or essentially rulings for transfer pricing purposes.

7. Limited time periods for audits

Recent amendments also introduce a default five-year limitation period for tax audits and assessments, subject to specific statutory exceptions. While the standard audit and assessment period is five years, this may be extended to up to 15 years in cases involving fraud or tax evasion.

8. Pillar 2 implementation

Many multinational groups will begin to feel the practical effect of the Domestic Minimum Top-Up Tax (DMTT), the UAE's implementation of the OECD’s global minimum tax under Pillar 2. While the rules apply for financial years starting on or after January 1, 2025, it is 2026 that marks the transition to an operational phase.

9. Reduced compliance obligations for imported goods and services

Businesses that apply the reverse-charge mechanism for VAT purposes in the UAE may benefit from reduced compliance obligations.

10. Substance and CbC reporting focus

Tax authorities are expected to continue strengthening the enforcement of economic substance and Country-by-Country (CbC) reporting frameworks. In the UAE, these regimes are increasingly being used as risk-assessment tools, providing tax authorities with a comprehensive view of multinational groups’ global footprints and enabling them to assess whether profits are aligned with real economic activity.

Contributed by Thomas Vanhee and Hend Rashwan, Aurifer

Ultra processed foods

- Carbonated drinks, sweet or savoury packaged snacks, confectionery, mass-produced packaged breads and buns

- margarines and spreads; cookies, biscuits, pastries, cakes, and cake mixes, breakfast cereals, cereal and energy bars;

- energy drinks, milk drinks, fruit yoghurts and fruit drinks, cocoa drinks, meat and chicken extracts and instant sauces

- infant formulas and follow-on milks, health and slimming products such as powdered or fortified meal and dish substitutes,

- many ready-to-heat products including pre-prepared pies and pasta and pizza dishes, poultry and fish nuggets and sticks, sausages, burgers, hot dogs, and other reconstituted meat products, powdered and packaged instant soups, noodles and desserts.

Moon Music

Artist: Coldplay

Label: Parlophone/Atlantic

Number of tracks: 10

Rating: 3/5